DECLINE IN CROP INSURANCE PREMIUMS UNDERWRITTEN

Why in the news?

- General insurance companies have reduced their exposure to crop insurance under the Pradhan Mantri Fasal Bima Yojana (PMFBY) in FY24.

- Gross direct premiums underwritten by insurers declined by 4.17% to Rs 30,677 crore from Rs 32,011 crore in the previous year, despite significant crop losses due to adverse weather conditions.

Key Highlights:

- The PMFBY scheme has covered nearly 4 crore farmers, with a significant number enrolled through Common Service Centres (CSCs).

- The Ministry of Agriculture launched the AIDE app to facilitate enrolment of non-loanee farmers, resulting in significant engagement with intermediaries and insurance

brokers.

Source: Farm

| Pradhan Mantri Fasal Bima Yojana (PMFBY)

About

Objectives

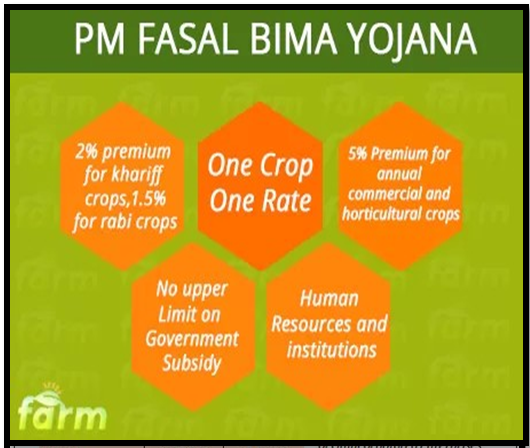

Premium Rates:

Associated Article: |