“GOVERNMENT LOWERS FISCAL DEFICIT, FOCUSES ON DEBT RATIO”

Why in the news?

- Fiscal deficit target for FY25 cut to 4.9% of GDP from 5.1% in interim Budget.

- FY24 fiscal deficit stands at 5.6% of GDP, lower than the revised estimate of 5.8%.

- Government aims to reduce the fiscal deficit below 4.5% by FY26-27.

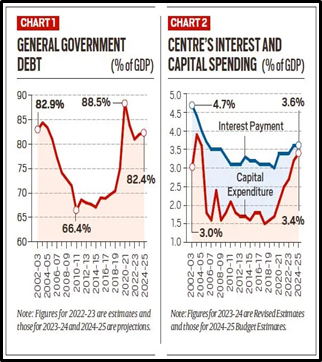

- Government prioritising debt-GDP ratio over fiscal deficit figures.

source:indianexpress

About Fiscal Deficit:

- Fiscal deficit: Shortfall when government expenditure exceeds revenue.

- Requires borrowing or asset sales to fund the deficit.

- Main revenue source: Taxes (expected Rs 26.02 lakh crore in 2024-25).

- Total revenue estimated at Rs 30.8 lakh crore for 2024-25.

- Fiscal surplus: Rare, occurs when revenues exceed expenditure.

- Focus: Controlling fiscal deficit, not balancing the budget.

Key Formulas:

- Fiscal Deficit: Total Expenditure – Total Receipts (excluding borrowings)

- Revenue Deficit: Total Revenue Receipts – Total Revenue Expenditure

- Debt to GDP Ratio: Total Debt of Country / Total GDP of Country

Legislation Related to Fiscal Management in India:

Associated Article: https://universalinstitutions.com/indias-fiscal-deficit-for-fy24-lower-than-revised-estimate/ |