INDIAN PATENT APPLICANTS OUTPACED FOREIGN ENTITIES IN FY24

Relevance: GS 3 – Issues relating to intellectual property rights

Why in the news?

- In 2022, patents approved for non-resident Indians and entities accounted for 46%, one of the highest rates globally among major economies.

- Increased applications in chemicals, pharma, computer science, and IT sectors have driven domestic patent applications in FY24 to outpace foreign applicants for the first time.

- Despite this, foreign entities continue to hold a dominant share of patents granted in India, comprising nearly two-thirds of the overall applications

India’s Economic Context:

- India has a trade deficit with 8 of its top 10 trade partners.

- Imports from China alone surpassed $100 billion in FY24.

- India aims to become the third largest economy in the next 5 years, currently being the fifth largest after the US, China, Germany, and Japan.

Skewed Patent Approvals Towards Foreign Entities

- Foreign entities dominate patent approvals, with major global IT companies like Qualcomm Inc., Samsung Electronics, Huawei Technologies, and Apple leading.

- Indian companies are edged out, as per data from the Controller General of Patents, Designs & TradeMarks (CGPDTM).

- Over 70% of final patent clearances are granted to foreign entities, though the gap is narrowing.

- Global Comparisons:

- In 2022,46% of patents approved in India were for non-resident Indians and foreign entities, one of the highest rates among major economies.

- In contrast, China’s share was 87%, indicating a significant difference.

- As per WIPO, Countries with high R&D spending, such as Japan (22.98%) and the Republic of Korea (26.61%), have a lower share of foreign patent approvals.

- Foreign patent domination in the European Patent Office was83%, in Germany 40.97%, and in the US 56.11%.

- Increase in Domestic Patent Applications:

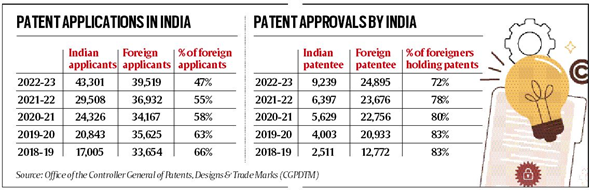

- Since FY19, domestic patent applications have steadily increased, narrowing the gap between domestic and foreign applicants.

- The share of resident applications rose from 34% in FY19 to 53% in FY24, as reported by the Office of the CGPDTM.

- In 2022,46% of patents approved in India were for non-resident Indians and foreign entities, one of the highest rates among major economies.

| Stagnation in India’s R&D Spending

Low R&D Spending:

Comparative International R&D Spending:

|

Domestic Patent Approval Rates

- Despite the rise in applications, approvals for domestic patents have not kept pace, with foreign entities still accounting for over 70% of approvals for nearly a decade.

- Experts attribute this to the quality of patent applications and the patent ecosystem in India.

- The shortage of patent examiners in India, with only 597 full-time equivalents (FTE) compared to the EU’s 3,982, Germany’s 821, and the US’s 8,000.

- In 2022, India ranked 6th globally in patent grants, with 30,490 patents granted, 72% of which went to non-residents.

- Trends in Domestic Patent Approvals:

- Government officials noted that the time lag in the patent process means current approvals often stem from applications filed 4-5 years ago.

- Until recently, foreign entities dominated patent filings, but this trend has shifted since 2020.

- In the 2022-2023 period, 53% of total filings were by residents, rising to 55% in 2023-2024.

- This shift is expected to reflect in future patent grants based on the merit of applications under the Indian Patent Act of 1970, as amended.

Impact of International Treaties:

|

Government Initiatives

- The government acknowledges the need for greater IP creation and ownership by Indian firms.

- In 2021, it launched a ₹76,000 crore semiconductor manufacturing incentive scheme.

- Over ₹7,500 crore of this amount is dedicated to design-linked incentives for chip companies engaged in original design and IP creation in the semiconductor sector.

Challenges of Low R&D Spending

- India as Back Office of Global IT Giants: In the early 90s, India emerged as the world’s back office, with little to no original intellectual property (IP) creation by Indian firms.

- Over time, these back offices evolved into global capability centres (GCCs), experiencing a boom in the last half-decade.

- Despite increased local value addition at GCCs, original IP creation remains limited.

- Inefficiencies in India’s R&D Capabilities: Trade policy experts highlight that the disparity reflects inefficiencies in India’s R&D capabilities.

- Foreign companies exploit these inefficiencies, pre-empting potential domestic competition in the Indian consumer market.

- Weak Investments: Economists point to lower R&D activity due to weak private investments and stagnant government spending.

- Corporate investments are currently low, impacting R&D investment cycles.

- Consequently, Indian manufacturing relies heavily on imported machinery, parts, and foreign technicians to meet export demands.

- Import Dependency: It hampers industrial growth and increases dependency on Chinese imports. China’s manufacturing success is attributed to innovation complementing capacity building.

- Foreign firms dominating patents increases India’s tech dependence and foreign exchange outgo.

- Expanding in existing technology:

- Initially, companies focus on expanding capacity with existing technology before investing in long-term research.

- China has outpaced India since the 1980s, with Chinese universities significantly enhancing research capabilities.

Way Forward for India’s Lagging Patent Applications

- Increase R&D Spending:

- Enhance both government and private sector investments in R&D to reach closer to global averages.

- Encourage public-private partnerships to boost innovation and research activities.

- Improve Patent Ecosystem:

- Increase the number of patent examiners to expedite the patent approval process.

- Provide training and resources to improve the quality of patent applications.

- Support for Startups and SMEs:

- Offer financial incentives and grants to startups and small-to-medium enterprises (SMEs) for R&D and patent filings.

- Establish incubators and innovation hubs to support early-stage research and development.

- Strengthen IP Laws and Enforcement:

- Update and enforce intellectual property laws to protect innovations and encourage domestic patent filings.

- Simplify the patent application process to make it more accessible.

- Foster Academia-Industry Collaboration:

- Promote partnerships between academic institutions and industry to drive research projects leading to patentable innovations.

- Facilitate technology transfer from universities to the private sector.

- Incentivize Original IP Creation:

- Implement schemes and policies that reward original IP creation and innovation.

- Encourage multinational corporations (MNCs) to engage in R&D activities within India rather than just utilizing it as a back office.

- Awareness and Education:

- Increase awareness about the importance of patents and intellectual property rights among researchers and businesses.

- Integrate IP education into the curriculum of engineering, science, and business programs.

- International Collaboration:

- Engage in international collaborations and exchanges to bring in best practices and advanced technologies.

- Leverage global patent systems like the PCT to facilitate the international protection of domestic innovations.

Alternative articles

- https://universalinstitutions.com/start-up-india/

- https://universalinstitutions.com/focus-on-local-patents-semiconductor-subsidies-urged-by-icea/

Mains question

Discuss the challenges faced by India in increasing its domestic patent applications and approvals. Suggest measures to enhance research and development (R&D) activities in the country. (250 words)