PRIVATE INVESTMENT IN INDIA

Syllabus:

- GS 3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Focus:

- Early signs of crowding in of private investment, domestic demand resilient

Source: THE PRINT

Reasons for Decline in Private Investments

- Economic Policy Uncertainty: Unfavorable government policies and policy uncertainty have deterred investment, reducing private sector confidence.

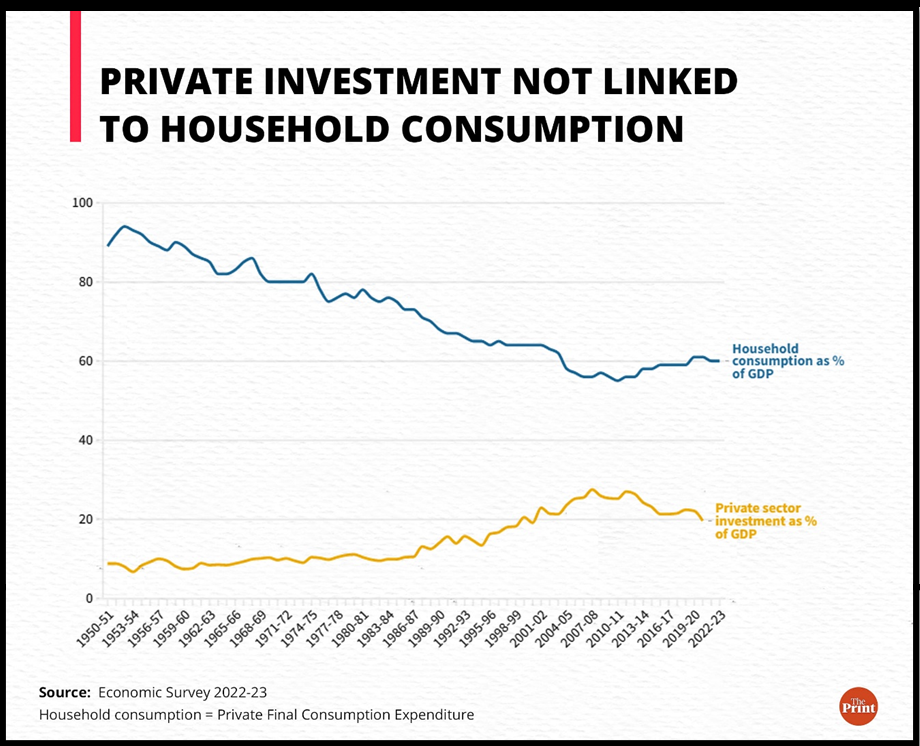

- Inverse Consumption-Investment Dynamics: Increased private consumption has not translated into increased investments, as funds directed towards consumption reduce the amount available for investment.

- Global Financial Influence: The global financial crisis of 2007-08 significantly impacted economic stability, leading to cautious investment behaviors.

- Slowed Reform Momentum: The slowdown in economic reforms under recent governments has led to stagnation in private investment growth.

- Structural Issues: Structural problems within the economy, including inefficient allocation of resources and regulatory hurdles, have also played a significant role.

Understanding Private Gross Fixed Capital Formation (GFCF)

- Definition and Importance: GFCF measures the growth of fixed assets like buildings and machinery, crucial for productivity and economic growth.

- Indicator of Investment Health: It acts as an indicator of private sector willingness to invest and is essential for long-term economic stability.

- Comparison with Public Investment: Unlike public investment, private GFCF signifies private sector investment, often considered more efficient in resource allocation.

- Historical Context: Developed economies typically have higher GFCF per capita, reflecting more substantial economic outputs.

- Economic Impact: A robust GFCF is necessary for improving living standards and enhancing overall economic output.

Historical Trends of Private Investments in India

- Post-Independence to Economic Liberalization: Initially, private investments hovered around 10% of GDP, showing minimal growth.

- Post-Liberalization Surge: Significant increases followed economic reforms in the late 1980s and early 1990s, fostering private sector confidence.

- Peak and Decline: Investments peaked at around 27% of GDP in 2007-08 but began declining post-2011-12, significantly dropping to 19.6% by 2020-21.

- Comparison with Public Investment: Public investment exceeded private investment until the 1980s but fell post-liberalization as private investments took precedence.

- Recent Trends: The last decade has seen a continued decline, exacerbated by the pandemic and ongoing economic challenges.

Influence of Strong Consumption on Private Sector Confidence

- Traditional Economic Theory: Strong consumption typically signals healthy demand, potentially boosting private investment as businesses anticipate higher returns on investment.

- Recent Observations: However, in India, increased private consumption has historically led to a decrease in private investment.

- Economist Perspective: Some economists argue that injecting more money into consumers’ hands might revive investment by increasing demand.

- Pandemic Impact: The pandemic has further complicated this dynamic, with heightened uncertainty affecting long-term investment decisions.

- Policy Recommendations: Suggestions include focusing on policies that stabilize and encourage spending to indirectly stimulate investment.

Role of Government Policies in Private Capital Formation

- Taxation and Incentives: Policies such as the reduction of corporate taxes from 30% to 22% in 2019 were intended to spur private investments.

- Regulatory Environment: A stable and clear regulatory framework is critical for attracting private sector investments.

- Government Spending: While government investment can fill gaps left by the private sector, it may also crowd out private investment by competing for the same resources.

- Policy Stability: Consistency and predictability in policies are essential for long-term investments, as businesses look for stable conditions before committing to large-scale investments.

- Direct and Indirect Influences: Beyond direct financial incentives, broader economic policies affecting labor laws, foreign trade, and market regulations significantly impact private capital formation.

| Types of Investment Models:

Public Investment Model:

Private Investment Model:

Public-Private Partnership (PPP) Model:

Models of Public-Private Partnership (PPP): Build-Operate-Transfer (BOT):

Build-Own-Operate (BOO):

Build-Operate-Lease-Transfer (BOLT):

Lease-Develop-Operate (LDO):

|

Source:The Hindu

Mains Practice Question:

“Discuss the role of private investment in the economic development of India. Analyze the challenges and opportunities associated with attracting private investment in the country. Propose measures the government can take to encourage sustainable private investment, particularly in key sectors such as infrastructure, technology, and manufacturing.”

Associated Articles:

https://universalinstitutions.com/fy24-new-private-investments-dip-15-states-lead-capex-rise/