Enrollments in the Atal Pension Yojana surpass 6 crore.

News

- With more than 79 lakh enrolments in the current Financial Year, the total number of participants in the Atal Pension Yojana (APY) has surpassed 6 crore according to the Ministry of Finance.

- The Ministry continued by saying that all banks’ tireless efforts have made it possible to include the most vulnerable segments of society in the pension program.

About APY

- APY was introduced in the country’s premier social security program, on May 9, 2015, with the goal of giving Indian citizens financial stability as they age.

- The program primarily targets the underprivileged, the impoverished, and laborers in the unorganized sectors.

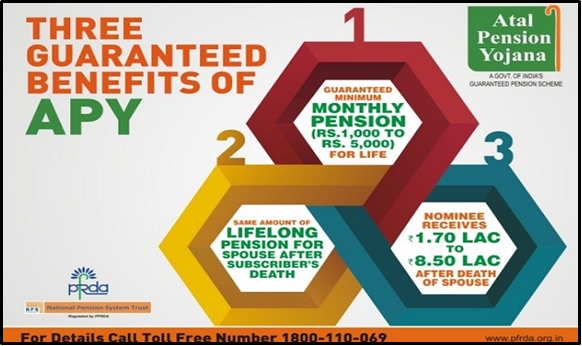

- A lifelong monthly pension of Rs 1,000 to Rs 5,000 under the APY is available to subscribers upon reaching 60 years of age, dependent upon their contributions, which change based on the age at which the scheme is joined. Following the subscriber’s death, the subscriber’s spouse would receive the same pension.

- Eligibility for APY: The APY program is open to all Indian citizens. The subscriber should be between the ages of 18 and 40. If a subscriber signs up later, her contribution levels will increase, while the levels for early subscribers would be lower.

- Administered By: Pension Fund Regulatory and Development Authority (PFRDA) administers the National Pension System (NPS).

Analysis: Social Security Needs

- A study published in 2021–22 that was referenced in the media states that approximately 53% of India’s salaried workforce does not receive any social security benefits. This effectively means that these workers are not eligible for health care and disability insurance, pensions, or provident funds.

- Merely 1.9% of the most impoverished 20% of India’s labor force is eligible for benefits. In the meantime, gig workers—roughly 1.3% of India’s working population—rarely receive any kind of social security benefit. In 2021, India’s social security system received a low ranking of 40 out of 43 countries by Mercer CFS.

- The time has come for India to provide universal social security to all of its workers by consolidating its current ad hoc measures and social security schemes. India’s workforce faces growing job insecurity due to the proliferation of hire/fire policies and increasingly on-demand work. Hence, proliferation of APY is a way forward and also the need of the hour in respect to India.

| PFRDA

● The NPS requires orderly growth, regulation, and promotion. The statutory authority for this purpose is the PFRDA, which was established by a Parliamentary enactment. ● It is operated by the Ministry of Finance’s Department of Financial Services. NPS: The government sponsors the NPS pension plan. It was introduced to government workers in 2004. Any Indian citizen between the ages of 18 and 65, whether they are residents or not, is now eligible to join NPS. |