RBI DEPUTY GOVERNORS RAISE SUPERVISORY CONCERNS AT ASSET RECONSTRUCTION FIRMS

Why in the news?

- RBI raises concerns over alleged unethical practices in asset reconstruction companies (ARCs).

- ARCs urged to prioritise governance and ethical conduct.

- Conference organised in Mumbai to address these issues.

source:scribd

About Asset Reconstruction Company (ARC):

- Specialised financial institution acquiring and managing distressed assets like NPAs.

- Banks offload troubled loans to ARCs at discounted prices, freeing up capital.

- ARCs aim to recover maximum value through loan restructuring or asset sales.

- Proceeds from recovery shared with banks based on profit-sharing agreements.

- Regulated by central banks or financial authorities to ensure ethical practices and financial system stability.

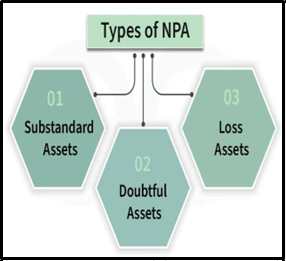

What are Non-Performing Assets (NPAs) ?

Classification of asset:

|