COMPENSATION FOR EXPORTERS AFFECTED BY CARBON TAX:

Why in the News?

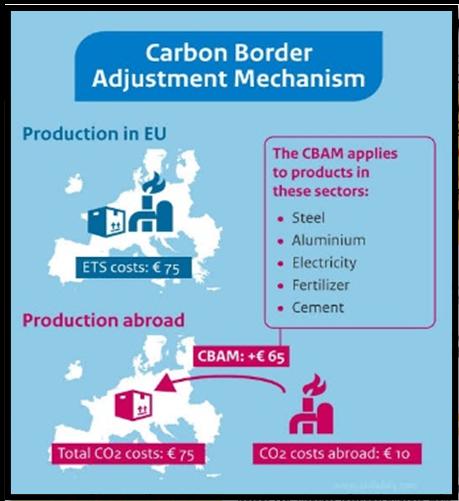

- The Indian government is considering various relief measures to counter the impact of the European Union (EU) and the UK’s carbon tax, known as the Carbon Border Adjustment Mechanism (CBAM).

- The CBAM, initiated on October 1, targets India’s iron, steel, and aluminium exports, valued at $8-$9 billion, impacting global competitiveness.

Source: SOHU

About Relief Measures:

- Compensation to affected exporters is being explored to help them remain competitive in the global market.

- Options on the table include seeking longer transition times and repatriation of duties. Collaborative mechanisms are under discussion to devise supportive measures and enhance product competitiveness.

Challenges and WTO Involvement:

- Addressing these measures within a free trade agreement (FTA) poses challenges, as WTO provisions allowing protective measures for human lives, plants, health, and the environment come into play.

- India has challenged the carbon tax at the WTO, asserting that CBAM violates special and differential treatment (SNDT) provisions, advocating longer transition periods for developing nations to safeguard trade interests.

The UK is set to implement its CBAM version by 2027, targeting emission-intensive industrial goods, further complicating the global trade landscape.

Source: SOHU

Source: SOHU