DECIPHERING THE DECLINE IN INDIA’S CURRENT ACCOUNT DEFICIT (CAD)

Syllabus:

- GS 3 : Government budgeting

Focus:

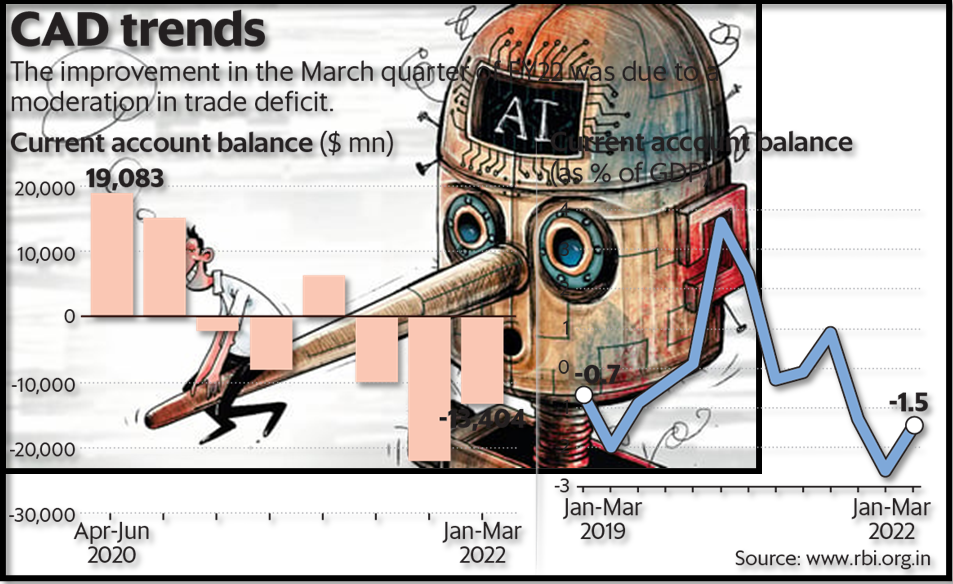

India’s CAD has seen a notable decline, dropping from 2% of the GDP in Q3 2022-23 to a mere 1.2% in Q4 2023-24.

Source: IE

Significance:

- CAD serves as a pivotal indicator, reflecting a country’s external economic balance.

- A higher CAD often triggers concerns about potential rupee depreciation.

- The reduction in CAD boosts investor confidence in India’s macroeconomic stability.

- It also improves India’s position in the global economic landscape.

| Understanding the Current Account Deficit (CAD)

Definition:

Significance:

Adverse Effects of CAD on Economy:

○ This elevates import costs, leading to increased inflation and reduced purchasing ability.

○ This escalates the national debt, posing further economic challenges. |

Understanding the Current Account Components

- The current account encapsulates various transactions between India and the global market.

- It includes goods (exports of gems, jewellery, and software services), imports (oil, gold, electronic goods), tourist expenditures, and remittances.

- The balance of these components determines the health of India’s external trade relations.

- The current account is essential for evaluating India’s economic openness and integration with the global economy.

- It offers insights into the country’s economic health and its ability to meet foreign obligations.

Trade Deficit Dynamics

- The trade deficit, specifically the goods trade, saw a slight increase by 0.4% year-on-year from Q3 2022-23 to Q3 2023-24.

- A substantial 26% surge in the trade deficit was observed from Q1 to Q3 2023-24, indicating increasing challenges in trade balance.

- The rising trade deficit suggests higher imports compared to exports, which can strain foreign reserves.

- It also points towards the need to boost domestic manufacturing and reduce dependency on imports.

- A widening trade deficit can lead to a weaker currency and inflationary pressures.

Detailed Analysis of Imports

- Between Q1 and Q3 2023-24, both oil and non-oil imports experienced an upswing.

- Oil imports consistently comprised around 26% of the total imports.

- Non-oil imports were almost 2.8 times greater than oil imports in the fiscal year 2023-24.

- The surge in imports of certain goods like vegetable oil (110%) and electronic goods (34%) indicates changing consumer preferences and industrial needs.

- Gold imports, often linked to India’s Balance of Payment concerns, rose by a mere 6%, suggesting reduced demand or stricter regulations.

Positive Trends in Exports

- The rise in exports of services like software, business, and travel registered a 5.2% growth year-on-year.

- The net services balance saw a remarkable growth of 28% from Q1 to Q3 2023-24, helping counterbalance the trade deficit.

- It highlights the potential of India’s service sector in contributing to the economy.

- A robust service export can create more job opportunities and boost foreign exchange reserves.

- Continued focus on service sector innovation and quality can further enhance India’s global service export competitiveness.

Service Payments and their Implications

- Payments for “other personal, cultural, and recreational services” witnessed a staggering increase of 284%, escalating from $94 million in 2018-19 to $362 million in 2022-23.

- There’s potential to retain these foreign exchange outflows by promoting domestic expenditures, such as conducting marriages within India.

- Curbing overseas travel expenses can also help save on precious foreign exchange.

- Addressing these outflows can strengthen India’s foreign exchange reserves and improve the current account balance.

- Encouraging domestic tourism can offset the outflow of foreign exchange on travel and leisure services.

Rise in Private Remittances

- Private remittances by Indians working abroad have been a significant support to the current account balance.

- Remittances showed a growth of 2.1% year-on-year in Q3 2023-24 and an impressive 16% overall in 2023-24.

- Private transfers from India exhibited a robust growth, surging by 84% from 2018-19 ($5,795 million) to 2022-23 ($10,689 million).

- This growth reflects the increased overseas employment opportunities for Indians and their contributions to the home country.

- The consistent rise in remittances underscores the importance of the Indian diaspora in bolstering the country’s economic health.

Challenges

- Despite the reduction in CAD, the trade deficit remains a concern, with a significant 26% surge observed.

- Rising imports of certain goods indicate changing consumption patterns and potential over-dependency on foreign products.

- Escalating service payments highlight the need to curb unnecessary foreign expenditures and promote domestic alternatives.

- The challenges in trade balance emphasize the urgency to boost domestic manufacturing and reduce import dependency.

- The fluctuating global economic scenario and geopolitical tensions can further strain India’s external sector.

Way Forward

- Policymakers must strategize to reduce the trade deficit by promoting domestic manufacturing and exports.

- Encouraging innovation and R&D can help develop import substitutes and reduce dependency on foreign goods.

- Focus on enhancing the quality and competitiveness of Indian exports, especially in the service sector, can boost foreign exchange earnings.

- Implementing policies to curb unnecessary foreign expenditures and promoting domestic alternatives can strengthen the current account balance.

- Strengthening ties with the Indian diaspora and facilitating their contributions to the homeland can further boost remittances and foreign exchange reserves.

Conclusion:

The decline in India’s Current Account Deficit (CAD) offers a promising outlook for the country’s external economic stability. While positive trends in service exports and remittances bolster the current account, challenges like rising trade deficits and escalating service payments necessitate strategic policy interventions. Sustainable growth demands a balance between promoting domestic manufacturing, curbing unnecessary expenditures, and fostering innovation in export sectors.

Source: The Hindu

Mains Practice Question:

Discuss the recent trends in India’s Current Account Deficit (CAD) highlighting the factors contributing to its decline. Also, analyze the challenges faced by India’s external sector and suggest measures for sustainable improvement.

Associated Articles: