INDIA’S ELECTRONIC MANUFACTURING SERVICE INDUSTRY IS HUMMING — NOW TO STICK TO THE FLIGHT PATH

Relevance: GS 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment; Technology missions

Why in the news?

- Manufacturers must consider nearshoring to reduce supply chain disruptions.

- Schemes target reducing cheap imports, boosting exports, and job creation.

- Significant funds are allocated for large-scale electronics manufacturing.

- India’s competitiveness relies on reforms, de-bureaucratisation, contract enforcement, dispute resolution, last-mile facilitation, sectoral ecosystems, and governance stability.

Recent Developments in India’s Electronics Manufacturing Services (EMS) Industry

- Google Pixel 8 production: 1 lakh units to be made in India by Padget Electronics; 25-30% for export.

- Apple doubled iPhone exports from India: $580 million to $1.1 billion in one year.

- Tata Sons’ $14 billion semiconductor investment: Chip fabrication facility at Dholera in Gujarat and OSAT (outsourced semiconductor assembly and test) facility at Morigaon in Assam in collaboration with PSMC Taiwan.

Evolution and Technological Advances in EMS

- Origin: Began in the early ’80s with OEMs engaging smaller manufacturers.

- Growth: Leveraged scale and expertise for multi-OEM manufacturing, material procurement, and cost reduction.

- Surface-mount technology (SMT): Components mounted directly on printed circuit boards, along with wave/bulk soldering, accelerated industry growth.

- Emerging technologies:

- IoT: Enabled smart component and device production.

- AI and ML: Enhanced efficiencies in maintenance, defect detection, and supply chain optimisation.

- Robotics: Improved precision in component placement and soldering.

- Blockchain: Increased supply chain trust and reduced counterfeiting.

- 3D Printing: Used for rapid prototyping and custom components.

- Advanced Materials: Graphene and polymers enable lightweight, breakthrough designs with improved performance.

Global Manufacturing Shifts

- China’s Dominance: From 2015-19, China accounted for 16% of global manufactured goods exports.

- Shift in Strategy: US efforts to minimize dependence on China led to trade tensions.

- Supply Chain Risk Mitigation: COVID-19 disruptions prompted the ‘China Plus One’ strategy.

- Alternative Locations: MNCs seek countries with skills and political stability; Vietnam benefited from low-wage labor, proximity to China, favorable taxation, and FTAs.

- India’s Competitiveness: Dependent on reforms, de-bureaucratisation, contract enforcement, effective dispute resolution, last-mile facilitation, sectoral ecosystem building, and governance stability.

Growth and Government Initiatives

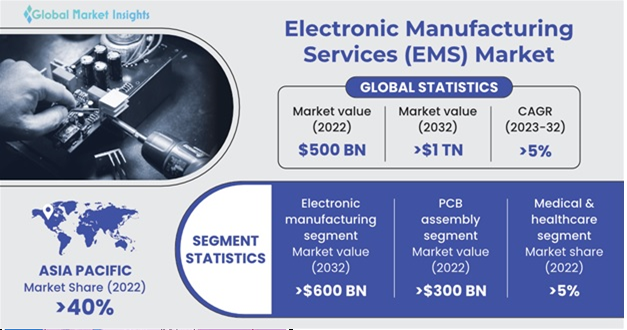

- Electronics Manufacturing Growth: Grew at a CAGR of 20.1% in FY23, expected to reach $300 billion by 2026.

- Government Schemes:

- 2020: Modified Electronics Manufacturing Clusters, PLI for large-scale electronics manufacture.

- 2021: PLI for hardware.

- 2023: PLI 2.0 for IT hardware.

- Objectives: Curb cheap imports, boost exports, create jobs; highest disbursal for large-scale electronics manufacture.

- New Focus: Tracking consumption of personal use appliances and items (e.g., PlayStation consoles, AirPods, Bluetooth devices).

Industry Challenges and Strategies

- Competitive Global Market: Vying for large contracts globally.

- Technological Advancements: Requires significant investments and skilling.

- Environmental Regulations: Must comply with stringent material and waste disposal standards.

- Rising Wages: Need to manage increasing labor costs.

- Strategic Decisions:

- Geographical Operations: Decide where to operate.

- Nearshoring: Bring production closer to markets to reduce supply chain disruptions.

- Industry Verticals: Focus on sectors like EVs, telecom, industrial, healthcare, durables, or wearables.

- Sustainability: Use green energy sources, eco-friendly materials, and processes.

- Workplace Diversity: Promote diversity and inclusivity.

- Winning Strategy: Counter commoditization with a solution- and design-led approach, built on compliance and automation.

Solutions and Future Outlook

- Strategic Geographical Operations: Evaluate markets for stability, growth potential, and regulatory support. Example: Setting up manufacturing facilities in India to benefit from government incentives and emerging market opportunities.

- Nearshoring Strategies: Establish production facilities closer to target markets to mitigate supply chain disruptions. Example: Moving manufacturing operations from China to Southeast Asian countries like Vietnam or Thailand to serve regional markets more efficiently.

- Diversification Across Industry Verticals: Identify sectors with high demand and growth potential, diversifying product offerings accordingly. Example: Expanding into the healthcare sector by producing medical devices and equipment alongside consumer electronics.

- Adoption of Sustainable Practices: Implement green energy sources, eco-friendly materials, and efficient waste management systems. Example: Investing in renewable energy solutions for manufacturing processes, reducing carbon footprint.

- Workforce Development and Inclusivity: Invest in training programs to upskill employees and promote diversity in the workplace. Example: Partnering with local educational institutions to offer specialized training courses in electronics manufacturing.

- Innovation and Automation: Embrace automation technologies to improve efficiency and reduce costs while fostering a culture of innovation. Example: Implementing robotics and AI-driven systems for assembly line optimization and quality control.

- Strategic Partnerships and Alliances: Form collaborations with technology providers, research institutions, and other industry players to leverage expertise and resources. Example: Partnering with universities for research on advanced materials and manufacturing techniques.

Associate articles

Mains question

Discuss the challenges and strategic imperatives for the Electronics Manufacturing Services (EMS) industry in the context of global competition, technological advancements, and sustainability goals. (250 words)