INDIAN TAXATION SYSTEM

GENERAL SCENARIO OF INDIAN TAXATION

- Origin of Tax: The term “tax” comes from “taxation,” indicating an estimation process.

- Historical Presence: Direct taxation has been a part of India’s financial system since ancient times.

- Purpose of Taxation: Taxes are collected by the government to fund projects that boost the economy and improve citizens’ standard of living.

- Legal Authority: The Indian Constitution grants the power to levy taxes to both the Central and State governments.

- Legislative Requirement: For any tax to be enforced in India, it must be supported by laws passed by either the Parliament or the State Legislature.

- Nature of Tax: Tax is a mandatory financial charge, not a voluntary contribution. Failure to pay is subject to legal penalties.

- Direct Tax Collections Increase: From April 1, 2022, to February 10, 2023, India’s Direct Tax Collections rose by 24.09%, reaching Rs. 15.67 lakh crore, as reported by the Finance Ministry.

- Net Direct Tax Collections: After considering refunds, the net Direct Tax collection amounted to Rs. 12.98 lakh crore, marking an 18.40% increase over the previous year’s collections for the same timeframe.

- Segment Growth:

- Corporate income tax collections grew by 19.33%.

- Personal income tax collections surged by 29.63%.

- Future Expectations: The government projects a 10.5% growth in revenue from corporate and personal income taxes for the next fiscal year, aiming to achieve Rs 18.23 lakh crore.

Canons of Taxation by Adam Smith

Adam Smith, in his seminal work “The Wealth of Nations” (1776), introduced four fundamental principles or “Canons of Taxation” that he believed should underpin any effective taxation system. These principles are designed to ensure that taxes are fair, efficient, and conducive to the well-being of society.

Canon of Equality

- Principle of Fairness: Equity in taxation means that everyone should contribute to the government’s revenue in a manner that is fair and just. This principle recognizes that taxpayers have varying capacities to pay.

- Proportional Taxation: Smith advocated for a system where taxes are proportional to the income or wealth of individuals. This means that those with higher incomes should pay more taxes than those with lower incomes, ensuring that the tax burden is aligned with the ability to pay.

- Addressing Inequality: The Canon of Equity seeks to prevent regressive taxation that disproportionately affects lower-income groups. By ensuring that taxes are levied based on the capacity to pay, the system aims to reduce economic disparities.

Canon of Certainty

- Predictability and Clarity: This canon emphasizes that the tax obligations of individuals should be clear and predictable. Taxpayers should know in advance how much tax they owe, the manner of payment, and to whom the payment is to be made.

- Preventing Arbitrary Taxation: By ensuring certainty in the tax system, this principle aims to protect taxpayers from arbitrary decisions and harassment. It fosters a sense of trust and compliance among taxpayers.

Canon of Convenience

- Ease of Payment: Taxes should be levied in a manner and at a time that is most convenient for the taxpayer. The process of paying taxes should be straightforward, without causing undue hardship.

- Simplifying Tax Compliance: The convenience of payment facilitates compliance and reduces frustration among taxpayers. An easy and straightforward tax payment process is crucial for maintaining a positive relationship between taxpayers and the government.

Canon of Taxation

- Efficiency in Collection: A good tax system is one that minimizes the costs associated with collecting taxes. The expenses involved in tax collection should be a small fraction of the amount collected.

- Maximizing Revenue with Minimal Disruption: According to Smith, the design of taxes should ensure that the government maximizes its revenue without excessively burdening taxpayers. The aim is to keep administrative costs low while ensuring that the tax collection process is efficient and yields substantial revenue for public purposes.

Other Canons of Taxation:

Canon of Simplicity

- Straightforward Tax System: This principle emphasizes the importance of having a tax structure that is easy to understand and administer. A simple tax system reduces administrative costs and compliance burdens, making it easier for taxpayers to fulfill their obligations.

- Benefits: Simplicity in taxation helps eliminate confusion and misunderstandings, potentially increasing compliance rates and reducing the likelihood of tax evasion. It also facilitates more efficient tax collection by the government.

Canon of Productivity

- Effective Revenue Generation: Taxes should be designed to generate substantial revenue for the government without imposing unreasonable burdens on taxpayers. The productivity of a tax system is measured by its capacity to fund public services effectively.

- Balancing Act: While ensuring productivity, it’s crucial that taxes do not deter economic activities or investments. The system should strike a balance, encouraging growth while providing the necessary funds for government operations.

Canon of Flexibility

- Adaptability to Economic Changes: A flexible tax system can adjust to economic fluctuations, allowing for increases in revenue during periods of economic growth and providing relief during downturns.

- Application: Flexibility is particularly important for indirect taxes. For instance, taxes on luxury items might be increased as general wealth and spending power grow, while taxes could be lowered during economic hardships to relieve pressure on consumers.

Canon of Diversity

- Multiple Taxes at Lower Rates: Instead of relying on a single tax source with high rates, a diversified tax approach involves spreading the tax burden across various taxes. This can prevent excessive burdens on any single taxpayer or sector and reduce the chances of tax evasion.

- Encourages Economic Growth: By distributing the tax load more evenly and avoiding high tax rates, the Canon of Diversity supports investment and economic development. Lower, more varied tax rates can stimulate spending and investment, contributing to a healthier economy.

Types of Taxes

| Basis | Direct Taxes | Indirect Taxes |

| Meaning | Levied on personal income/wealth, paid directly to government. | Levied on goods/services, paid by consumers but collected by sellers. |

| Incidence and Impact | Imposed and paid by the same person. | Imposed on sellers, but the economic burden is on consumers. |

| Tax Burden | Progressive; higher income leads to higher tax rates. | Regressive; higher income individuals pay a smaller proportion of their income. |

| Evasion | Possible, due to direct assessment. | More difficult, as it’s collected at point of sale. |

| Inflation Impact | Helps reduce inflation. | Contributes to inflation. |

| Shiftability | Cannot be shifted to others. | Can be shifted to consumers. |

| Examples | Income Tax, Wealth Tax, Capital Gains Tax. | GST, Excise Duty. |

METHODS OF TAXATION

Proportional Taxes

- Consistent Tax Rate: In a proportional tax system, the tax rate remains constant regardless of the amount of the tax base, which can be income, property value, wealth, or goods. This means the percentage of tax is the same for all taxpayers.

- Impact on Taxpayers: As income or the tax base increases, the amount of tax paid also increases in direct proportion. If a taxpayer’s income doubles, their tax payment doubles as well, maintaining the same rate across all income levels.

- Primary Tax Base: Income is often used as the primary base for proportional taxes because it reflects an individual’s capacity to pay.

Progressive Taxes

- Increasing Tax Rate: The tax rate increases as the taxable amount or base increases. This method aims to tax individuals based on their ability to pay, with higher earners paying a higher percentage of their income in taxes.

- Equity Principle: By extracting a greater proportion from rising incomes, progressive taxes are seen as a way to redistribute wealth more equitably across society, reducing income inequality.

- Faster Growth in Tax Payments: As income grows, the amount of tax paid grows at an even faster rate, ensuring that those with the highest incomes contribute a larger share to public finances.

Regressive Taxes

- Decreasing Tax Rate with Higher Income: Regressive taxes impose a higher burden on lower-income individuals relative to their income, as the tax rate decreases as the income or tax base increases.

- Impact on Equity: Such taxes are considered unjust and inequitable because they exacerbate income disparities and place a disproportionately heavy burden on the poor.

- Common in Consumption Taxes: Regressive effects are often seen in consumption taxes like sales taxes, where lower-income individuals end up paying a higher percentage of their income compared to wealthier individuals.

Digressive Taxes

- Mildly Progressive Rate: Digressive taxes are a mix between progressive and proportional taxes. They are progressive up to a certain income level, after which the tax rate flattens out or becomes a flat rate.

- Balancing Equity and Efficiency: This method seeks to ensure that high-income earners do not face excessively steep tax rates, thus maintaining incentives for earning while still adhering to equity principles to a degree.

Specific Tax

- Fixed Amount Per Unit: A specific tax, or per unit tax, is charged as a fixed amount for each unit of a good or service sold. This method is straightforward and easy to administer, especially for tangible products.

- Independent of Price: The tax amount does not vary with the price of the product, making it proportional to the quantity sold rather than the value. This can be advantageous for items where quantities are easily measured.

Ad Valorem Tax

- Value-Based Taxation: Ad valorem taxes are levied based on the assessed value of an item. This method is commonly used for property taxes, where the tax is a percentage of the property’s assessed value.

- Wide Application: Besides property, ad valorem taxes can apply to a range of items, including import duties on goods from other countries, making it a versatile approach to taxation based on the value of goods and services.

Single Tax System

- Inelastic Supply: The total amount of land is fixed, and its supply does not increase in response to increased demand, making it a stable tax base.

- Non-Depletion: Unlike other natural resources, land itself cannot be depleted or destroyed by overuse, ensuring a perpetual source of revenue.

- Efficiency: A tax on land value is considered to be efficient because it does not discourage productive economic activity in the same way taxes on income, consumption, or investment might. Since the tax is levied on the value of the land itself rather than what is produced on the land, it does not penalize individuals or businesses for improving their property or being productive.

- Equity: Proponents argue that because the value of a given piece of land is largely determined by external factors like location, infrastructure, and community development, taxing land value captures the societal contribution to an individual’s wealth without diminishing personal effort.

Multiple Tax System

- Diversification of Revenue Sources: Relying on multiple taxes reduces the risk associated with fluctuations in any single tax base, ensuring a more stable revenue stream for government operations.

- Fairness: By spreading the tax burden across different types of taxes, a multiple tax system can more effectively address issues of equity and ability to pay. For example, progressive income taxes ensure that those with higher earnings contribute a greater share of their income.

- Economic Policy Objectives: Different taxes can be tailored to achieve specific policy goals, such as discouraging harmful consumption through excise taxes on tobacco and alcohol, or encouraging investment through lower capital gains taxes.

- Adaptability: A multiple tax system can be adjusted more easily to respond to economic changes, social priorities, or technological advancements. It allows governments to introduce new taxes or modify existing ones to better meet the needs of society.

Direct taxation system

- The direct taxation system involves taxes that are directly imposed on individuals and entities based on their income and wealth, and these taxes are paid directly to the government. Direct taxes are administered by the Central Board of Direct Taxes (CBDT) in India, part of the Ministry of Finance, which makes recommendations on direct tax programs and policies. The system is designed to be progressive, ensuring fairness by taxing individuals and entities according to their capacity to pay, with various taxes targeting different forms of income and wealth.

Income Tax

- Applicable Entities: Individuals, Hindu Undivided Families (HUFs), unregistered businesses, and other groups.

- Taxation Principle: Progressive, based on income slabs. The tax rates vary according to the amount of net income, with different brackets established for taxing income at increasing rates as income rises.

- Notable Exclusions: Agricultural income is exempt from income tax. Surcharge applies for income exceeding certain thresholds.

Capital Gains Tax (CGT)

- Definition: Tax on profit or gain from the sale of a capital asset.

- Asset Classification: Includes tangible assets like land and buildings, and intangible assets like patents and copyrights. Capital assets are further classified into short-term (held for less than 36 months) and long-term (held for more than 36 months), with the holding period for immovable property revised to 24 months for certain cases starting from FY 2017-18.

- Taxation: The rates vary depending on whether the gain is short-term or long-term.

Corporation Tax

- Applicability: Companies and commercial enterprises’ earnings.

- Taxation Basis: A separate entity concept where businesses pay taxes independently from their owners’ personal income.

- Rate: As of January 2023, the corporate tax rate for domestic companies is 22%.

Minimum Alternate Tax (MAT)

- Purpose: Ensures that companies declaring substantial profits but paying minimal taxes through exemptions pay a minimum level of tax.

- Rate: Set at 15% as of January 2023.

Securities Transaction Tax (STT)

- Scope: Levied on transactions done on Indian stock exchanges involving stocks, options, and futures contracts.

Commodities Transaction Tax (CTT)

- Applicability: Imposed on non-agricultural commodity futures traded on exchanges.

- Coverage: Includes metals like gold, silver, and copper, as well as energy commodities like crude oil and natural gas.

Other Taxes

- Estate Duty: Levied on the estate of the deceased, repealed since 1985.

- Wealth Tax: Imposed on individuals, HUFs, and companies exceeding a certain net wealth threshold, repealed in 2015.

- Gift Tax: Taxed on gifts received, repealed since 1998.

- Fringe Benefits Tax (FBT): Tax on benefits provided by employers to their employees, removed in 2009.

Customs Duties

- Nature: Levied on goods crossing international borders, aimed at protecting the country’s economy and generating revenue.

- Types: Includes Basic Duty, Countervailing Duty, Protective Duty, Anti-Dumping Duty, and Export Duty.

- Basis of Calculation: Generally ad valorem (based on the value of goods).

Advantages Of Direct Taxation:

Progressive Nature

- Equity: Direct taxes are inherently progressive, meaning the tax rate increases as the taxable amount (or tax base) increases. This ensures that those who earn more pay a higher percentage of their income in taxes, aligning with the principle of equity in taxation.

- Ability to Pay: This progressiveness is linked to the taxpayer’s ability to pay, making it a crucial tool for reducing income and wealth disparities within a society.

Certainty

- Predictability for Taxpayers and Government: Direct taxes offer a high degree of certainty. Taxpayers know in advance how much tax they owe, and the government can predict its tax revenues more accurately. This certainty aids in personal financial planning and government budgeting.

Elasticity

- Responsive to Economic Changes: The nature of direct taxes allows for flexibility and responsiveness to economic conditions. As individuals’ income levels rise, tax revenues to the government naturally increase, making direct taxes income elastic. This elasticity means that tax policies can adapt to economic growth or contraction without needing frequent legislative changes.

Economic Efficiency

- Low Collection Costs: The process of collecting direct taxes is relatively cost-effective because taxes are paid directly by the taxpayers to the government. This direct relationship between the taxpayer and the state minimizes administrative costs and complexities.

- Inflation Control: In times of inflation, the government can adjust direct tax rates to reduce disposable income, thereby decreasing consumer demand and potentially lowering inflation rates.

Equity

- Fairness: Direct taxes are designed to be equitable, with the tax burden distributed according to taxpayers’ ability to pay. Wealthier individuals contribute more to public revenues, while those with lower incomes may benefit from exemptions or lower tax rates. This approach aims to mitigate economic inequality.

Important Instrument for Fiscal Policy

- Regulation of Demand: By adjusting direct tax rates, the government can influence the amount of money in circulation, which in turn can impact consumer demand. For instance, raising direct taxes during inflationary periods can help curb excessive demand for goods and services, stabilizing prices.

- Volatility and Currency Rates: Through mechanisms like the Tobin Tax on international currency transactions, direct taxation can help manage exchange rate volatility and speculative trading, contributing to financial stability.

Mitigating Inflation

- Demand Management: The strategic increase in direct taxes during periods of high inflation can help control demand by reducing the amount of money available for spending. This can be an effective tool in cooling down an overheated economy and preventing inflation from spiraling out of control.

Issues Related Direct Taxation in India

Cross-border transactions

- The taxation of non-residents in India has traditionally been tied to their physical presence in the country. This approach has led to complexities in taxing digital businesses and services that can operate transnationally without a physical footprint, resulting in disputes, base erosion, and profit shifting (BEPS) where multinational companies shift profits to low-tax jurisdictions. This issue challenges the traditional notions of nexus and source of income in the era of digital economy.

Synchronization with the global economy

- As India’s economy becomes more intertwined with the global market, the need for a tax system that does not discriminate between foreign and local enterprises becomes more pronounced. Differential treatment can deter foreign investment and complicate India’s participation in international trade and investment frameworks.

Narrow tax base

- India’s tax base is considered narrow, with a small proportion of the population paying direct taxes. Expanding and broadening the tax base can increase revenue without the need to increase tax rates, which can help in creating a more equitable tax system and in reducing the tax burden on the current pool of taxpayers.

Protracted tax litigation

- India is known for its lengthy tax litigation process, which not only overburdens the judiciary but also results in significant costs to the government in terms of locked-up funds that could otherwise be used for development purposes. This situation also creates uncertainty for businesses and can deter investment.

Complex corporate tax rate structure

- The effective corporate tax rate in India varies significantly across different industries due to various exemptions and incentives. This lack of uniformity can lead to inefficiencies and perceptions of unfairness, affecting investment decisions.

Rationalization and simplification

- The Indian taxation system is complex, with numerous laws, rules, and regulations that can be challenging to navigate. There is a pressing need for rationalization and simplification to make the tax system more efficient, transparent, and user-friendly.

Clarity in complex arrangements

- The lack of clarity in tax laws, especially concerning complex transactions and international tax arrangements, creates uncertainty and can lead to disputes between taxpayers and the tax authority.

Tax litigation volume

- India has a high volume of tax disputes between the tax administration and taxpayers, with a relatively low percentage of tax arrears being recovered. This indicates inefficiencies in the dispute resolution process and the need for more effective mechanisms.

Tax evasion and avoidance

- Tax evasion and avoidance are significant issues in India, with individuals and corporations employing illegal means or exploiting loopholes to reduce their tax liability. This undermines the equity of the tax system and leads to a loss of revenue for the government.

Outdated Income Tax Act

- The Income Tax Act in India contains provisions that may no longer be relevant or that have not kept pace with the changes in the economy and technology. This can create inconsistencies and inefficiencies in the tax system.

Balance between direct and indirect taxes

- The reliance on indirect taxes, which are regressive and tend to disproportionately affect the poor, has been increasing. There’s a need for a more balanced approach that ensures fairness and does not unduly burden any single group, especially the economically vulnerable.

Government Initiative in Direct Taxation SYSTEM

Project Insight and Operation Clean Money

- Objective: Utilize data analytics to enhance tax compliance and make better use of information in tax administration.

- Impact: These projects aim to identify non-compliance and tax evasion through the analysis of massive datasets, thereby widening the tax base and ensuring fair tax practices.

Corporate Rate Cut

- Reduction in Tax Rates: The corporate tax rate was cut from 30% to 22% to stimulate industrial activity and promote compliance.

- Effective Tax Rate: The effective tax rate for all domestic corporations is set at 25.17%.

- Incentive for New Manufacturing Enterprises: New manufacturing companies are offered a lower corporate tax rate of 15%, aiming to boost the manufacturing sector.

Dividend Distribution Tax (DDT) Repeal

- Repeal in Finance Act 2020: The DDT was repealed to enhance the attractiveness of the Indian equity market, encouraging investment.

Vivad Se Vishwas Scheme

- Resolution of Tax Disputes: This initiative facilitates the resolution of pending tax disputes, helping both the government and taxpayers by ensuring timely revenue collection and reducing litigation costs.

Encouragement of Digital Transactions

- Digital Economy: This measure supports the digitalization of the economy and aims to reduce cash transactions, thereby minimizing unaccounted transactions.

Monetary Threshold Increase for Appeals

- Higher Limits for Judicial Appeals: The monetary threshold for filing appeals has been raised, which helps in reducing frivolous litigation and focusing on significant cases.

Expansion of Scope for TDS and TCS

- Widening Tax Base: By including various additional transactions under TDS (Tax Deduction at Source) and TCS (Tax Collection at Source), the tax base is expanded, ensuring a broader compliance spectrum.

Concessional Rate under Finance Act 2020

- Tax Incentives: Individuals and co-operatives can opt for concessional income tax rates provided they forgo specific exemptions and incentives, aiming to simplify the tax system.

Increasing Tax Compliance

- E-Sahyog and Project Saksham: These platforms facilitate online filing of returns and assist with the implementation of GST, making compliance easier for taxpayers.

- SWIFT Expansion: The expansion of the Indian Customs Single Window Interface for Trade (SWIFT) aims to streamline customs procedures for trade facilitation.

General Anti-Avoidance Rules (GAAR)

- Implementation from April 1, 2017: GAAR helps authorities assess whether transactions have substantial commercial substance, thereby preventing tax avoidance schemes.

Place of Effective Management (POEM)

- Determining Tax Residence: POEM standards were introduced to tax the global income of companies whose place of effective management is in India, affecting how international companies are taxed.

Information Sharing Agreement

- Cooperation with the United States: Through an agreement under the Foreign Account Tax Compliance Act (FATCA), India collaborates with the U.S. to exchange tax-related information, enhancing global tax compliance.

Way Forward: Direct Taxation System

Arresting Tax Evasion

- Issue: The exemption of agriculture revenue from taxes is designed to support farmers, but it can be exploited by non-agricultural entities to evade taxes by falsely claiming their income as agricultural.

- Solution: Implement stricter verification processes and clearer criteria to distinguish between genuine agricultural income and other forms of income masquerading as agricultural, to prevent misuse of this exemption.

Reducing Tax Terrorism

- Issue: The term “tax terrorism” refers to aggressive tax collection practices that can create a climate of fear among taxpayers.

- Solution: Enhance transparency in the taxation structure and limit the discretionary powers of tax authorities to ensure that tax collection is fair, predictable, and reasonable. This involves clear tax guidelines and the use of technology to minimize subjective decisions.

Creating a Level Playing Field

- Issue: Large corporations often have the resources to navigate complex tax structures, gaining advantages over startups and smaller firms that cannot afford such expertise.

- Solution: Simplify the tax code to make it easier for all businesses to understand and comply with their tax obligations, ensuring no undue advantage is given to entities simply because they have more resources.

Reducing Sectoral Disparities

- Issue: The tax system can sometimes be unequal across different sectors, with some sectors enjoying lower effective tax rates due to various exemptions and incentives.

- Solution: Review and adjust sector-specific tax policies to ensure that the effective tax rate is more uniform across sectors, promoting a fair competitive environment.

Addressing Vertical Inequity

- Issue: Corporate tax breaks can lead to vertical inequity, where individuals or entities with higher incomes or profits end up with disproportionately large tax benefits.

- Solution: Ensure that tax breaks and incentives are designed in a way that they do not disproportionately benefit the wealthier individuals or larger corporations at the expense of smaller entities or less wealthy individuals.

Reducing the Effective Tax Rate

- Issue: A high tax rate can deter investment and growth, especially when compared to other countries with more competitive tax rates.

- Solution: Consider lowering the effective tax rate to make the tax system more competitive internationally, thereby attracting more investment and promoting economic growth.

Rationalising Tax Exemptions

- Issue: Tax exemptions are sometimes granted through opaque processes, without clear rules.

- Solution: Make the process for granting tax exemptions more transparent and based on established criteria to ensure fairness and to reduce opportunities for manipulation.

Eliminating Double Taxation

- Issue: Income from partnership businesses is often taxed twice—once at the corporate level and again at the individual owner level.

- Solution: Reform tax laws to eliminate double taxation, ensuring that income is taxed either at the corporate level or at the individual level but not both, to promote fairness and encourage entrepreneurship.

Direct Tax Reforms

Collection of Taxes (As of March 10, 2023)

- Growth in Direct Tax Collections: There was a significant increase in direct tax collections, showing a 22.58% growth in gross collections (Rs. 16.68 lakh crore) compared to the previous year. Net collections, after refunds, stood at Rs. 13.73 lakh crore, marking a 16.78% increase.

- Achievement of Budget Estimates: The collections represented 96.67% of the total Budget Estimates and 83.19% of the Total Revised Estimates for fiscal year 2022-23.

- Growth Rates by Tax Type: Corporate Income Tax (CIT) collections grew by 18.08% in gross revenue, and Personal Income Tax (PIT), including Securities Transaction Tax (STT), saw a 27.57% increase. Net growth after refunds was 13.62% for CIT and 20.73% (PIT only)/20.06% (PIT including STT).

- Securities Transaction Tax (STT) Collections: The government had budgeted Rs. 20,000 crores for STT in FY23, which is likely to be surpassed given the current rate of collection.

- Refunds Issued: Refunds totaling Rs. 2.95 lakh crore were issued, showing a 59.44% increase from the previous year.

Reforms of 2020-21

- Simplification of Returns: Introduction of measures to pre-fill income tax returns for individuals opting for the new regime, reducing the need for professional help.

- Digitization and Non-contact Procedures: The government moved towards electronic verification and assessment of tax returns to minimize personal interaction between taxpayers and authorities.

- Taxpayer’s Charter: Implementation of a charter to ensure effective operation of the tax system and compliance.

- Elimination of Dividend Distribution Tax (DDT): To boost stock market investment, DDT requirement for companies was removed.

- Concessional Corporate Tax Rate: A reduced tax rate of 15% was introduced for new domestic electricity-generating companies.

- Sovereign Wealth Fund Incentives: Exemption from taxes on interest, dividends, and capital gains for foreign sovereign wealth funds investing in crucial sectors.

- Start-up Support: Deferral of tax on ESOPs for employees for 5 years, until they leave the company or sell their shares.

- Vivad se Vishwas Scheme: A new scheme to resolve direct tax litigation.

Direct Tax Proposal in Union Budget 2023:

- Increased Presumptive Taxation Limits for MSMEs and Professionals: The budget proposes to increase the turnover limits for small and medium-sized enterprises (MSMEs) and professionals for presumptive taxation. For MSMEs, the limit is increased to Rs. 3 crores, and for professionals, it’s raised to Rs. 75 lakhs. This means that these entities can opt for a simplified tax scheme if their turnover does not exceed these thresholds, which simplifies compliance and reduces tax burden.

- Tax Cut for Manufacturing Cooperatives: Manufacturing cooperatives are set to benefit from a reduced tax rate of 15%. This reduction aims to support the cooperative sector’s growth and make it more competitive, aligning it with the corporate tax rates for new manufacturing companies.

- TDS Reduction on Cash Withdrawals in the Cooperative Sector: The budget proposes reducing the tax deducted at source (TDS) for cash withdrawals made by cooperative societies, aiming to ease the financial operations within the cooperative sector.

- Support for Startups: Startups will now be allowed to carry forward their losses for a period of ten years on changes in shareholding. This is an increase from the previous limit, supporting startups in their early and often volatile phases by providing tax relief on their losses for a longer duration.

- Extension of Incorporation Date for Income Tax Benefits: The date of incorporation for new businesses to be eligible for income tax benefits is extended until March 31, 2024. This move is intended to encourage entrepreneurship and the establishment of new businesses by providing them with additional time to avail tax benefits.

- Reducing Income Tax Litigation: To address the backlog of pending appeals, the budget proposes appointing 100 joint commissioners to hear these appeals. This measure aims to expedite the resolution process and reduce the number of unresolved cases.

- Removal of TDS Threshold for Online Gaming: The Rs. 10,000 threshold for tax deducted at source (TDS) on winnings from online gaming will be removed. This step is likely taken to ensure taxation at the source for smaller winnings, potentially increasing tax compliance in the online gaming sector.

- Tax Exemption on Conversion of Gold: The conversion of physical gold into electronic gold receipts (EGRs) and vice versa will not attract capital gains tax. This exemption aims to promote the digitalization of gold investments and transactions.

- Personal Income Tax Announcements:

- The rebate limit in the New Tax Regime has been increased to Rs. 7 lakh, meaning individuals with income up to this amount will not have to pay any tax under this regime.

- The budget proposes to simplify the tax slabs to five and increase the exemption limit to Rs. 3 lakhs. The new slab rates are more progressive and aim to provide relief to middle-income taxpayers.

- The highest surcharge rate has been reduced from 37% to 25%, which will decrease the maximum marginal rate (MMR) by 39%. This reduction in the surcharge rate is intended to lower the tax burden on high-income earners.

- While the new income tax regime will be the default, taxpayers have the option to continue with the old regime if it’s more beneficial for them, providing flexibility and choice in tax planning.

Direct Taxation: Committees and Commission

- Kelkar Committee (2015)

- Chairperson: Vijay Kelkar

- Objective: To evaluate and recommend improvements for the Public-Private Partnership (PPP) model in India. Although primarily focused on PPPs, the recommendations could indirectly influence fiscal policies and direct taxation, as PPP projects involve significant financial and tax implications.

- Raja Chelliah Committee

- Chairperson: Prof. Raja Chelliah

- Objective: Formed in 1991, the Tax Reforms Committee was tasked with overhauling India’s tax system. The committee’s goal was to make the tax system more efficient, equitable, and suited to the economic environment of the time.

- Outcomes: It issued three reports between 1991 and 1993, suggesting a wide range of tax reforms. These recommendations included lowering tax rates, broadening the tax base, simplifying tax laws, and improving tax administration. Many of these suggestions have shaped India’s direct and indirect tax policies over the years.

- V. Reddy Committee

- Chairperson: Y.V. Reddy

- Objective: To examine issues related to the money supply and propose methods for conducting extensive analytical surveys by the Reserve Bank of India, commercial and cooperative banks, and the organized financial sector at regular intervals. While its focus was not directly on taxation, its findings can influence fiscal policies and, by extension, taxation through monetary policy adjustments.

- Wanchoo Committee (1971)

- Chairperson: Not specified, but named after its chairperson

- Objective: Recommended focusing fiscal and financial resources on selected areas to create growth poles rather than evenly distributing resources across all backward areas. This approach to targeted development could influence direct taxation policies by identifying priorities for economic support and incentives.

- Parthasarathy Shome Panel

- Chairperson: Parthasarathy Shome

- Objective: Established in 2012 to develop final General Anti-Avoidance Rules (GAAR) aimed at addressing tax avoidance, especially by foreign investors. The panel sought to provide tax certainty and address concerns of international investors beyond just Foreign Institutional Investors (FIIs), touching upon broader non-resident taxpayer issues.

- Outcomes: Its recommendations were aimed at making India’s tax regime more transparent and investor-friendly while ensuring the country’s tax base is protected against erosion through aggressive tax planning and avoidance strategies.

- Akhilesh Ranjan Committee

- Chairperson: Akhilesh Ranjan

- Objective: The Central Board of Direct Taxes (CBDT) formed an e-commerce Taxation Committee to review e-commerce business models and their tax implications. This was especially pertinent given the digital economy’s growth and the challenges it posed to traditional tax frameworks.

- Outcomes: The committee’s report, delivered on March 21, 2016, influenced the development of the Finance Bill, 2016. It aimed at addressing the unique challenges of taxing e-commerce transactions, which often cross traditional tax jurisdictions and categories.

Direct Tax Code

- Streamlining the Framework: The DTC aims to replace the Income Tax Act of 1961 and other pieces of direct tax legislation such as the Wealth Tax Act of 1957. This move is intended to simplify and consolidate all central government direct tax laws into one coherent piece of legislation, making it easier for taxpayers to understand and comply with.

- The main goals of the DTC include:

- Simplification and Consolidation: By combining various laws into a single legislation, the DTC aims to simplify the direct tax system, making it more accessible and less cumbersome for taxpayers.

- Efficiency and Effectiveness: Improving the tax system’s performance by making it more effective in collecting taxes and more efficient in terms of reducing administrative and compliance costs.

- Integration of Direct Taxes: It seeks to bring together laws on income tax, dividend distribution tax, fringe benefits tax, and wealth tax under one umbrella.

- Horizontal Equity: Ensuring fair treatment among different classes of taxpayers, aligning with best international practices.

- Simplicity and Resilience: The tax regulations proposed under the DTC aim to be straightforward, stable, and robust, fostering greater compliance.

- Broadening the Tax Base: By minimizing exemptions and deductions, the DTC intends to widen the tax base, potentially increasing tax revenue.

- Key Features

- Litigation Management: Amendments to sections allowing tax officers to re-assess cases based on specific criteria and to inspect books of accounts for up to six years, aiming to streamline dispute resolution.

- Threshold for Filing Cases: Raising the minimum amount for filing tax cases to reduce frivolous litigation and enhance the efficiency of the tax system.

- Anonymity in Assessments: Making assessment procedures anonymous and enabling public requests for clarifications from the Central Board of Direct Taxes (CBDT) to improve transparency and trust.

- Reduced Compliance Burden: Aligning tax compliance with global trends and best practices to reduce the burden on taxpayers and widen the tax base.

- Use of Artificial Intelligence: Incorporating AI into tax compliance and administration processes to increase efficiency and accuracy.

- Personal Income Tax Rates: Proposing a reduction in personal income tax rates to a range from 5% to 20%, making the tax system more progressive and potentially boosting consumer spending.

- Impact on Different Age Groups: The DTC also addresses the personal income tax structure by categorizing taxpayers into three age groups: those under 60, those between 60 and 80, and those aged 80 and above. This segmentation may lead to age-specific tax benefits or considerations, reflecting the government’s approach to providing financial relief or incentives to different segments of the population based on age.

GAAR – General Anti Avoidance Rule

Objective and Application:

- GAAR is a part of direct tax laws aimed at preventing tax avoidance practices.

- It grants tax authorities the power to scrutinize and nullify transactions or arrangements if they believe these are made primarily to gain a tax advantage, bypassing the substance of the transactions.

Key Benefits:

- Reduces Tax Evasion and DTAA Misuse: By challenging aggressive tax planning strategies, it mitigates the exploitation of tax treaties (Double Taxation Avoidance Agreements) and domestic tax laws.

- Prohibits Round-Tripping: Prevents the practice of routing investments through countries with favorable tax treaties but without substantial business activities, to avoid taxes.

- Reduces Money Laundering: By scrutinizing transactions that lack commercial substance, it aids in curbing money laundering activities.

Key Disadvantages:

- Increased Authority to Tax Officers: May lead to arbitrary decisions if not checked properly.

- Potential for Corruption: Greater discretionary powers could lead to corrupt practices.

- Increased Uncertainty and Compliance Burden: Businesses may face difficulty in planning their transactions due to uncertainty about how rules will be applied.

- Potential Impact on Creditworthiness: Aggressive tax adjustments could affect the financial health and credit ratings of companies.

Minimum Alternate Tax (MAT)

Purpose and Function:

- Designed to bring companies with zero or minimal tax liabilities (due to exemptions, deductions, etc.) into the tax net by imposing a tax on their book profits.

- Initially introduced in 1988, repealed in 1990, and re-introduced in 1996.

Calculation and Changes:

- Companies must pay the higher of their regular tax liability or 15% (plus applicable surcharges and cess) of their book profits as per the Companies Act, 2013.

- In 2019, the MAT rate was reduced from 18.5% to 15% for companies, alongside a reduction in corporate tax rates, with new domestic manufacturing companies being exempt from MAT.

Scope:

- Applies to all entities operating in India, with exceptions for certain sectors like life insurance and shipping (subject to tonnage tax), and companies without a permanent establishment in India.

- The concept has been extended under the Alternative Minimum Tax to include all other taxpayers.

Tax Buoyancy

Definition and Importance:

- Tax buoyancy measures the responsiveness of tax revenue growth to changes in Gross Domestic Product (GDP).

- A high tax buoyancy indicates that tax revenues increase significantly with economic growth without increasing tax rates, suggesting an efficient and elastic tax system.

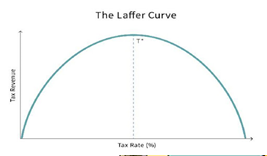

Laffer Curve

Key Concepts of the Laffer Curve:

- Zero Revenue at Extreme Tax Rates: At a 0% tax rate, the government collects no tax revenue. Similarly, at a 100% tax rate, government revenue would also be zero because individuals would have no incentive to earn taxable income, assuming all income is taken by the government.

- Increasing Revenue with Moderate Tax Rates: For tax rates between 0% and 100%, the curve posits that there is a range where increasing tax rates will lead to an increase in tax revenue. This is because the tax base (total taxable income) remains sufficiently large, even as taxes increase, to generate higher total revenue.

- Decreasing Revenue with High Tax Rates: Beyond a certain point, further increases in the tax rate will cause tax revenue to decrease. This is due to the disincentive effects of high taxes on work effort, investment, and economic output. As tax rates increase, individuals and businesses are less motivated to earn taxable income, either by working less, investing less, or finding ways to avoid taxes, leading to a shrinkage of the tax base.

- Two Effects of Tax Cuts: Laffer highlighted two main effects of tax cuts on government budgets:

- Arithmetic Effect: Directly, lowering tax rates will decrease tax revenue if all other factors remain constant.

- Economic Effect: Indirectly, lower tax rates can stimulate economic activities, expanding the tax base, and potentially increasing overall tax revenue.

- Tax Elasticity: This refers to how responsive the total tax revenue is to changes in the tax rate. If a government reduces corporate income tax, for example, from 30% to 25%, and revenue increases, it would indicate a point on the Laffer Curve where a lower rate leads to higher revenue, due to increased economic activity.

Tobin Tax

- The Tobin Tax, named after Nobel Laureate James Tobin, was conceptualized as a tax on all spot conversions of one currency into another. Its primary goal is to curb speculative currency transactions, thereby stabilizing currency values. Unlike taxes that directly affect consumers, the Tobin Tax targets market participants, specifically those engaged in short-term financial transactions across currencies. James Tobin suggested this tax as a means to manage exchange rate volatility and proposed two broad solutions:

- Adopting a Common Currency: This approach involves countries transitioning to a shared currency, aligning monetary and fiscal policies, and pursuing economic integration to mitigate exchange rate fluctuations.

- Increasing Financial Segmentation: Tobin also suggested enhancing financial segmentation between nations. This would allow for more autonomous financial policy-making by central banks and governments, potentially reducing the impact of international capital flows on domestic currencies.

Global Examples of Tobin Tax Implementation

- Sweden tried a version of the Tobin Tax by imposing a 0.5% tax on share transactions, which did not meet expectations.

- European Union Countries like Belgium, Germany, and France, among others, introduced a tax on financial transactions involving shares and bonds at 0.1%, and derivatives at 0.01%.

- Other Countries such as Thailand, Brazil, Chile, and Malaysia have experimented with similar taxes, with varying degrees of success.

- India’s Securities Transaction Tax (STT) resembles the Tobin Tax. Implemented in 2004, it applies to transactions involving securities traded on stock exchanges.

Pigouvian Tax

- Pigouvian taxes target economic activities generating negative externalities—costs not reflected in the market price of goods or services, borne by unrelated third parties. These taxes aim to correct market inefficiencies by aligning the private cost of production or consumption with its true social cost, thereby reducing the negative impacts on society.

Examples of Pigouvian Taxes

- India’s Clean Energy Cess on coal is a form of Pigouvian tax designed to mitigate environmental damage from coal usage.

- France’s Noise Levy on flights at major airports charges between 2 and 35 euros to account for noise pollution.

- Carbon Taxes in over 40 countries penalize greenhouse gas emissions from fossil fuels.

- The Netherlands’ Groundwater Levy on water companies aims to preserve clean drinking water for future generations.

- European countries have implemented fees on plastic and paper bags to encourage the use of reusable bags and reduce waste.

Surcharge

- A surcharge is an additional tax levied on the existing tax owed, serving as a significant revenue source for governments. It’s applied only to the tax amount, not the total income or revenue, and the collected funds are typically allocated to the government’s general fund for discretionary use. Surcharges can vary by income level or corporate revenue, with specific rates applied to individuals, domestic companies, and foreign corporations based on their earnings.

Cess

- Cess is essentially a tax on tax, earmarked for a specific purpose. Unlike general taxes, cess is collected with a designated goal in mind, such as funding education or healthcare initiatives. Once the objective for which the cess was imposed is achieved, it is supposed to be discontinued. Cess ensures that the collected funds are spent on the intended public welfare projects, distinguishing it from other forms of taxation.

Indirect Taxes

- Indirect Tax: A tax collected by an intermediary (such as a retailer) from the person who bears the ultimate economic burden of the tax (the consumer). The intermediary then remits the tax to the government. Unlike direct taxes, where the tax incidence and impact fall on the same entity, in indirect taxes, these are on different entities.

- Examples: Customs duty, excise duty, service tax, sales tax, Value Added Tax (VAT), and Goods and Services Tax (GST).

- Management: Managed by the Central Board of Indirect Taxes and Customs (CBIC), previously known as the Central Board of Excise and Customs (CBEC).

Types and Variants of Indirect Taxes

- Goods and Services Tax (GST)

- A comprehensive, multi-stage, destination-based tax that has replaced almost all indirect taxes on goods and services by the federal and state governments in India.

- GST is levied at every step in the production process but is meant to be refunded to all parties in the various stages of production other than the final consumer.

- Excise Duty

- Traditionally levied on the manufacture of goods within India.

- Post-GST, the concept of Central Excise Duty has been subsumed into the Central GST (CGST) for most products.

- Sales Tax

- Levied on the sale or purchase of certain goods within India.

- Integrated GST (IGST) has replaced the sales tax for inter-state transactions, and State GST (SGST) for intra-state transactions.

- Dividend Distribution Tax (DDT)

- A tax that was levied on the dividends distributed by Indian companies to their shareholders.

- DDT has been abolished in the 2020 budget, shifting the tax liability from companies to individuals, who now pay tax on dividends received according to their applicable income tax slab.

- Service Tax

- Applied to all services provided in India, with the exception of services listed on the ‘negative list’ (services that are not subject to the tax).

- Service Tax has been subsumed into GST.

- Value Added Tax (VAT)

- A tax applied to the sale of goods within a state, aiming to reduce market distortions.

- VAT has been replaced by State GST (SGST) post the implementation of GST.

Evolution and Impact of Indirect Taxes in India

- The shift to GST represents a significant overhaul of the indirect tax regime in India, aiming to create a unified market by eliminating the cascading effect of taxes on the production and distribution of goods and services. This shift simplifies the tax structure, broadens the tax base, and increases compliance while aiming to boost economic growth.

The Sources of Non-Tax Revenue

Special Assessment of Betterment Levy

- Definition: A betterment levy is a special assessment imposed on individuals or entities that benefit directly from a public project or government activity.

- Example: When a government builds a public infrastructure project like a road or park, it can lead to an increase in the value of nearby property. The owners of this property may be charged a levy because they are considered to have benefited from the project.

Gifts, Grants, and Aids

- From Governments: Gifts and grants can be between governments, where one government provides financial resources to another without expecting repayment. This is often seen in the form of the central government distributing funds to state or local governments to help them carry out their duties.

- Foreign Aid: Assistance from foreign countries, which can come in various forms like military aid, food aid, or technical assistance. This type of aid is particularly crucial for developing countries, helping them achieve growth and development objectives.

Escheats

- Definition: Escheat is a legal process where the state acquires ownership of property (including assets and estates) from individuals who die without a will or lawful heirs.

- Significance: It serves as a source of revenue for the government, though not a primary one, as instances of escheat are relatively infrequent.

Fees

- Service Fees: Governments charge fees for specific services provided to citizens. Unlike taxes, paying a fee usually implies receiving a direct benefit or service in return.

- Examples: Common services for which fees are charged include issuing passports, driver’s licenses, and processing other official documents. The key distinction from taxes is the element of choice and direct benefit associated with fees.

Earnings from Public Enterprises

- Profits and Dividends: Governments often own or have significant stakes in various enterprises that operate in sectors like energy, transportation, and banking. These public-sector enterprises can generate profits or surpluses.

- Utilization: The profits or dividends received from these enterprises contribute to the government’s revenue, which can be redirected to fund public services and projects.

Merits of Indirect Taxation

- Elasticity: Indirect taxes are flexible, allowing for significant revenue generation from small rate increases due to their broad application across goods and services.

- Equitability: By imposing higher taxes on luxury items predominantly consumed by the wealthy, indirect taxes can adhere to principles of fairness.

- Sin Tax/Consumption Control: Indirect taxes can discourage the consumption of undesirable goods, such as luxury items or harmful substances, by making them more expensive.

- Convenience: These taxes are collected in small amounts at the point of purchase, making it convenient for consumers and reducing the administrative burden on individuals.

- Economic Cost: The collection cost of indirect taxes is lower since the responsibility lies with manufacturers and merchants, who act as honorary tax collectors.

- Wider Coverage and Broad Base: Indirect taxes have a broad impact, affecting almost everyone in society since they apply to the purchase of goods and services.

Demerits of Indirect Taxation

- Uncertainty: Increasing indirect taxes can lead to higher prices, reducing demand for goods and potentially affecting government revenue.

- Lack of Civic Consciousness: Since taxes are embedded in prices, consumers may be unaware they are paying taxes, reducing awareness of public finance contributions.

- Inelasticity Compared to Direct Taxes: Indirect taxes are less flexible in responding to economic changes because they are often applied at fixed rates.

- Regressive Nature: Indirect taxes can be considered unfair since they impose the same tax burden on both rich and poor, regardless of their income levels.

Issues with Indirect Tax

- Exclusions and High Tax Rates: Certain essential goods are exempt from GST, and high tax rates in some sectors contribute to economic slowdowns.

- Tax Evasion: The system struggles with invoice matching, leading to fraudulent activities.

- Agricultural Burdens: Farmers face GST on necessary inputs without receiving input tax credits, increasing their costs.

- Compliance and Multiple Rate Challenges: The GST system’s complexity, with multiple rates and exclusions, hampers compliance and efficiency.

Government Initiatives in Indirect Taxation

- Trade Policy Measures: Adjustments to customs and excise duties, improvements to anti-dumping and safeguard measures, and GST reforms are highlighted.

- Excise Duty Adjustments: Proposals for changes in excise duties on tobacco and other goods to balance revenue generation and economic impact.

- GST and Administrative Reforms: Implementation of GST, improvements in customs processes, and establishment of research units for better tax policy formulation.

Budget Implications for 2023

- The 2023 budget includes proposals to simplify the indirect tax structure, reduce the number of customs duty rates, modify duties on various goods, and amend the CGST Act to decriminalize certain offences and ease compliance burdens.

GOODS AND SERVICE TAX (GST)

Multi-stage: GST is imposed at every step of the production process but is meant to be refunded to all parties in the various stages of production other than the final consumer.

- Value addition: GST is levied on the value additions at each stage of the supply chain, from manufacturing to the point of sale to the final consumer.

- Destination-based: The tax is collected from the point of consumption and not the point of origin like previous taxes.

Key Features

- Unified Tax: GST amalgamates various central and state taxes into a single tax system, reducing the complexity and making the tax system more transparent and efficient.

- 101st Constitutional Amendment Act: This act enabled the implementation of GST in India, marking a significant reform in the Indian tax system.

- GST Council: The decision-making body that governs GST regulations and rates, chaired by the Finance Minister of India.

Objectives Of GST

- Documentation reduction: By replacing several indirect taxes with a single tax, GST simplifies documentation and procedural requirements for businesses.

- Efficiency and Simplification: It streamlines the tax filing process, reducing the cost and complexity associated with managing multiple indirect taxes.

- Input Tax Credit: GST allows businesses to claim credit for the taxes paid on inputs, which reduces the tax liability and eliminates the cascading effect of taxes.

- Common Market: GST facilitates a unified market across India, removing tax-induced price distortions between states.

- Increase the tax base: By simplifying the tax structure, GST aims to include more businesses under the tax regime and increase the overall tax base.

Current Rate Structure

- CGST, SGST, and IGST: The GST is divided into Central GST (CGST), State GST (SGST) for intra-state sales, and Integrated GST (IGST) for inter-state sales. The rates are designed to keep the overall tax incidence neutral to pre-GST regimes.

GST Revenues

- Revenue Data: As an example, in March 2023, the gross GST revenue collected was significant, showcasing the effectiveness of GST in revenue generation. The data indicates a substantial increase in collections compared to previous years, reflecting the growing compliance and expansion of the tax base.

Goods and Service Tax Network (GSTN)

- Not-for-Profit Organization: The GSTN is a non-profit entity responsible for managing the IT infrastructure for GST implementation, ensuring a smooth and transparent functioning of the GST regime.

- Ownership and Operation: Partially owned by the government and the rest by private financial institutions, GSTN plays a crucial role in processing and managing GST-related data, making it a backbone for the successful implementation of GST.

The National Anti-Profiteering Authority (NAA)

- The National Anti-Profiteering Authority (NAA) is a regulatory body established under Section 171 of the Central Goods and Services Tax (CGST) Act of 2017. Its primary goal is to ensure that the benefits of reduced tax rates or input tax credits under the Goods and Services Tax (GST) regime are passed on to the consumers by way of price reductions. This is integral to maintaining transparency and fairness in the pricing of goods and services post-GST implementation, which was a significant tax reform aiming to unify the Indian market under a single tax system.

Functions of NAA

- Ensuring GST Rate Reduction Benefits are Passed to Consumers: It ensures that when the GST Council reduces tax rates on goods and services, these reductions are passed on to the consumers. This is critical in maintaining the intended effect of GST to reduce the overall tax burden on the end consumers.

- Input Tax Credit (ITC) Adjustments: It oversees that any change in the input tax credit is proportionately reflected in price reductions to the consumers. This means if a business benefits from input tax credit, the savings should be passed on to the consumers as well.

- Composition and Leadership: The NAA is headed by a senior official of the rank of Secretary to the Government of India, along with four technical members from the Centre and/or States. This composition ensures that the authority has the necessary expertise and representation to effectively carry out its mandate.

Broader Impact and GST Council

- The establishment of the NAA and its functions are part of a broader framework aimed at enhancing the efficacy of the GST system. The GST Council, with the Union Finance Minister as its Chair and members from state governments, plays a pivotal role in this ecosystem by determining GST rates, rules, and regulations.

Success of GST Regime

- Ease of Doing Business: Simplification of tax structures and clear guidelines have contributed to a better business environment.

- Revenue Collection: There has been a significant increase in GST collections over the years, indicating successful implementation and compliance.

- State Revenues Growth: States have seen a growth in revenue, which signifies the distributional benefits of GST.

- Compliance and Efficiency: The use of technology, like the GST Network (GSTN), has improved tax compliance and administration.

Challenges and Way Forward

- Coverage Exemptions: Certain products like petrol and diesel are outside GST’s purview, leading to potential revenue losses.

- Compensation to States: The compensation mechanism for states has been a contentious issue, especially as the initial compensation period comes to an end.

- Multiple Tax Rates: The presence of multiple tax rates complicates the system and deviates from the ideal of a uniform tax rate.

- Technical and Implementation Issues: Challenges in the implementation of electronic systems and the actual issuance of receipts have been noted.

Tax to GDP ratio

- Government Resource Management: It indicates how effectively a government is able to mobilize its economic resources through taxation. A higher tax-to-GDP ratio suggests that a government is more capable of funding its operations, including public services, infrastructure, and social programs, without relying excessively on borrowing.

- Economic Indicator: The tax-to-GDP ratio can serve as an economic indicator, reflecting the size and effectiveness of a country’s tax system. A rising ratio may indicate an expanding tax base, either through economic growth, improved tax compliance, or both.

- Fiscal Capacity: This ratio is a measure of a government’s fiscal capacity, representing its ability to generate revenues to finance its expenditure without incurring unsustainable levels of debt. Governments with a higher tax-to-GDP ratio have a greater ability to fund their activities sustainably.

- Policy Tool: For policymakers, the tax-to-GDP ratio is a useful tool for comparing tax systems across countries and over time. It helps in evaluating the impact of tax policies and reforms on the economy.

India’s tax-to-GDP ratio

- Growth in Tax Collections: India witnessed a substantial increase in its tax collections by 34% in 2021-22, reaching 27 lakh crore and pushing the tax-to-GDP ratio to an 11.7%, a peak not seen in at least the previous 23 years. This was a notable rise from the 10.3% ratio of the previous year.

- Direct and Indirect Taxes: The rise in tax revenue was driven by significant increases in both direct taxes (49%) and indirect taxes (20%). Corporate tax collections surged by 56.1%, and personal income tax collections by around 43%.

- Tax Buoyancy: The tax buoyancy ratio, which measures the responsiveness of tax revenue growth to GDP growth, was healthy at 1.9 in 2021-22. This indicates a robust response of tax revenues to economic growth, with direct taxes showing particularly strong buoyancy at 2.8.

Understanding Behavioral Economics

- Behavioral economics examines how psychological influences, societal norms, emotional factors, and cultural contexts shape economic decisions, including market behaviors and public choices. The field has gained significant attention and credibility, especially after Richard H. Thaler, a pioneering figure in this area, received the Nobel Prize in Economics in 2017. His work, particularly the concept of “nudging” detailed in his book “Nudge: Improving Decisions About Health, Wealth, and Happiness,” explores how subtle policy shifts can encourage people to make better choices for themselves and society without limiting their freedom of choice.

ECO-SURVEY 2019: BEHAVIOURAL ECONOMICS IMPROVE TAX COMPLIANCE

- BADLAV (Beti Aapki Dhan Lakshmi and Vijay Lakshmi): This initiative aims to shift societal attitudes toward valuing daughters, moving beyond the “Beti Bachao” (Save the Daughter) mindset to celebrating daughters as valuable and victorious members of society.

- Swachh Bharat (Clean India): Encouraging cleanliness and sanitation through behavioral changes rather than mere infrastructure development.

- LPG Subsidy: Moving from asking citizens to “Give it up” to making them “Think about it,” encouraging voluntary relinquishment of LPG subsidies by those who can afford to do so.

- Tax Compliance: Encouraging a transition from tax evasion to voluntary tax compliance through behavioral nudges.

Nudge Policies

- In the context of India’s rich cultural and social fabric, nudge policies hold significant potential for driving behavioral change across various sectors, including tax compliance, environmental sustainability, savings, and social welfare. These policies aim to guide people toward better decisions by making those decisions more appealing, easier to choose, or more socially rewarding, without restricting their freedom to choose otherwise.

Limitations

- Despite the promise of behavioral economics, there are limitations to its applicability. It’s not a cure-all for every economic challenge. In areas requiring more substantive policy shifts or regulatory measures, nudges may be insufficient. Moreover, the diversity of India’s cultural, social, and economic landscapes means that a one-size-fits-all approach from the central government may not be effective everywhere. Successful implementation of nudge policies also hinges on the underpinnings of robust infrastructure and education systems, areas where India faces challenges at the grassroots level.

The recommendations by the Chief Economic Adviser (CEA)

- The recommendations by the Chief Economic Adviser (CEA), Subramanian K., propose innovative and culturally integrated approaches towards improving tax compliance and acknowledging high taxpayers in India. These recommendations are not only aimed at increasing the efficiency of the tax system but also at fostering a positive attitude towards tax compliance through social and moral incentives.

Naming Important Sites After Highest Taxpayers

- Objective: This recommendation aims to publicly acknowledge and honor the contributions of the highest taxpayers over a decade by naming important public sites and infrastructure after them, such as roads, railroads, schools, universities, hospitals, and airports.

- Impact: This could lead to a positive social perception of tax compliance, motivating more individuals and businesses to fulfill their tax obligations diligently. It serves as a recognition of the taxpayer’s contribution to national development.

Ease of Paying Taxes

- Simplified Tax Forms: Pre-populated income tax forms with straightforward language are suggested to make the tax-paying process more accessible and less intimidating for everyone.

- Mandatory Filing: The idea of making it compulsory for every eligible individual to file an Income Tax form, regardless of whether they owe any tax, aims to improve tax compliance and ensure everyone participates in the tax system.

Highlighting the Sin of Unpaid Debt

- Cultural and Religious Appeal: By emphasizing that unpaid debt is considered a sin in major religions like Hinduism, Islam, and Christianity, the recommendation seeks to leverage cultural and religious values to discourage tax evasion.

- Public Awareness Campaigns: Suggested commercials that highlight the moral and spiritual implications of tax evasion could create a strong societal disapproval of such actions, thereby reducing tax evasion.

VIP Treatment for Top Taxpayers

- Incentives for Compliance: The top ten highest taxpayers in each district would receive special treatment and privileges, such as priority boarding at airports, special lanes at immigration and highways, and fast-track services at toll booths.

- Rationale: These incentives act as tangible benefits for tax compliance, aiming to create a competitive environment where paying higher taxes is associated with prestige and special privileges, further encouraging compliance.

Nature of Tax Evasion

- Misrepresentation of Financial Information: Reporting lower income, profits, or gains than actually earned, and inflating deductions.

- Bribery and Corruption: Using bribes to influence tax officials or to avoid scrutiny and hide funds in undisclosed locations.

- Informal Sector Activity: A significant portion of tax evasion is associated with the informal sector, where transactions often go unreported.

Tax Evasion

Several factors contribute to the prevalence of tax evasion

- Political Instability and Frequent Government Changes: These factors contribute to the lack of a stable and clear tax system.

- Regular Changes in Tax Policy: Frequent policy shifts create confusion among taxpayers and officials, complicating compliance.

- Ineffective Enforcement of Penalties: Weak penalty enforcement encourages non-compliance among taxpayers.

- High Tax Burden: Perception of excessive taxation motivates individuals and entities to seek evasion methods.

- Corruption and Bribery: A lack of robust mechanisms to prevent corruption aids in tax evasion practices.

- Complex Tax Procedures and Multiple Taxes: A complicated tax system and the presence of numerous taxes burden taxpayers, making evasion seem appealing.

- Tax Law Complexity and Loopholes: The intricate nature of tax legislation allows savvy individuals to find and exploit avoidance loopholes.

Government Initiatives Against Tax Evasion

- Operation Clean Money (2017): Post-demonetization drive to scrutinize significant bank deposits.

- Project Insight (2017): A data analytics platform designed to trace and mine data for identifying tax evaders.

- Tax (Evasion) Disclosure Schemes: Amnesty programs allowing tax evaders to declare undisclosed income and settle their tax liabilities without facing prosecution.

- Income Declaration Scheme (IDS) and Pradhan Mantri Garib Kalyan Yojana (PMGKY): Schemes offering a mechanism for voluntary disclosure of concealed income, with specific tax, penalty, and surcharge rates.

- Prevention of Money Laundering Act (PMLA-2002): Framework aimed at combating money laundering activities.

- Benami Transactions Prohibition Act (BTPA-1988/2016): Legislation targeting properties held in fictitious names or through proxies to evade taxes.

- Sabka Vishwas Scheme (Budget 2019): A dispute resolution scheme aimed at reducing litigation in service tax and excise duty collections.

- Special Investigation Team on Black Money (2014): Established by the Supreme Court to propose strategies against domestic and offshore black money concealment.

Tax avoidance

Methods of Tax avoidance

- Country of Residence

- Incorporating in a Tax Haven: Companies may choose to incorporate in jurisdictions with lower tax rates to reduce their overall tax burden. This practice can involve the establishment of subsidiaries in offshore jurisdictions that offer favorable tax regimes.

- Individuals Moving to Tax Havens: Similarly, individuals may relocate to countries known as tax havens to enjoy lower personal tax rates.

Double Taxation

- Double Taxation Agreements (DTAs): Many countries have entered into DTAs to prevent income earned abroad from being taxed both in the country of origin and the country of residence. While these agreements aim to prevent double taxation, they can also be used to minimize tax liabilities through careful planning and structuring of cross-border investments.

- Limited DTAs with Tax Havens: There are fewer DTAs with countries considered as tax havens, which can affect the strategies used for tax avoidance.

Legal Entities

- Formation of Separate Legal Entities: Individuals can legally avoid taxes by establishing separate entities, such as corporations, trusts, or foundations, to which they transfer their assets. Profits or revenue generated by these entities may be subject to different tax treatments, potentially lowering the overall tax liability.

- Offshore Entities: Establishing these entities in offshore jurisdictions can further reduce tax burdens due to more favorable tax laws.

Legal Vagueness

- Exploiting Ambiguities: The complexity and ambiguity of tax laws can be exploited to minimize tax liabilities. The blurred lines between business expenses and personal expenses are common areas of ambiguity that taxpayers might leverage.

- Tax Evasion Vs Tax Avoidance

Tax Havens

- Use of Tax Shelters: Investments or entities that offer tax benefits, such as deductions or exemptions, are commonly referred to as tax shelters. These can significantly reduce a taxpayer’s income tax burden.

- Jurisdictions with Low or No Taxes: Tax havens are countries or territories that impose low or no taxes on foreign individuals and businesses, making them attractive for tax avoidance strategies.

Transfer Mispricing

- Manipulating Transfer Pricing: Transfer mispricing involves setting the prices of transactions between related parties (such as subsidiaries of the same company) in a way that shifts profits to lower-tax jurisdictions. This practice can reduce the overall tax liability of a multinational enterprise by artificially lowering profits in high-tax countries and increasing them in low-tax countries.

Round-Tripping

- Round-tripping refers to a circular form of trading where a company sells an underused asset to another company with the agreement to buy back the same or similar assets at around the same price. This practice doesn’t result in any real economic value or change in ownership in the long term. However, these transactions can be misleadingly recorded as genuine sales and purchases, artificially inflating a company’s financial performance and market activity. This misrepresentation violates the accounting principle of substance over form, which states that transactions and their financial reporting should reflect their actual economic reality, not just their legal form.

Double Taxation Avoidance Agreement (DTAA)

- The DTAA is an international agreement between two countries that aims to prevent individuals and companies from being taxed twice on the same income. This scenario often occurs in cases of international trade and investment, where income might be subject to tax in both the country where it is earned and the individual’s or company’s home country.

Objectives

- Promote Foreign Investment: By preventing double taxation, DTAAs make it more financially appealing for investors to engage in cross-border investments.

- Avoid Income Double Taxation: These agreements directly address and seek to eliminate instances where income would otherwise be taxed in both countries.

- Encourage Global Commerce: By delineating clear tax obligations, DTAAs facilitate international trade and investment, technological exchange, and ensure transparency.

Benefits

- Under the Income Tax Act of 1961, specific provisions (Sections 90 and 91) offer relief from double taxation, either by providing exemptions or credits for taxes paid in the foreign country. Section 90 covers cases where India has a DTAA with the other country, while Section 91 applies when there is no such agreement.

- India has signed DTAAs with over 96 countries, making the agreements reciprocal and ensuring that benefits apply to both Indian residents and residents of those foreign countries.

Importance

- DTAAs increase a country’s attractiveness to foreign investors by resolving double taxation issues. They provide tax certainty, often allowing for exemptions or credits for taxes paid abroad, ensuring a fair distribution of tax rights among nations involved.

Misuse of DTAA

- However, DTAAs can be misused, especially when agreements are with tax haven countries, allowing businesses to enjoy lower tax liabilities by routing investments through these jurisdictions. This practice can lead to significant revenue losses for countries where the income is generated but not taxed due to the DTAA structure. The misuse of DTAAs poses challenges in international taxation, calling for careful monitoring and potential revisions to prevent abuse while still encouraging global business activity.

Base Erosion and Profit Shifting (BEPS)

- Base Erosion and Profit Shifting (BEPS) refers to strategies by multinational companies to shift profits from higher-tax jurisdictions to lower-tax jurisdictions or tax havens, thereby eroding the tax base of the higher-tax jurisdictions. This practice undermines the fairness and integrity of tax systems worldwide and can give multinational corporations an unfair competitive advantage over domestic companies that pay their fair share of taxes. The issue is particularly critical for developing countries, which rely more heavily on corporate income tax, especially from multinational corporations.

Working Mechanism of BEPS