THE KARNATAKA GIG WORKERS BILL

Syllabus:

GS 2:

- Welfare schemes for vulnerable section of the society.

GS 3:

- Employment and Mobalization of resources.

Why in the News?

The draft Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill, 2024, aims to provide social security and welfare measures for gig workers. It follows Rajasthan’s similar legislation, highlighting the growing recognition of gig workers’ challenges and the need for regulatory frameworks to address their rights and welfare.

Source: Deccan Herald

| Gig Workers and Legislation in India:

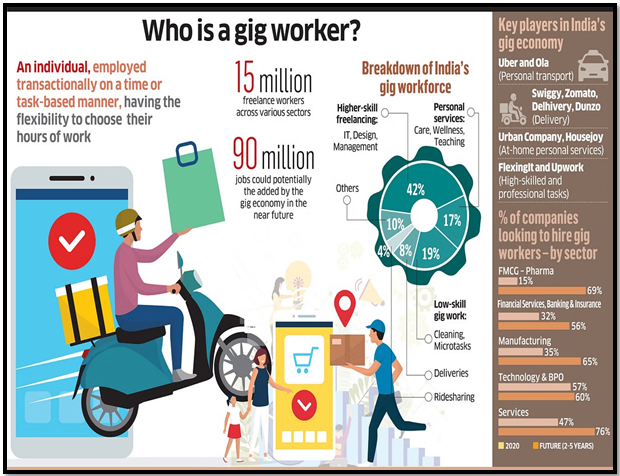

Definition: Gig workers are individuals who perform temporary or freelance jobs, typically through digital platforms or apps. They work independently, often on a flexible schedule, and may provide services such as ridesharing, food delivery, or other on-demand tasks. Legislation: India lacks specific laws for gig workers, who fall under informal employment categories. Recent Developments: States like Rajasthan and Karnataka have introduced bills aiming to provide social security and welfare benefits to gig workers. |

Overview of the Karnataka Gig Workers Bill

- Introduction: Last month, Karnataka introduced the draft Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill, 2024, aimed at providing social security and welfare measures for gig workers.

- Bill Release: The draft was shared on July 9, 2024, following the recent enactment of a similar law in Rajasthan.

- Welfare Board Model: Both Karnataka and Rajasthan’s legislations are based on a welfare board model, which is more suited for self-employed informal workers rather than addressing employment relations.

- Employment Relations: The Bill does not adequately address the crucial aspect of employment relations, which is essential for gig workers.

- Focus on Welfare: While the Bill focuses on welfare measures, it falls short of recognizing the need to formalize employment relations in the gig economy.

- Similarities: The Karnataka Bill mirrors the Rajasthan legislation but does not solve the core issues faced by gig workers.

Rise of Gig Work and Associated Issues

- Growing Workforce: The number of gig and platform workers has increased significantly, particularly in the app-cab and retail delivery sectors.

- Future Projections: NITI Aayog projects the gig workforce to expand to 23.5 million workers by 2030, highlighting the sector’s importance in employment generation.

- Protests and Agitations: Gig workers in India have been protesting against issues like revenue sharing, working hours, and various working conditions.

- Legal Framework Challenges: Existing labor laws are based on employer-employee relationships, making it difficult to address gig work issues within this framework.

- Aggregator Model: Aggregators consider themselves as technology providers, viewing gig workers as independent contractors, complicating the employment relations.

- Worker Demands: Gig workers seek fair treatment, improved working conditions, and access to social security as legal entitlements, challenging the current aggregator model.

UK Ruling and Indian Legal Context

- UK Supreme Court Ruling: The UK Supreme Court ruled that Uber is an employer, applying existing labor laws to Uber drivers.

- Indian Legal Framework: In India, gig workers are included in the Code on Social Security 2020 as informal self-employed workers but are not mentioned in other key labor codes.

- Rajasthan and Karnataka Laws: Both Rajasthan and Karnataka have introduced recent legislations, but they avoid defining employment relations in gig work.

- Term ‘Aggregator’: The Karnataka Bill uses the term ‘aggregator’ for app companies, avoiding the term ’employer’, thus not applying protective labor laws.

- Unresolved Issues: Important issues like minimum wage, occupational safety, working hours, leave entitlements, and collective bargaining remain unresolved in gig work.

- Working Conditions: There is no guarantee on minimum earnings or regulation on working hours for gig workers, leading to unsafe and unfair working conditions.

Core Issues with the Welfare Board Model

- Welfare Schemes: The welfare board model provides some welfare schemes but does not replace institutional social security benefits like provident fund, gratuity, or maternity benefits.

- Historical Implementation: Historically, welfare board models have been poorly implemented, as seen with the Construction Workers Welfare Act of 1996 and the Unorganized Workers Social Security Act.

- Minimum Wage and Working Hours: The Karnataka Bill does not address minimum wages or working hours for gig workers, focusing instead on income security regarding payment deductions.

- Income Security: Section 16 of the Bill discusses income security but does not guarantee minimum income or wage entitlements.

- Weekly Payments: Section 16(2) requires weekly payments but does not specify a minimum amount, leaving gig workers without assured minimum earnings.

- Employment Relationship: The Bill, like the Code on Social Security 2020 and the Rajasthan Act 2023, fails to address the employment relationship in the gig economy, complicating employment relations and protecting workers’ rights.

Challenges to Gig Workers

- Lack of Employment Rights: Gig workers are often classified as independent contractors, excluding them from basic employment rights such as minimum wage, overtime pay, and sick leave.

- Inconsistent Income: Earnings for gig workers can be highly variable, with no guaranteed minimum income, making financial stability difficult to achieve.

- Long Working Hours: Without regulations on working hours, gig workers often work excessively long hours to make ends meet, leading to health issues and burnout.

- Lack of Social Security: Gig workers typically do not receive social security benefits like provident fund, gratuity, or maternity benefits, leaving them vulnerable in times of need.

- Inadequate Health and Safety Protections: Gig work often involves physical risks, but without formal health and safety protections, workers are at higher risk of injury or illness.

- Uncertain Job Security: Gig work is inherently unstable, with no long-term job security, making it difficult for workers to plan for the future.

- Limited Bargaining Power: Gig workers lack collective bargaining rights, limiting their ability to negotiate better pay and working conditions.

- Expense Burden: Gig workers often bear the cost of essential work-related expenses, such as vehicle maintenance and fuel, which can significantly reduce their net income.

- Lack of Career Progression: The gig economy offers limited opportunities for skill development and career advancement, trapping workers in low-wage, low-skill jobs.

| Case Study on Gig Worker:

Conducted by People’s Association in Grassroots Action and Movements. Key Highlights: 1. Long Working Hours:

2. Low Pay:

3. Financial Strain:

4. Unsatisfactory Compensation:

5. Work Conditions:

6. Issues with Platforms:

|

Future Directions/ Way Forward:

- Recognition of Employment Relations: Employment relations in gig work need to be recognized to apply protective labor laws effectively.

- Role of Aggregators: Aggregators are de facto employers as they set the terms and conditions of employment, and this must be acknowledged in legislation.

- Social Security: Gig workers require access to institutional social security benefits to ensure fair and safe working conditions.

- Policy Improvements: Future policies should address the gaps in current legislation, ensuring minimum wages, regulated working hours, and comprehensive social security for gig workers.

- Worker Protections: Legal frameworks need to protect gig workers’ rights and provide a stable and secure working environment.

- Sustainable Solutions: Sustainable solutions must be developed to balance the interests of gig workers and aggregators, ensuring a fair and equitable gig economy.

Conclusion

The draft Karnataka Bill represents a step towards addressing the issues faced by gig workers but falls short in recognizing employment relations and providing comprehensive protections. Effective legislation must balance the interests of workers and platforms, ensuring fair wages, job security, and social benefits for the gig workforce.

Source:The Hindu

Mains Practice Question:

Discuss the challenges faced by gig workers in India and evaluate the effectiveness of recent legislative measures like the draft Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill, 2024, in addressing these issues.

Associated Article: