RBI VIEWS ON STAGFLATION RISK

Why in the News?

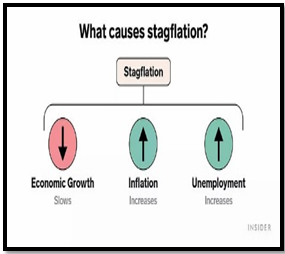

- Reserve Bank of India (RBI) officials see the risk of stagflation, a combination of economic stagnation and high inflation, dropping from 3% in August to 1% based on recent data.

Source: Insider

About the Assessment:

The assessment considers two approaches:

- One based on phases of low economic growth coinciding with high inflation, and

- Second using “Inflation at Risk” (IaR) and “Growth at Risk” (GaR) frameworks employing quantile regression.

Major Determinants of Stagflation:

- Primary factors :

- Supply-side shocks like commodity price spikes,

- Tighter financial conditions, and

- Higher depreciation of the domestic currency

- Historical episodes of elevated stagflation risks

- Asian Crisis,

- Global Financial Crisis,

- Taper tantrum,

- COVID-19 pandemic.

- Global factors

- S. dollar’s appreciation post-pandemic

- Higher commodity prices

The RBI emphasizes its commitment to maintaining price stability while monitoring stagflation risks, considering both domestic and global economic dynamics.

Source: Insider

Source: Insider