GIVE SOUTHERN STATES THEIR FAIR SHARE OF TAX REVENUES

Relevance: GS 2 – Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein.

Why in the News?

- Karnataka, Kerala, and Tamil Nadu accuse the Central government of biased allocation of federal funds.

- Chief Ministers from these states lead protests in the capital, advocating for a fair share of resources.

- Allegations of “stepmotherly treatment” surface, citing discrimination linked to political affiliations.

- The main source of dispute revolves around alterations in tax devolution policies, especially with the implementation of the Goods and Services Tax (GST) and the criteria set by the 15th Finance Commission.

IMPACT OF GST ON SOUTHERN STATES

- Impact on Fiscal Autonomy: Prior to GST, southern states, along with others, had the autonomy to set value-added tax (VAT) rates, enabling them to tailor taxation to their fiscal requirements.

- However, the introduction of GST shifted the dynamics, making states reliant on the Union government for fund allocation, thus eroding their fiscal autonomy within the federal structure.

- Transition Assurances: With the implementation of GST, the Centre assured states of a 14 percent increase in tax revenues and pledged fair compensation for any losses incurred during the transition phase.

- GST Compensation Mechanism: To facilitate compensation, the GST Compensation Cess was levied, with southern states expected to receive the highest compensation due to their significant contributions to the divisible pool.

- Despite the ongoing collection of the GST compensation cess by the Union government, the disbursement of GST compensation to states was ceased last year.

- Financial Consequences: Consequently, states like Tamil Nadu are grappling with annual losses exceeding Rs 20,000 crore, highlighting the financial strain and concerns regarding fair compensation and fiscal stability.

IMPACT OF FINANCE COMMISSION ON SOUTHERN STATES

- 15th Finance Commission’s Impact: It aggravated the existing disparities by adopting the 2011 population census as the primary determinant for tax devolution.

- This departure from the previous commission’s methodology, which incorporated a blend of the 1971 and 2011 censuses, aimed to reward states for effective population control measures.

- Consequences of Census Shift:

- However, the reliance solely on the 2011 census has resulted in states with larger populations, such as Uttar Pradesh, receiving a significantly higher share of devolved taxes.

- Conversely, less populous southern states find themselves at a disadvantage due to this shift.

- Disparity in Tax Devolution:

- Uttar Pradesh received 18 percent of the devolved taxes, highlighting the impact of its large population.

- In contrast, states like Tamil Nadu (4.2 percent), Karnataka (3.65 percent), Telangana (2.13 percent), Andhra Pradesh (4.11 percent), and Kerala (1.96 percent) received substantially lower shares, exacerbating the regional disparities.

- However, the reliance solely on the 2011 census has resulted in states with larger populations, such as Uttar Pradesh, receiving a significantly higher share of devolved taxes.

Parliamentary Inquiry

- The inquiry sought comprehensive data on GST, direct and indirect taxes paid by states to the Union government, and details on funds allocated to each state as part of central taxes over the past five years.

- Data Revelations:

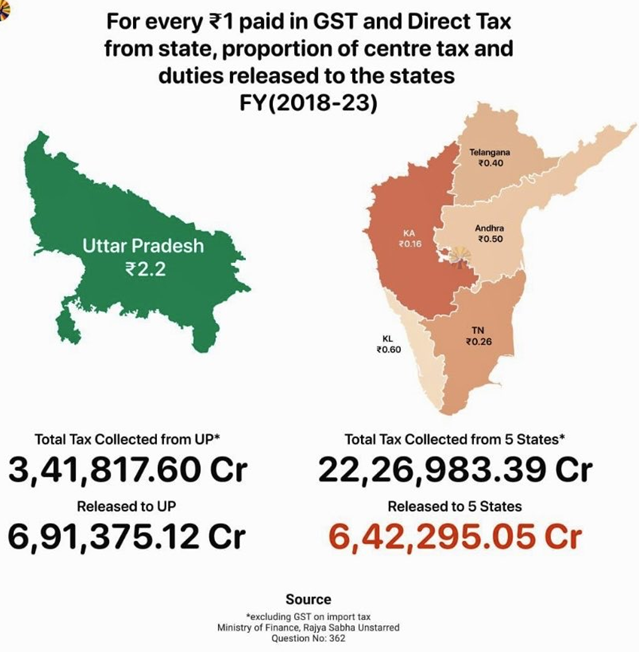

- Southern states, namely Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, and Kerala, collectively contributed over Rs 22.26 lakh crore through GST and direct taxes (excluding GST) in the past five years.

- Surprisingly, only Rs 6.42 lakh crore has been devolved to these states during the same period.

- In contrast, Uttar Pradesh, contributing Rs 3.41 lakh crore during the specified timeframe, was allocated a substantial Rs 6.91 lakh crore, highlighting a significant disparity in financial distributions.

- Southern states, namely Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, and Kerala, collectively contributed over Rs 22.26 lakh crore through GST and direct taxes (excluding GST) in the past five years.

Concerns with the Allocation

- Unanswered Inquiry on Allocation Formula: Despite raising concerns about the disparity in financial allocations, there has been no response from the government regarding the consideration of changing the allocation formula.

- This omission contradicts the Rajya Sabha rules, which mandate specific and complete answers to parliamentary inquiries.

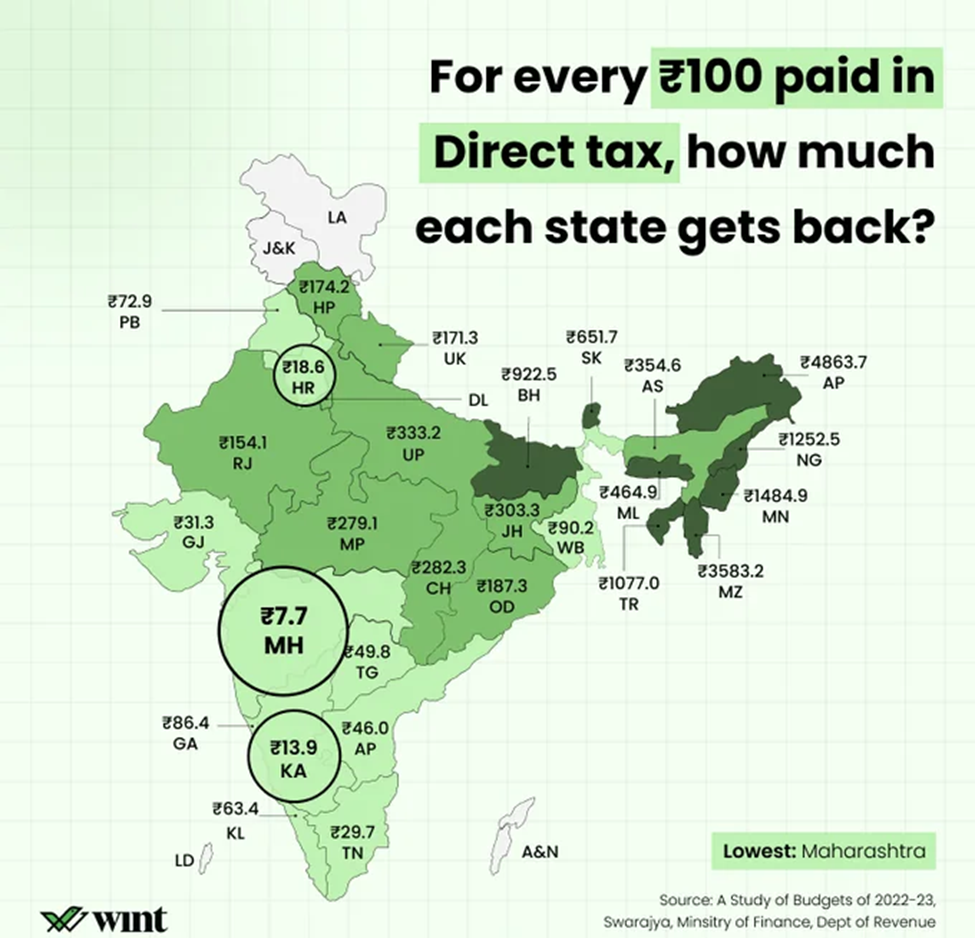

- Examination of Central Taxes Allocation: An analysis of the proportion of central taxes and duties released to states reveals significant disparities.

- Between 2018-19 and 2022-23, for every rupee paid in GST and direct tax:

- Tamil Nadu received only 26 paise on average.

- Karnataka received 19 paise.

- Kerala received 62 paise.

- Andhra Pradesh received 50 paise.

- Telangana received 40 paise.

- Declining Shares:

- Notably, Tamil Nadu’s share declined from 27 paise to 24 paise between 2018-19 and 2022-23.

- Similarly, Karnataka’s share decreased from 22 paise to 12 paise,

- Telangana’s from 60 paise to 31 paise,

- Kerala’s from 81 paise to 50 paise, and

- Andhra Pradesh’s from 56 paise to 49 paise.

- Disparity Between Southern and Northern States:

- A stark contrast emerges when comparing the financial allocations received by southern states to those received by some northern states.

- Uttar Pradesh receives a considerable Rs 2.02 for every rupee paid to the Union government, while Madhya Pradesh gets Rs 1.70 and Rajasthan receives Rs 1.14.

- Between 2018-19 and 2022-23, for every rupee paid in GST and direct tax:

Magnitude of Disparity:

- Southern states, collectively, receive approximately 25 percent of the share of what they contribute, highlighting a significant disparity.

- In contrast, states like Uttar Pradesh are allotted more than 200 percent of what they contribute, underscoring the magnitude of the discrepancy.

- Concerns Raised:

- The disparity raises questions about bias towards southern states in terms of financial allocations.

- While not suggesting that a large portion of the share should not be allocated to Uttar Pradesh or other northern states, the concern revolves around why the southern states are consistently receiving lower allocations relative to their contributions.

Possible Reasons for this Disparity

- Punitive Treatment for Good Policies:

- The southern states feel that they are being unfairly penalized for implementing effective policies, including measures to control population growth.

- Despite their efforts to enact beneficial policies, they perceive a lack of proportional reward in terms of financial allocations.

- Call for Allocation Formula Reconsideration:

- Southern leaders argue that it is high time for the allocation formula to be re-evaluated.

- They demand that southern states be given their fair shares, reflecting their contributions and policy efforts.

- Fairness and Equity:

- The demand for fair shares aligns with the principle of fairness and equity in resource distribution among states.

- Revising the allocation formula to reflect the contributions and policy initiatives of southern states is seen as crucial to addressing the perceived injustices.

Mains question

Discuss the perceived disparity in financial allocations between southern and northern states in India, considering the impact of policy initiatives and contributions. Analyze.