DELINQUENCIES SURGE IN CARD, MSME, UNSECURED LOANS, IMPACTING BANKING.

Why in the news?

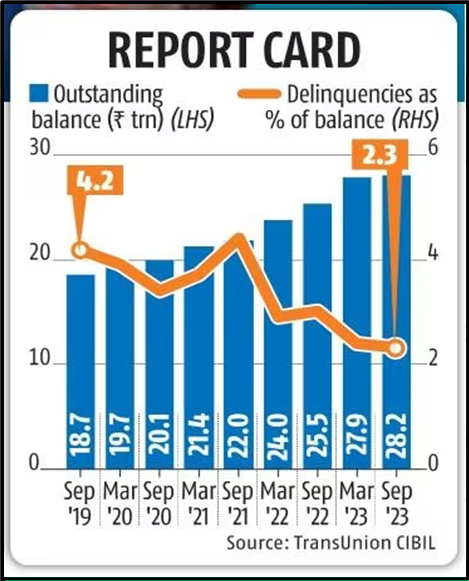

Rise in delinquencies observed in credit card, unsecured, and MSME loans, prompting ICRA to revise banking sector outlook to ‘stable.’

source:bussinessstandard

source:bussinessstandard

About the Types of Delinquencies:

- Credit card, unsecured, and MSME loans are experiencing increased delinquencies.

- Public sector banks show better performance due to higher exposure to performing corporate loans.

- Private sector banks, with more retail and MSME loan exposure, face stronger challenges in asset quality.

About Investment Information and Credit Rating Agency(ICRA):

- ICRA Limited, founded in 1991, is India’s Investment Information and Credit Rating Agency.

- It’s an independent entity supported by financial institutions, banks, and financial services companies.

- ICRA evaluates creditworthiness and provides investment information.

- Its assessments assist stakeholders in making informed investment and credit decisions.

What is Credit Rating?

- A credit rating assesses the creditworthiness of a borrower, indicating their ability to fulfil financial obligations.

- It applies to individuals, corporations, governments, or any entity seeking to borrow funds.

About Credit Rating Agencies (CRAs):

- CRAs assign credit ratings, evaluating debtors’ repayment capability and default likelihood.

- Six SEBI-registered CRAs in India: CRISIL, ICRA, CARE, SMERA, Fitch India, and Brickwork Ratings.

|

source:https://www.thehindu.com/business/icra-sees-rise-in-credit-card-unsecured-and-msme-loan-delinquencies/article68051149.ece#:~:text=There%20were%20clear%20signs%20that,outlook%20for%20the%20banking%20sector.

source:bussinessstandard