THE PMLA – A LAW THAT HAS LOST ITS WAY

Syllabus:

GS 2 and 3:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Role of external state and non-state actors in creating challenges to internal security.

Focus:

- ED arrested Delhi CM Arvind Kejriwal.

Source:- The Hindu

The Prevention of Money Laundering Act (PMLA), enacted by the Indian Parliament in 2002 and enforced in 2005, was designed to combat the laundering of drug money, a significant issue recognized globally for its potential to destabilize economies and threaten national sovereignty. The background to the PMLA emphasizes its focus on countering the massive influx of black money generated through international drug trafficking. The law originated from a series of international resolutions and conventions, highlighting the global consensus on the urgent need to address money laundering related to the drug trade.

Key Points:

- UN Convention and FATF Formation: The United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances in 1988, followed by the establishment of the Financial Action Task Force (FATF) in 1989, laid the groundwork for global efforts against money laundering.

- UN Resolutions and Global Action: The United Nations General Assembly’s adoption of resolutions calling for member countries to enact legislation to combat drug money laundering further catalyzed the formation of the PMLA.

- Scope of the PMLA: Initially, the PMLA targeted crimes directly related to drug trafficking and money laundering. However, subsequent amendments expanded its scope to include a broad range of offences not originally intended under the act.

- Issue of Scope Creep: Amendments to the PMLA have incorporated offences beyond drug money laundering into its purview, diverging from the act’s original intent and leading to criticisms of scope creep.

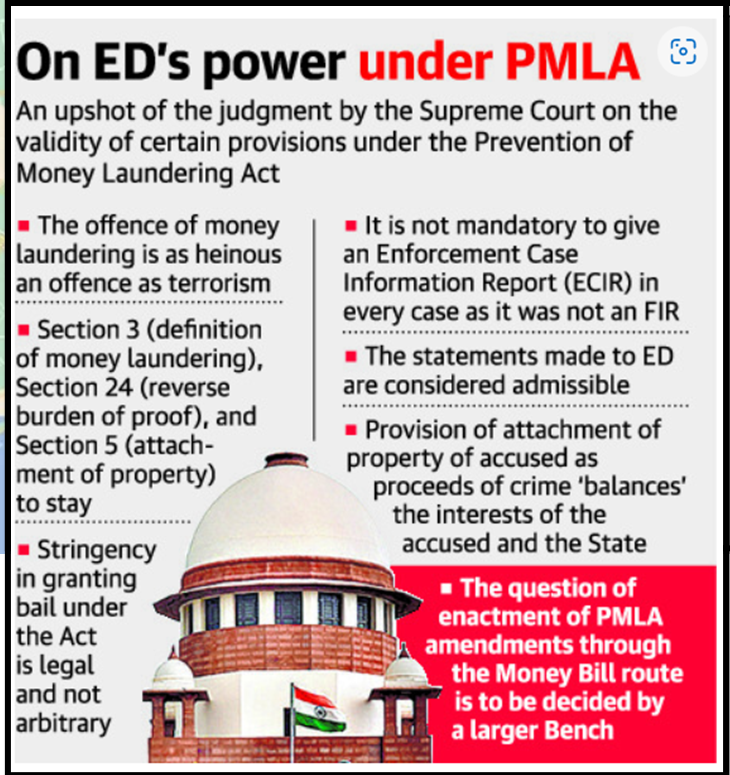

- Controversial Bail Provision: The PMLA’s bail provision, which presumes guilt over innocence, has sparked significant debate and legal challenges, highlighting concerns over the presumption of innocence and the right to bail.

- Judicial Perspective on Bail: Supreme Court decisions on the bail provision of the PMLA reflect evolving judicial interpretations, balancing the act’s objectives against constitutional rights to personal liberty and fairness.

PMLA, 2002: An Overview

Background:

- Enacted to fulfill India’s global commitment under the Vienna Convention to combat money laundering.

- Key international commitments include the United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances (1988), Basle Statement of Principles (1989), Forty Recommendations of the Financial Action Task Force on Money Laundering (1990), and the Political Declaration and Global Program of Action adopted by the United Nations General Assembly in 1990.

About:

- Criminal law aimed at preventing money laundering and facilitating the confiscation of proceeds derived from criminal activities.

- Forms the central legal framework in India for combating money laundering.

- Applicable to financial institutions, banks (including RBI), mutual funds, insurance companies, and their intermediaries.

Objectives:

- Confiscate and seize proceeds of crime involved in money laundering.

- Establish a legal framework to prevent money laundering and terrorist financing.

- Strengthen mechanisms for investigating and prosecuting money laundering offenses.

- Enhance international cooperation in combating money laundering and related crimes.

Regulating Authorities:

- Directorate of Enforcement (ED): Responsible for enforcing PMLA provisions and investigating money laundering cases.

Scope and Amendments

- Original Scope: Covered offences under IPC and Narcotic Drugs and Psychotropic Substances Act, 1985.

- Expansion: Subsequent amendments broadened the scope to include a variety of offences beyond drug money laundering.

- Controversy Over Scope: Amendments have led to debates on the act’s deviation from its original purpose.

Critical Issues

- Concern Over Broadened Scope: Inclusion of unrelated offences dilutes the focus on drug money laundering.

- Bail Provision: Section 45 presumes guilt over innocence, reversing the traditional legal principle of presumption of innocence.

- Legal Challenges: The bail provision faced constitutional challenges, reflecting concerns over rights to liberty and fair trial.

Judicial Responses

- Supreme Court Rulings: Varied decisions on the constitutionality of the bail provision, highlighting the tension between legislative intent and constitutional rights.

- Policy vs. Liberty: Debates on whether the PMLA’s stringent measures align with fundamental principles of justice and personal freedom.

While the PMLA represents a crucial step in India’s efforts to combat money laundering, particularly in relation to drug trafficking, its evolution through amendments has sparked debates on its scope, application, and impact on legal rights. The act’s expansion to include offences not directly related to its original intent raises questions about the balance between combating money laundering and ensuring fairness and justice within the legal system. The ongoing dialogue between legislative objectives, judicial interpretations, and civil liberties underscores the complexity of implementing robust anti-money laundering measures while upholding democratic principles and rights.

| FATF: An Overview

About: · Established in 1989, FATF is an intergovernmental organization. · It sets global standards for combating money laundering, terrorist financing, and related threats to the international financial system. · FATF functions as a policy-making body to promote the implementation of measures against financial crimes. Objective: · Primary objective: To set international standards and promote effective implementation of measures to combat money laundering, terrorist financing, and proliferation of weapons of mass destruction. Formation: · Initiated by the G7 countries in response to concerns about money laundering’s impact on the global economy. · Initially focused on developing recommendations to combat money laundering, later expanded to counter terrorist financing and emerging threats. Grey List and Black List: · Maintains a “grey list” for jurisdictions with deficiencies in anti-money laundering and counter-terrorist financing frameworks. · “Black list” (Call for Action) includes countries with severe deficiencies, leading to potential international sanctions. Member Countries: · Currently comprises 39 members, including 37 jurisdictions and 2 regional organizations (Gulf Cooperation Council and European Commission). · Collaborates with international organizations like the United Nations to enhance global cooperation against financial crimes. India and FATF: · India became a FATF member in 2010, actively participating in global efforts to combat money laundering and terrorist financing. |

Source:

https://universalinstitutions.com/supreme-court-clarifies-pmla-accused-rights/

Mains Practice Question:

Critically analyze the evolution and implementation of the Prevention of Money Laundering Act (PMLA), 2002, in the context of its original objectives and the subsequent amendments that have expanded its scope. Discuss the implications of these amendments for the legal principles of presumption of innocence and the right to bail. Suggest measures to balance the act’s stringent requirements with the fundamental rights enshrined in the Indian Constitution.