‘RBI ACTIONS TO RESTRICT CREDIT GROWTH’:

Why in the news ?

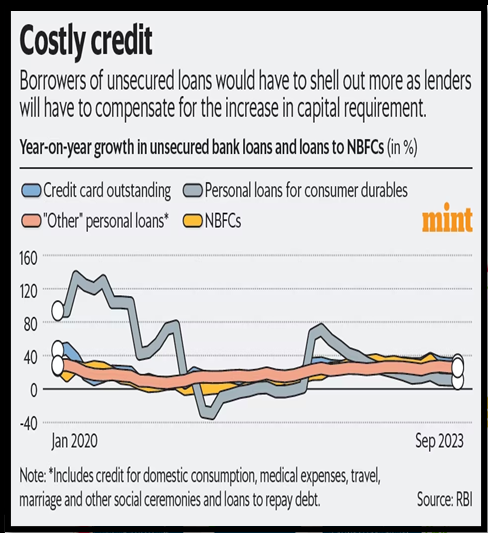

RBI’s strict measures to control lending and improve compliance are expected to slow loan growth, raise costs, and impact valuations.

About the Regulatory Measures and Impact:

- RBI’s stringent actions aim to control lenders’ exuberance, enhance compliance, and protect customers.

- S&P Global predicts a slowdown in loan growth to 14% in 2024-25 from 16% due to increased capital costs.

- Compliance costs for small lenders may rise, affecting their competitiveness.

source:mint

| About credit growth:

● Bank credit growth attributed to rising retail loans. ● Retail loans encompass personal loans (car, mortgage, signature, credit cards) and certain business loans. ● Retail credit growth at 9%, expected to rise, led by mortgages (51% of retail loans) and supported by unsecured and vehicle loans. |