SEBI, RBI CONCERNED ABOUT SURGING F&O MARKET

Why in the news?

- SEBI and RBI are concerned about the rapid growth in Futures and Options (F&O) trading.

- The surge is impacting capital formation and posing systemic risks to India’s economic growth.

- F&O turnover at NSE and BSE increased from ₹2,189 lakh crore in May 2022 to ₹9,504 lakh crore in May 2024 (up 334%).

source:slideshare

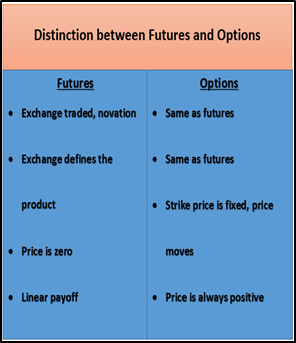

About Futures vs. Options (F&O):

- Meaning: Derivatives based on underlying assets.

- Futures: Obligatory, unlimited risk/reward.

- Options: Right without obligation, limited risk/reward.

- Usage: Futures for speculation/hedging; Options for hedging/speculation.

| About Securities and Exchange Board of India(SEBI):

SEBI: Statutory body established April 12, 1992. Purpose: Protect investor interests and regulate securities markets. Act: Established under the Securities and Exchange Board of India Act, 1992. Key points:Reserve Bank of India (RBI)

|