A GREEN WEALTH TAX IN BUDGET 2024

Syllabus:

GS 3:

- Government Budgeting.

- Taxation in India

Why in the News?

The Indian government is considering implementing a wealth tax-financed Indian Green Deal (IGD) in the upcoming Budget 2024. This policy aims to address climate change, inequality, and unemployment by investing in green energy, infrastructure, and the care economy, promoting sustainable and inclusive economic growth.

Source: TH

Introduction and Overview:

- Wealth Tax Proposal: A wealth tax-financed Indian Green Deal (IGD) can simultaneously address the urgent issues of climate change, inequality, and unemployment, providing a multifaceted solution.

- Budget Priorities: The upcoming Budget must prioritize employment generation and inequality reduction to fully capitalize on India’s demographic dividend and support its young population.

- Long-Term Vision: To achieve sustainable growth, the government should implement policies that incentivize employment in both public and private sectors, ensuring long-term economic stability.

- Comprehensive Approach: The Indian Green Deal (IGD) should deliver on social, democratic, and climate fronts by integrating bold steps towards a just, inclusive, and sustainable development model.

- Key Elements: An effective Indian Green Deal (IGD) would encompass green energy, infrastructure, and care economy (health and education) initiatives, fostering a holistic and sustainable growth trajectory for India.

Understanding Wealth Tax

Wealth Tax – Background

Wealth Tax in India

|

Rise in Inequality and Carbon Emissions

- Wealth and Income Inequality: Over the past two decades, wealth and income inequality in India have surged dramatically, exacerbating social and economic disparities.

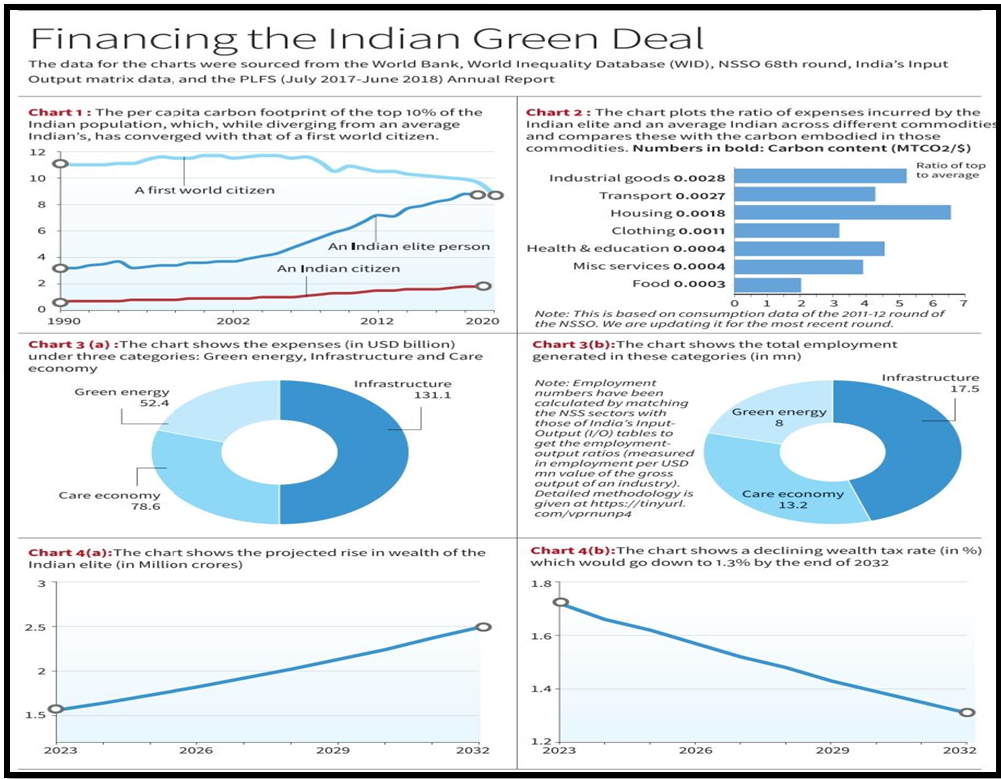

- Carbon Emissions: Increased consumption by the Indian elite has led to significantly higher carbon emissions, making their carbon footprint comparable to that of first-world citizens.

- Consumption Patterns: The elite’s consumption of carbon-intensive commodities, including housing, industrial goods, transport (airlines, SUVs), and clothing, drives the rise in emissions.

- Wealth Tax Solution: Implementing a wealth tax can simultaneously address wealth inequality and reduce carbon emissions, tackling two critical issues at once.

- Charts Analysis: Data highlights the stark contrast between the carbon footprint of the top 10% of the Indian population and that of the average Indian, illustrating the impact of wealth disparity.

Indian Green Deal (IGD) Framework

- Three-Part IGD: The IGD should include green energy, infrastructure, and care economy sectors, aiming to overhaul India’s energy system and foster sustainable development over a decade.

- Atmanirbhar Package: By reallocating the 10% of GDP from the Atmanirbhar package, the proposal suggests investing 5% in infrastructure, 3% in the care economy, and 2% in green energy.

- Employment Generation: The IGD could create 38.7 million jobs, equivalent to 8.2% of the Indian labor force, significantly alleviating unemployment and boosting economic activity.

- Charts Overview: Expense allocation and employment generation under the IGD categories are illustrated, demonstrating the program’s potential to drive sustainable economic growth.

- Funding the IGD: A wealth tax rate of approximately 1.7% can initiate the IGD, with a projected decline to 1.3% by 2032 as the wealth of the Indian elite increases.

Addressing Funding and Implementation

- Tall Ask: Funding 10% of GDP for the IGD is a substantial requirement, necessitating careful financial planning and strategic allocation of resources to ensure feasibility.

- Wealth Tax Rate: Calculations show that a wealth tax can effectively finance the IGD, with the rate gradually declining over time as the program gains momentum and wealth distribution improves.

- Long-Term Benefits: The IGD not only addresses climate change but also tackles inequality and unemployment, creating a sustainable, equitable, and prosperous economy for all citizens.

- Global Leadership: By implementing the IGD, India can set a global example in tackling climate change and socio-economic issues, demonstrating a commitment to sustainable and inclusive development.

- June 2024 Mandate: The recent mandate calls for a strategic course correction, providing the government with a pivotal opportunity to prioritize innovative and transformative policies in the Budget.

Wealth Tax in Various Parts of the World

|

Challenges

- Implementation Complexity: Coordinating the multifaceted components of the Indian Green Deal (IGD) across sectors like green energy, infrastructure, and care economy can be complex and requires robust planning and execution.

- Funding Constraints: Securing the necessary funding for the IGD, amounting to 10% of GDP, poses a significant challenge, particularly in a resource-constrained environment.

- Political Will: Ensuring consistent political support and overcoming resistance from various stakeholders, including the wealthy elite who may oppose the wealth tax, is critical for successful implementation.

- Administrative Bottlenecks: Streamlining administrative processes and overcoming bureaucratic hurdles is essential to avoid delays and inefficiencies in the rollout of the IGD.

- Monitoring and Evaluation: Establishing effective mechanisms for monitoring and evaluating the impact of IGD initiatives to ensure they meet their intended goals and make necessary adjustments.

- Public Acceptance: Gaining widespread public acceptance and understanding of the wealth tax and its benefits is necessary to build support for the IGD.

- Economic Disruption: Managing the potential short-term economic disruptions caused by the transition to green energy and new infrastructure projects is crucial to maintaining economic stability.

- Technical Capacity: Developing the technical capacity and expertise required to implement and manage advanced green technologies and sustainable infrastructure is a significant challenge.

Way Forward

- Clear Roadmap: Develop a detailed roadmap outlining the implementation steps, timelines, and milestones for the Indian Green Deal to ensure clarity and direction.

- Stakeholder Engagement: Engage with all relevant stakeholders, including industry leaders, policymakers, and the public, to build consensus and support for the IGD initiatives.

- Incremental Funding: Adopt an incremental approach to funding, starting with a wealth tax rate of 1.7% and gradually decreasing it as the program gains momentum and wealth distribution improves.

- Capacity Building: Invest in capacity-building initiatives to enhance the technical expertise and administrative capabilities required to manage and implement the IGD effectively.

- Transparent Monitoring: Establish transparent monitoring and evaluation frameworks to track progress, measure impact, and make data-driven adjustments to the IGD initiatives.

- Public Awareness Campaigns: Launch public awareness campaigns to educate citizens about the benefits of the wealth tax and the IGD, fostering public support and acceptance.

- Economic Diversification: Implement policies to mitigate short-term economic disruptions by promoting economic diversification and supporting industries transitioning to green technologies.

- International Collaboration: Leverage international partnerships and collaborations to gain access to advanced technologies, best practices, and funding opportunities, enhancing the IGD’s effectiveness and sustainability.

Conclusion

The proposed IGD in Budget 2024 presents a comprehensive strategy to tackle critical issues of climate change, inequality, and unemployment. By leveraging a wealth tax, India can pioneer a sustainable development model that balances economic growth with social equity and environmental responsibility.

Source:The Hindu

Mains Practice Question:

Discuss the potential benefits and challenges of implementing a wealth tax-financed Indian Green Deal (IGD) in Budget 2024. How can this initiative address climate change, inequality, and unemployment in India? Provide suggestions for effective implementation.

Associated Article: