PAYTM BANK’S EXIT FROM UPI UNLIKELY TO BE DISRUPTIVE

Why in the news?

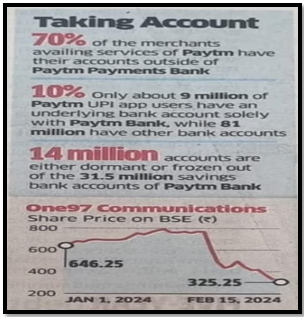

- The regulatory-mandated exit of Paytm Payments Bank from the Unified Payments Interface (UPI) platform, a popular digital payment system in India.

- Out of 90 million Paytm UPI users, only about 15 million exclusively use the app for transactions.

source:gyanias

What are Payment banks:

- Payment banks, like Airtel Payments Bank and India Post Payments Bank, operate on a smaller scale without credit risk involvement.They perform typical banking operations but cannot provide loans or issue credit cards.

- Payment banks can accept demand deposits (savings and current accounts) but not time deposits, and cannot establish subsidiaries for non-banking financial services.

- Objectives:Promote financial inclusion by offering small savings accounts and payment/remittance services.

| UPI (Unified Payments Interface):

· India’s mobile-based fast payment system enabling instant transactions 24/7. · Users utilize a Virtual Payment Address (VPA) to conduct transactions securely without revealing sensitive bank account details. Virtual Payment Address (VPA): · Unique identifier for individuals within the digital payments system. · Created by users to facilitate fund transfers, serving as an alternative to sharing confidential bank account information. National Payments Corporation of India (NPCI) · National Payments Corporation of India (NPCI) serves as the overarching body for all retail payment systems in India. · Established with guidance and support from the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA). |

source:gyanias

source:gyanias