SEBI’S PROPOSALS TO CURB SPECULATION

Why in the news?

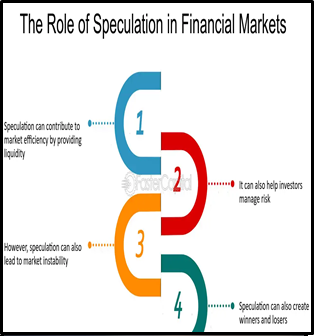

Sebi’s new proposals aim to curb excessive retail speculation in derivatives, ensuring market stability and protecting retail investors.

source:lotusarise

source:lotusarise

Key Objective and Measures:

- Objective: Reduce excessive retail speculation in derivatives.

Measures:

- Maintain depth in F&O for effective hedging.

- Prevent speculation from shifting to smallcaps.

Impact:

- Adapting trading revenue models and business strategies.

- Introducing conservative investment options (portfolio management services, AIFs) to manage risks and protect household savings.

| About Securities and Exchange Board of India(SEBI):

Origin:

- Before SEBI: Regulated by Controller of Capital Issues under Capital Issues (Control) Act, 1947.

- SEBI established in 1988, statutory powers in 1992 with SEBI Act.

Structure:

- Chairman (Union Government nominee).

- Two members from the Union Finance Ministry.

- One member from RBI.

- Five additional members (at least three whole-time).

Powers:

- Quasi-legislative: Formulates rules on obligations and insider trading.

- Quasi-executive: Examines accounts, gathers evidence.

- Quasi-judicial: Passes judgments on market malpractices.

- Approval: Approves by-laws of securities exchanges.

Functions:

- Protect investors and market development.

- Inspect accounts, mandate listings.

- Register brokers, control malpractice.

- Educate investors, provide a platform for market participants.

About Future and options( F&O):

- Futures: Contracts requiring the buyer to purchase or the seller to sell an asset at a fixed future date and price.

- Options: Contracts granting the holder the right, but not the obligation, to buy or sell an asset at a set price within a specified period.

|

source:lotusarise