CONCERNS OVER EU CARBON BORDER ADJUSTMENT TAX

Why in the news?

- The Economic Survey criticises the EU’s Carbon Border Adjustment Tax (CBAT) as protectionist.

- The tax, part of the Carbon Border Adjustment Mechanism (CBAM), imposes tariffs on energy-intensive imports like iron, steel, and aluminium.

- The Survey argues that CBAM contradicts the Paris Agreement’s principle of “Common but Differentiated Responsibilities.”

source:researchgate

About Carbon Border Adjustment Mechanism (CBAM) :

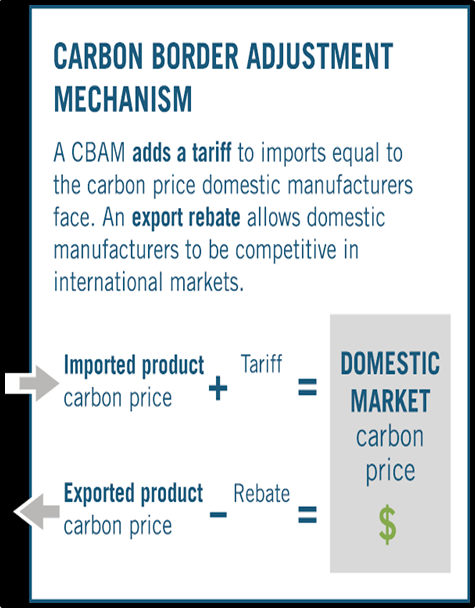

- Purpose: Tariff on carbon-intensive products to ensure fair carbon pricing.

- Implementation: Importers buy carbon certificates reflecting EU carbon prices.

- Start Date: Definitive regime from 2026; transitional phase (reporting only) until 2025.

- Coverage: Iron, steel, cement, fertilisers, aluminium, electricity, hydrogen.

About EU Carbon Border Tax (CBAM):

About European Union(EU):

Associated Article: https://universalinstitutions.com/decong-the-eus-carbon-border-tax/

|