CLOSING TAX LOOPHOLES : INDIA-MAURITIUS TREATY AMENDMENTS”

Syllabus:

GS 2:

- Issues arising out of their Design and Implementation of Policies

- Bilateral, Regional and Global Agreements involving India and/or affecting India’s interests.

GS 3:

- Taxation and Effects of Liberalization on the Economy,

Why in the News?

- This article is in the news due to recent amendments to the India-Mauritius tax treaty, aimed at plugging tax loopholes.

- The changes reflect efforts to combat tax evasion and ensure fair taxation practices in cross-border investments.

Source: TH Business line

Importance of Tax Treaties:

- Define Taxation Rules: Tax treaties establish the framework for taxing income generated across borders, providing clarity on tax liabilities for multinational entities.

- Attract Investment: Developing nations often negotiate favourable tax treaties to attract foreign investment by offering incentives and minimizing tax burdens.

- Balance of Power: Tax treaties reflect the power dynamics between nations, with negotiations influenced by economic and political considerations.

- Legal Certainty: Clear tax treaty provisions help avoid double taxation and provide legal certainty for businesses operating internationally.

Evolution of Tax Laws:

- BEPS Program: The Base Erosion and Profit Shifting program aimed to address tax avoidance strategies used by multinational corporations to shift profits to low-tax jurisdictions.

- OECD Best Practices: The OECD developed best practices to reform international tax laws, focusing on transparency, fair taxation, and preventing tax evasion.

- Multilateral Instrument (MLI): The MLI allows countries to swiftly implement tax treaty changes to align with BEPS recommendations and prevent treaty abuse.

- Global Cooperation: International efforts to reform tax laws reflect the need for global cooperation to combat tax evasion and ensure fair taxation practices.

Reforms in Tax Treaties:

- Treaty Abuse Prevention: The MLI introduced provisions to prevent treaty abuse, including anti-avoidance rules such as the Principal Purpose Test (PPT).

- Anti-Avoidance Measures: Countries amended tax treaties to incorporate anti-abuse rules, denying treaty benefits in cases of tax avoidance.

- India-Mauritius Treaty: Amendments to the India-Mauritius tax treaty aimed to address treaty shopping and ensure benefits are not granted for tax avoidance purposes.

- Impact on Investments: Reforms in tax treaties may impact investment flows, as investors may reconsider investment structures to comply with new tax regulations.

Impact on India-Mauritius Treaty:

- Restriction of Treaty Benefits: The amended protocol to the India-Mauritius treaty restricts treaty benefits if obtaining them is a principal purpose of the transaction.

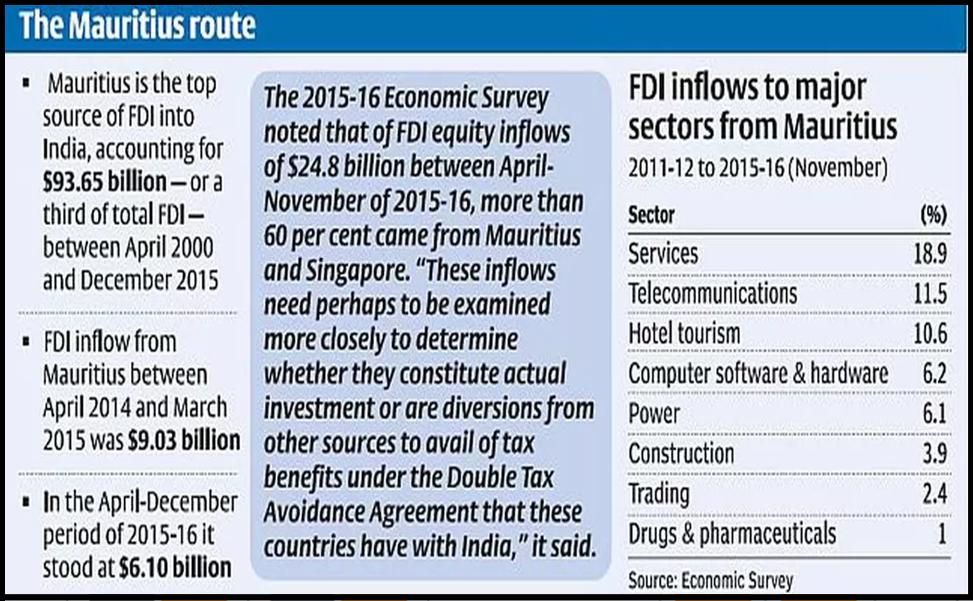

- Financial Flows from Mauritius: The reform targets financial flows from Mauritius, which has been a preferred route for investors to benefit from tax treaty advantages.

- Composition of FDI Inflows: Changes in the India-Mauritius tax treaty are expected to impact the composition of Foreign Direct Investment (FDI) inflows into India.

- Compliance and Enforcement: Tax authorities will enforce the amended treaty provisions to ensure compliance and prevent tax evasion through treaty abuse.

About GAAR Implementation

|

Global Tax Reform:

- Shift Towards Minimum Taxation: Global tax reforms focus on establishing minimum tax rates to prevent profit shifting and ensure fair taxation across jurisdictions.

- Subject to Tax Rule (STTR): Proposals like the STTR aim to tax low-taxed intra-group transactions, discouraging tax avoidance strategies.

- Impact on Treaty Benefits: Global tax reforms may impact tax treaty benefits, prompting countries to renegotiate treaties to align with new tax regulations.

- Economic Considerations: As international tax laws evolve, countries must prioritize economic considerations over tax benefits to attract sustainable investment and foster economic growth.

Challenges:

- Legal Complexity: Implementing amendments to tax treaties involves navigating legal complexities, including interpreting treaty provisions and addressing potential loopholes.

- Enforcement Issues: Tax authorities may face challenges in enforcing amended treaty provisions, especially in cases of cross-border transactions and treaty abuse.

- International Cooperation: Ensuring cooperation among nations is crucial for effectively implementing tax treaty reforms and preventing tax evasion through global coordination.

- Investor Uncertainty: Changes in tax treaties may create uncertainty for investors regarding their tax obligations and investment structures, potentially impacting investor confidence.

- Compliance Burden: Businesses operating across borders may encounter increased compliance burdens due to changes in tax treaty provisions, requiring them to adapt their tax planning strategies.

Way Forward:

- Capacity Building: Invest in building the capacity of tax authorities to effectively enforce amended treaty provisions and address emerging tax challenges.

- Enhanced Collaboration: Foster greater collaboration among countries to exchange information, share best practices, and coordinate efforts to combat tax evasion and treaty abuse.

- Clear Guidance: Provide clear guidance to taxpayers and businesses on the implications of amended tax treaties, ensuring transparency and facilitating compliance.

- Investor Education: Educate investors about changes in tax regulations and the importance of compliance with amended treaty provisions to mitigate risks and uncertainties.

- Continuous Review: Continuously review and evaluate the effectiveness of tax treaty reforms, incorporating feedback from stakeholders and making adjustments as needed to address evolving tax challenges.

- Promote Stability: Maintain stability and predictability in tax policies to support long-term investment and economic growth, while also addressing tax avoidance and ensuring fair taxation practices.

Conclusion:

The amendments to the India-Mauritius treaty mark a significant step in closing tax loopholes and preventing treaty abuse. As international tax laws evolve, countries are prioritizing fair taxation to foster sustainable investment environments.

Source:The Hindu

Main Practice Question:

Discuss the significance of recent amendments to the India-Mauritius tax treaty in the context of global efforts to prevent tax avoidance and promote fair taxation in cross-border investments.

Associated Articles:

https://universalinstitutions.com/india-mauritius-update-tax-treaty-to-tackle-evasion-concerns/