STATES’ BORROWING IN Q4

Why in the News?

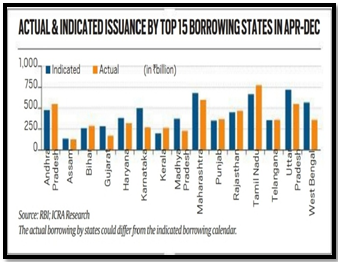

- Six states, including Andhra Pradesh, Karnataka, and Punjab, sought to borrow Rs 16,000 crore in the first weekly auction of January-March.

- States anticipate record borrowing of Rs 4.13 lakh crore in the Q4 FY24, leading to concerns about higher supply of dated securities.

Potential Economic Ramifications:

- Higher supply of state government securities alongside G-sec supply may weigh on state government bonds.

- Borrowing costs for states likely to rise compared to the Centre.

- Yield spread between 10-year state government loans and the benchmark 10-year G-sec is expected to widen further.

- Concerns of higher supply of dated securities may lead to a steepening of the curve.

- Weighted average cut-off of state government securities increased, leading to a rise in borrowing costs for states compared to the Centre.

Source: India Express

| Key Terms

G-Sec · G-Secs are tradable instruments issued by the Central or State Government acknowledging the Government’s debt. · They include short-term Treasury Bills (maturity < 1 year) and long-term Government Bonds or Dated Securities (maturity ≥ 1 year). Dated securities · Dated securities refer to long term interest-bearing debt instruments issued by governments with a specified maturity date. · Investors receive periodic interest payments until the maturity when the principal is repaid. For example, government bonds, where investors earn interest until the bond matures, are considered dated securities |

Source: India Express

Source: India Express