RBI’S ACTION AGAINST PAYTM PAYMENTS BANK

Why in the News?

- RBI bars Paytm Payments Bank from offering key services like deposits, prepaid instruments, FASTags, etc., after February 29 due to persistent non-compliances.

- Customers allowed withdrawal or utilization of balances without restrictions.

Probable Reasons for RBI’s Move:

- RBI scrutiny on Paytm Payments Bank since 2018, possibly due to concerns over KYC compliance and FT-related issues.

- Lack of information barriers within the group and data access to China-based entities, raising regulatory concerns.

Source: MINT

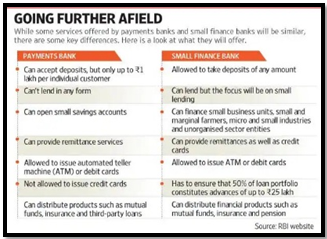

| About Payment Banks

· Payment banks (e.g., Airtel Payments Bank, India Post Payments Bank) function similarly to traditional banks but operate on a smaller scale. · Dr. Nachiket Mor-led committee proposed the concept of ‘Payments Bank’ to serve lower-income groups and small businesses. · They lack credit risk involvement and offer limited services; they handle typical banking operations but cannot provide loans or issue credit cards. · Payment banks solely accept demand deposits, like savings and current accounts, excluding time deposits. · They are restricted from establishing subsidiaries for non-banking financial activities. |

Source: MINT

Source: MINT