RBI’S FINANCIAL STABILITY REPORT HIGHLIGHTS

Why in the News?

- RBI’s financial stability reports highlights , Healthy balance sheets of financial institutions, moderating inflation, and fiscal consolidation contribute to stability.

Source: The Hindu

Key Highlights:

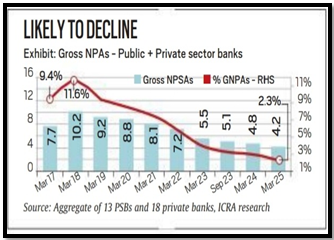

- Gross Non-Performing Assets (GNPA) ratio reaches a multi-year low at 3.2%, and net non-performing assets (NNPA) ratio stands at 0.8% in September 2023.

- Stress tests projects , Capital to Risk-weighted Assets Ratio (CRAR) at 14.8% in September 2024.

- GNPA ratio for all banks may improve to 3.1% by September 2024 under baseline scenarios.

About Financial Stability Report:

- The FSR is a report released by RBI that reflects the combined evaluation of the Sub-Committee of the Financial Stability and Development Council (FSDC), led by the RBI Governor.

- Released biannually.

- Provides an assessment of risks to financial stability and evaluates the resilience of the financial system.

| Key Terms

Non-Performing Asset (NPA) · NPA categorizes loans or advances in default or arrears on scheduled payments. · Debt is marked as non-performing when payments remain overdue for at least 90 days. · GNPA : Gross non-performing assets represent the total defaulted loans acquired from financial institutions. · NNPA : Net non-performing assets are the realized amount after deducting provisions from the gross non-performing assets. Capital Adequacy Ratio (CAR) · CAR, or Capital-to-Risk Weighted Asset Ratio, is the ratio of a bank’s capital to its risk-weighted assets and current liabilities. · Decided by central banks, it prevents excessive leverage by commercial banks, safeguarding against insolvency risks. |

Source: The Hindu

Source: The Hindu