SUPREME COURT’S REVIEW ON RETROSPECTIVE TAXES

Why in the news?

- The Supreme Court reserves order on whether its July 25 judgement on State taxation of mines and minerals should be applied retrospectively.

- Solicitor-General Tushar Mehta argues against retrospective application, citing potential severe impacts on industries and the common man.

Source:ET

Judgement Background:

- The July 25 verdict, by an 8:1 majority, affirmed State legislatures’ power to tax mineral rights, unrestricted by Parliament.

- The ruling supports federalism and addresses economic imbalances in mineral-rich States.

Concerns and Risks:

- Retrospective taxes could burden companies, potentially leading to bankruptcy risks.

- Senior advocate Harish Salve highlights the potential financial strain on companies, including public sector undertakings (PSUs), based on historical tax demands.

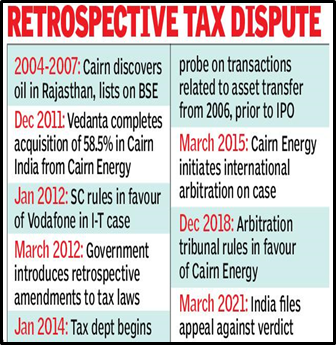

What is a Retrospective tax ?

|