FRBM RETHINK: AIM FOR CLARITY IN INDIA’S FISCAL POLICY FRAMEWORK

Syllabus:

GS 3:

- Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

- Changes in Industrial Policy and their Effects on Industrial Growth.

Why in the News?

India is reconsidering its fiscal policy framework to enhance fiscal clarity. The Finance Minister’s announcement to aim for a declining public debt-to-GDP ratio post-2025-26 marks a significant shift from the current focus on annual fiscal deficits, emphasizing sustainable public finances over the medium term.

Source: IE

Introduction and Context:

- New Framework: India is shifting towards a new fiscal policy framework. Finance Minister Nirmala Sitharaman announced that post-2025-26, the government will aim to keep the fiscal deficit low to ensure a declining central government debt-to-GDP ratio.

- Current Law: The existing fiscal law mandates the Union government to maintain an annual fiscal deficit below 3% of GDP, capping yearly government borrowing to control profligate budgeting.

- Flexibility: The fiscal law includes an escape clause allowing the government flexibility in fiscal policy during emergencies like a pandemic, avoiding rigid austerity measures.

- Global Shift: There’s a global trend towards second-generation fiscal rules, emphasizing sustainable public finances over the medium term, focusing on public debt rather than annual budget deficits.

- Review Committee: The 2017 FRBM review committee, led by N.K. Singh, recommended using the public debt-to-GDP ratio as the new fiscal policy anchor, suggesting a shift in how fiscal health is measured.

- Future Legislation: It’s unclear whether the government will introduce new legislation, amend the existing one, or change its strategy within the current legal framework to implement these changes.

| Fiscal Responsibility and Budget Management Act (FRBMA)

Overview:

FRBM Act: Provisions

FRBM Act: Significance

FRBM Act: Amendments

|

Implications for Fiscal Management

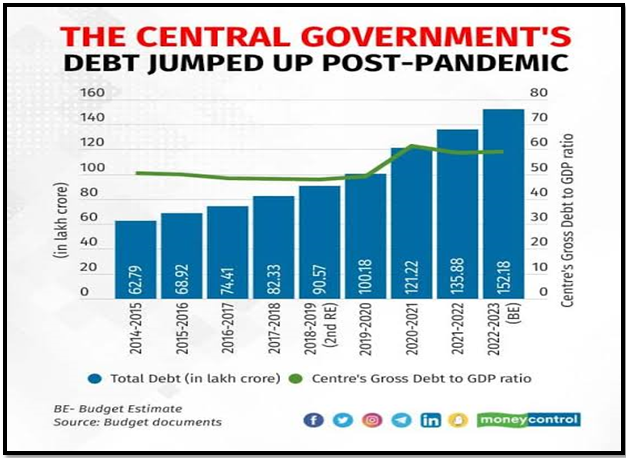

- Debt Management: Shifting from annual fiscal deficit to public debt ratio management will influence how the government handles its finances, aiming to reduce the public debt currently at 58% of GDP.

- Debt Reduction: There are two main methods to lower the public debt ratio: higher nominal GDP growth compared to government borrowing costs, and explicit policies to reduce the primary deficit.

- Growth-Interest Differential: Countries with a significant growth-interest rate differential need less fiscal austerity. India’s high growth has historically managed its public debt, but this may not be sustainable long-term.

- Fiscal Prudence: The N.K. Singh committee cautioned against relying solely on high growth to manage debt, emphasizing the need for fiscal prudence and realistic projections to maintain debt sustainability.

- Economic Indicators: The relationship between growth rates, interest rates, and fiscal policies must be carefully managed to ensure a stable debt trajectory, balancing growth with prudent fiscal management.

- Policy Adjustments: As economic conditions evolve, fiscal policies must adapt to maintain a favorable growth-interest differential and achieve long-term debt sustainability.

Communication and Implementation

- Clear Messaging: Communicating fiscal policy intentions through a sustainable public debt ratio is more complex than annual deficit targets, requiring clear, credible projections and transparent assumptions.

- Fiscal Council: Establishing a fiscal council, similar to the US Congressional Budget Office, can provide independent estimates of public debt trajectories, enhancing the credibility of fiscal policies.

- Policy Sovereignty: While a fiscal council wouldn’t set fiscal policies, it would offer unbiased debt projections, aiding the government in making informed fiscal decisions and improving transparency.

- Public Estimates: Regular public release of fiscal council estimates would increase trust in fiscal policies, helping stakeholders understand and anticipate fiscal strategies.

- Enhanced Credibility: Transparent and independent fiscal projections would reassure the private sector, investors, and international bodies about India’s commitment to sustainable fiscal management.

- Institutional Support: A robust fiscal council would support the government in navigating fiscal challenges, ensuring policies are based on accurate, reliable data and fostering long-term economic stability.

Considerations

- Policy Integration: Ensuring the new fiscal framework integrates smoothly with existing economic policies and development goals.

- Long-term Vision: Establishing a sustainable fiscal policy framework that supports economic growth, manages public debt effectively, and enhances overall fiscal stability for India.

- Technological Support: Utilizing advanced economic modeling and forecasting tools to support accurate debt trajectory estimates and policy planning.

- Institutional Support: Building robust institutional mechanisms, like a fiscal council, to provide independent and reliable fiscal estimates.

- International Standards: Aligning new fiscal policies with global best practices and standards to enhance credibility and investor confidence.

- Flexibility: Maintaining the flexibility to adjust fiscal policies as economic conditions evolve to ensure long-term sustainability.

- Transparency: Promoting transparency in fiscal policy decisions to build public trust and accountability in the government’s financial management.

Challenges

- Implementation Hurdles: Transitioning to a new fiscal framework involves overcoming significant challenges in policy formulation, implementation, and communication, requiring coordinated efforts across government bodies.

- Predictive Complexity: Estimating public debt trajectories involves complex projections based on future economic conditions, necessitating advanced modeling and continuous updates to reflect changing realities.

- Legislative Adjustments: Amending existing fiscal laws or introducing new legislation will require political consensus and careful drafting to ensure the new framework aligns with economic objectives.

- Compliance Monitoring: Ensuring adherence to new fiscal rules will be critical, involving regular assessments and potential adjustments to maintain policy effectiveness and economic stability.

- Stakeholder Coordination: Engaging with various stakeholders, including policymakers, economists, and the private sector, will be essential in refining and implementing the new fiscal framework.

- Public Communication: Effectively communicating complex fiscal policy changes to the public and private sectors to ensure understanding and acceptance.

- Economic Adaptability: The need to adapt fiscal policies swiftly in response to changing economic conditions and unforeseen challenges.

Way Forward

- Establish a Fiscal Council: Create an independent fiscal council to provide unbiased estimates and projections of public debt and fiscal policies, enhancing credibility and transparency.

- Legislative Reform: Amend the existing Fiscal Responsibility and Budget Management (FRBM) law to incorporate new fiscal rules focusing on sustainable public debt ratios.

- Enhanced Modeling: Utilize advanced economic modeling and forecasting tools to accurately estimate debt trajectories and guide policy decisions.

- Stakeholder Engagement: Engage with key stakeholders, including policymakers, economists, and the private sector, to refine and support the implementation of the new fiscal framework.

- Transparent Communication: Clearly communicate fiscal policy intentions and changes to the public and private sectors to ensure understanding and acceptance.

- Continuous Monitoring: Regularly assess and adjust fiscal policies based on economic conditions to maintain effectiveness and stability.

- Global Alignment: Align fiscal policies with international standards and best practices to build investor confidence and promote economic stability.

- Public Accountability: Promote transparency and accountability in fiscal policy decisions to build public trust and ensure responsible financial management.

Conclusion

India’s move towards a new fiscal policy framework, focusing on public debt-to-GDP ratio, necessitates establishing a fiscal council for independent debt trajectory estimates. This approach aims to enhance fiscal transparency and credibility, ensuring sustainable public finances while balancing economic growth and fiscal prudence.

Mains Practice Question

Discuss the implications of shifting India’s fiscal policy focus from annual fiscal deficits to the public debt-to-GDP ratio. How can a fiscal council enhance fiscal transparency and credibility in this new framework?

Source :The Mint

Associated Article:

https://universalinstitutions.com/government-lowers-fiscal-deficit-focuses-on-debt-ratio/