REPO RATE UNCHANGED

Why in the News?

- RBI’s Monetary Policy Committee (MPC) retained the repo rate at 6.5% in a 5:1 majority decision during its bi-monthly review.

- MPC also maintained the stance as ‘withdrawal of accommodation’ to balance inflation and growth concerns.

Inflation and Economic Outlook:

- Headline inflation forecast remains at 5.4% for the fiscal year amid uncertainty in food prices.

- Retail inflation surged to 5.69% in December, impacting MPC’s goal to sustainably reduce Consumer Price Indec (CPI) inflation to around 4%.

- GDP growth projected at 7% for FY 2024-2025, reflecting geopolitical tensions and financial market volatility.

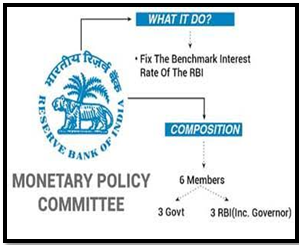

| About Monetary Policy Committee (MPC)

· Origin: Section 45ZB of the amended RBI Act, 1934 (2016) authorizes the central government to form a six-member Monetary Policy Committee (MPC). · Objective: Section 45ZB specifies that the MPC determines the Policy Rate to meet the inflation target. · Composition: The MPC comprises o RBI Governor (ex officio chairperson) o Deputy Governor responsible for monetary policy o A nominated Bank officer by the Central Board o Three individuals appointed by the central government. Key Terms · Repo Rate: The rate at which the central bank (RBI) lends money to commercial banks to manage short-term liquidity needs and control inflation. · Inflation: The rate at which the general level of prices for goods and services rises, eroding purchasing power. · Headline Inflation (CPI): The measure of the total inflation within an economy, reflecting changes in the prices of a basket of consumer goods and services. |