HAVING PANCHAYATS AS SELF-GOVERNING INSTITUTIONS

Relevance: GS 2 – Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein.

Why in the News?

- The 73rd and 74th Constitutional Amendments Acts, enacted three decades ago, aimed to establish local bodies as institutions of local self-government in India.

- These amendments were designed to decentralize power and enhance grassroots democracy by empowering local governance structures.

- In 2004, the Ministry of Panchayati Raj was established as a follow-up to the Constitutional amendments.

- The ministry’s primary objective is to strengthen rural local governments and facilitate effective implementation of decentralized governance initiatives.

FISCAL DEVOLUTION

Disparities in Devolution Status:

- Analysis reveals disparities among States, with some progressing while others lag behind in devolution efforts.

- The commitment of State governments plays a crucial role in determining the effectiveness of panchayati raj institutions at the grassroots level.

- Importance of Fiscal Devolution:

- The constitutional amendment provides detailed guidelines on fiscal devolution, including the generation of own revenues.

- States have enacted their own Panchayati Raj Acts, aligning with the Central Act, to empower panchayats with taxation and collection provisions.

- Efforts in Revenue Generation:

- Panchayats, guided by the provisions of State Panchayati Raj Acts, endeavor to maximize their own resource generation capabilities.

- Participatory planning and budgeting initiatives, facilitated by the Ministry, emerge as outcomes of these efforts, enhancing local governance effectiveness.

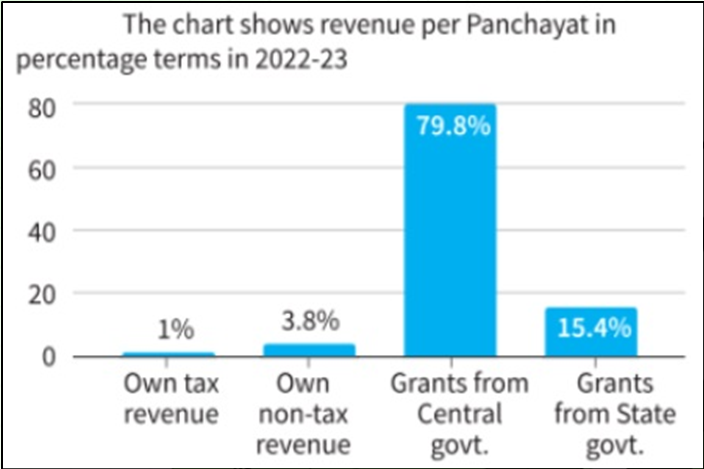

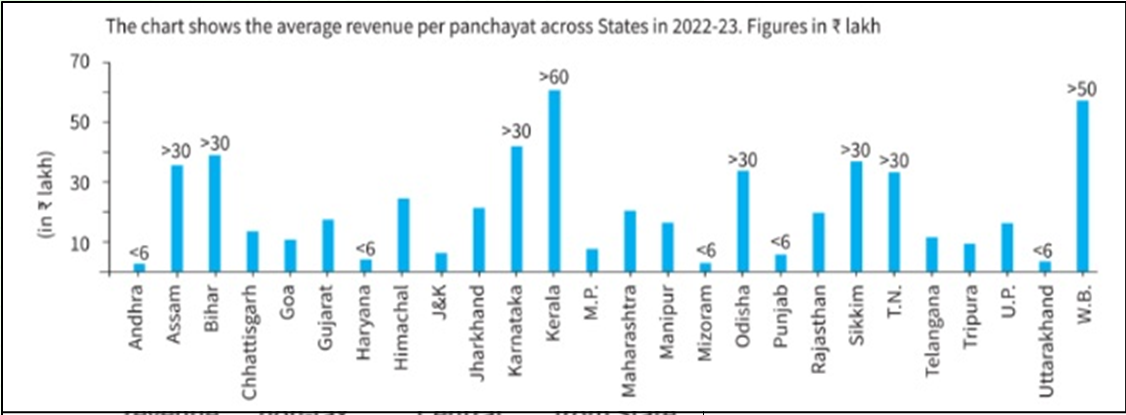

Revenue Composition of Panchayats

- A recent data highlighted that panchayats generate only 1% of their revenue through taxes.

- The majority of panchayats’ revenue, 80%, comes from the Central government, while 15% is contributed by the State governments.

- This revelation serves as an eye-opener for advocates of decentralization, indicating that despite three decades of devolution initiatives, panchayats’ revenue remains disproportionately dependent on grants from higher levels of government.

Avenues for own source of revenue

- Expert Committee Report on Own Source of Revenue (OSR): The Ministry of Panchayati Raj constituted an expert committee to delve into the own source of revenue (OSR) for rural local bodies.

- Major OSRs for Panchayats: Key OSRs include property tax, cess on land revenue, surcharge on additional stamp duty, tolls, tax on professions, advertisement revenue, and user charges for water, sanitation, and

- Incorporation in State Acts: The committee’s report details State Acts that have incorporated provisions for tax and non-tax revenue collection and utilization by panchayats.

Establishing Conducive Taxation Environment

- Panchayats are tasked with creating a conducive environment for taxation by implementing appropriate financial regulations.

- This involves decision-making on tax and non-tax brackets, determining rates, periodic revisions, defining exemption areas, and enacting effective tax management and enforcement laws.

- Potential for Non-Tax Revenue:

- Non-tax revenue sources encompass fees, rent, income from investment sales and hire charges, and receipts.

- Innovative projects, such as rural business hubs, commercial ventures, renewable energy projects, carbon credits, Corporate Social Responsibility (CSR) funds, and donations, present significant opportunities for generating OSR.

The Role of Gram Sabhas in Local Development

Gram sabhas play a pivotal role in nurturing self-sufficiency and sustainable development at the grassroots level by harnessing local resources for revenue generation.

- They actively participate in the planning, decision-making, and execution of revenue-generating projects spanning agriculture, tourism, and small-scale industries.

- Endowed with the authority to levy taxes, fees, and levies, gram sabhas channel funds towards local development endeavors, public services, and social welfare initiatives.

- By adhering to transparent financial practices and fostering inclusive participation, gram sabhas ensure accountability and cultivate community trust, thereby empowering villages to achieve economic independence and resilience.

- Therefore, gram sabhas must prioritize entrepreneurship promotion and cultivate partnerships with external stakeholders to amplify the impact of revenue generation endeavors.

CHALLENGES IN PANCHAYAT FUNDING

- Tax Collection Across Panchayat Tiers

- In many States, gram panchayats lack the authority to levy taxes, while intermediate and district panchayats are not entrusted with tax collection responsibilities in numerous regions.

- Data reveals that gram panchayats contribute 89% of own taxes, whereas intermediate panchayats collect 7%, and district panchayats manage a nominal 5%.

- There’s a pressing need to delineate Own Source of Revenue (OSR) sharing equitably across all three tiers of panchayats.

- Reluctance in Own Income Generation

- The increase in Central Finance Commission (CFC) grants has diminished the interest of panchayats in OSR collection.

- Allocations for rural local bodies from the 10th and 11th CFCs were ₹4,380 crore and ₹8,000 crore, respectively.

- In contrast, the 14th and 15th CFCs witnessed a substantial rise, with allocations reaching ₹2,00,202 crore and ₹2,80,733 crore, respectively.

- Tax collection decreased from ₹3,12,075 lakh in 2018-19 to ₹2,71,386 lakh in 2021-22, while non-tax collection dropped from ₹2,33,863 lakh to ₹2,09,864 lakh during the same period.

- The increase in Central Finance Commission (CFC) grants has diminished the interest of panchayats in OSR collection.

- Shift from Own Income Focus to Grant Dependency

- Panchayats, once driven to raise OSR to meet basic needs, now exhibit a growing dependence on grants allocated through central and State finance commissions.

- While some States offer matching grants as incentives, these policies are implemented sparingly.

- Additionally, panchayats lack the inclination to penalize defaulters, as OSR isn’t perceived as income directly linked to panchayat finance.

- Revenue Mobilization for Panchayats

- Panchayats face numerous obstacles in mobilizing resources, despite having all the necessary enabling factors.

- A prevalent ‘freebie culture’ in society contributes to a reluctance among citizens to pay taxes, while elected representatives fear that imposing taxes could harm their popularity.

SOLUTIONS

The Need for Education and Awareness

- The solution is clear: there’s a critical need to educate both elected representatives and the public about the importance of revenue generation for developing panchayats as self-sufficient governing bodies.

- Ultimately, reducing dependency on grants is essential, and panchayats must strive to sustain themselves using their own resources.

Collaborative Efforts Across Governance Tiers:

- Achieving this goal requires dedicated efforts at all levels of governance, including the state and central governments.

- Only through concerted efforts can panchayats progress towards financial autonomy and self-sufficiency.

Mains question

Discuss the challenges faced by panchayats in revenue mobilization. Evaluate the role of education in overcoming the ‘freebie culture’. (250 words)