STATE OF THE ECONOMY – TEMPER THE EUPHORIA

Relevance:

- GS3: Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Why in the News ?

IMF’s Revised Projections

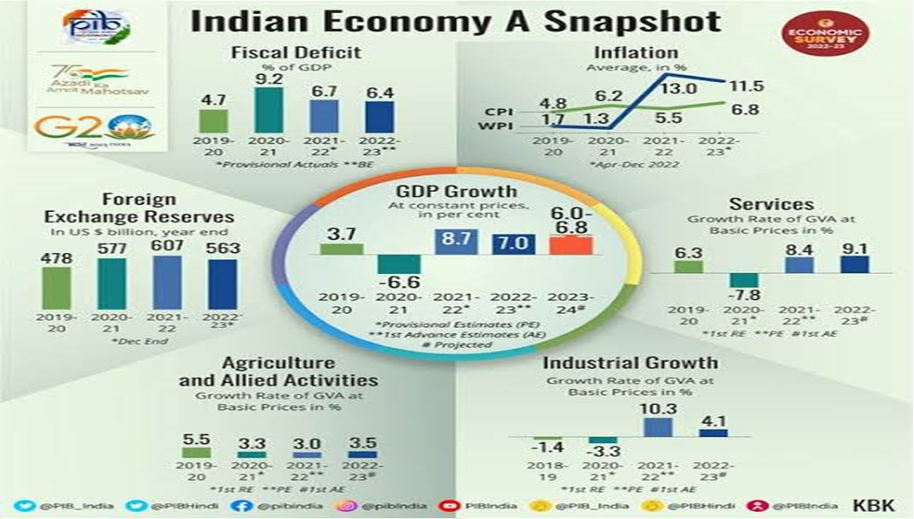

- The IMF’s semi-annual report for October 2023 revises India’s projected GDP growth rate for 2023-24 to 6.3%, a slight increase from the earlier estimate of 6.1%.

- This adjustment is viewed as a vindication of India’s short-term economic management, especially noteworthy as the IMF lowers global GDP growth projections, including for China, to 4.2%.

Source: PIB

Post-COVID Recovery and Challenges

- Acknowledging the global trend, economies most affected during the COVID-19 pandemic, including India, have shown significant recovery.

- Despite India’s GDP contracting by 25.6% in Q2 2020, the recovery raises concerns about employment, inflation, and the quality of recovery, particularly affecting essential food items for the poor.

Geopolitical Underpinnings

- Policymakers are urged to adopt a longer-term perspective, considering the fast-changing geopolitical landscape and its impact on economic policy.

- The end of globalization in the year 2022-23, marked by tectonic shifts in the world geopolitical order, reveals India’s vulnerabilities, especially regarding oil and food shocks.

Rising Deficit with China: Economic Frailty

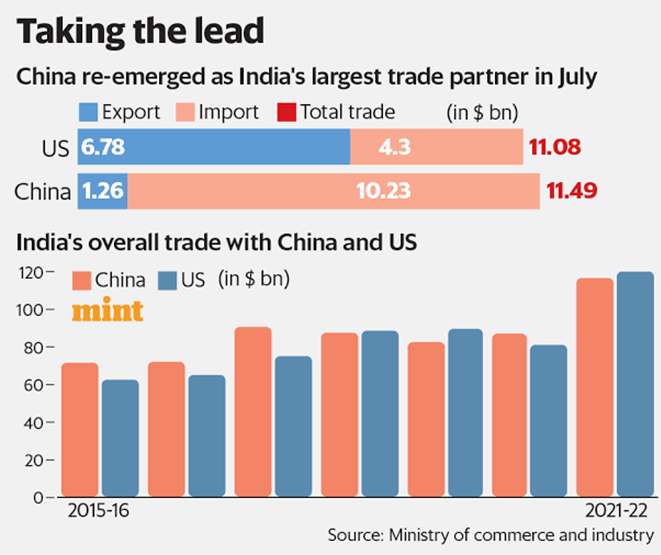

China-India Trade Dynamics

- India’s susceptibility to a soaring deficit with China is a pressing concern for its economic stability.

- Despite initiatives like Atmanirbhar Bharat Abhiyan, the trade deficit with China continues to rise, accounting for 15%-16% of India’s imports and a third of the trade deficit.

Merchandise trade with China and India’s total merchandise trade: (In $ billion)

| Trade deficit with China | India’s total trade deficit | |

| 2014-15 | -48.48 | -137.69 |

| 2015-16 | -52.7 | -118.72 |

| 2016-17 | -51.11 | -108.5 |

| 2017-18 | -63.05 | – 62.05 |

| 2018-19 | -53.57 | -189 |

| 2019-20 | -48.65 | -161.35 |

| 2020-21 | -44.03 | -102,53 |

| 2021-22 | -73.31 | -191.05 |

Source : The Mint

Impact on Industrial Growth

- Structural dependence on Chinese imports of manufactures contributes to a decline in India’s industrial growth rate from 13.1% in 2015-16 to negative 3.5% in 2019-20.

- Industrial growth rates, particularly in capital goods, exhibit an alarming regression over the years, posing challenges to India’s economic recovery.

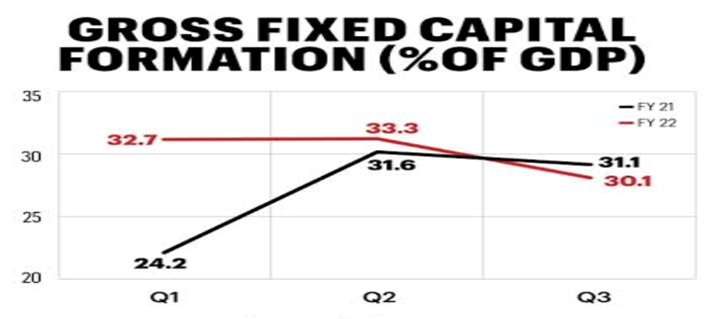

Decline in Capital Formation

- Over a longer period, the gross fixed capital formation to GDP ratio steadily declines from 34.3% in 2011-12 to 28.9% in 2021-22, signalling an unprecedented fall in post-independent India.

- The public sector’s share remains constant at 8%,

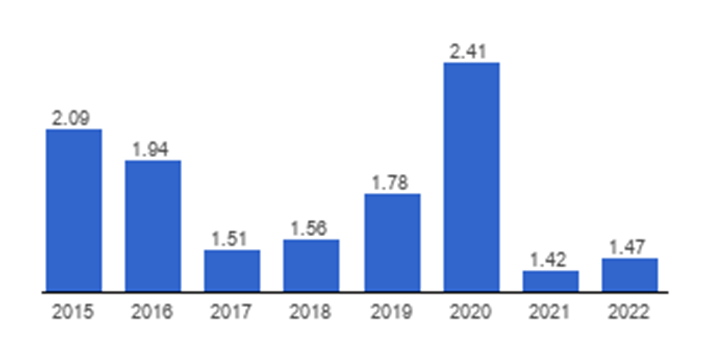

- Net foreign direct investment to GDP ratio decreases from 3.6% in 2008 to 2.4% in 2022.

| Gross Fixed Capital Formation (GFCF) to GDP ratio

· The Gross Fixed Capital Formation (GFCF) to GDP ratio is a financial indicator that measures the proportion of a country’s total economic output (Gross Domestic Product or GDP) represented by its investment in fixed capital assets. · It includes expenditures on machinery, equipment, buildings, and other durable goods used for production. · The GFCF to GDP ratio reflects the extent to which a country is investing in maintaining and expanding its physical capital stock, providing insights into the economy’s capacity for future growth and development. Source: Fortune India |

| Net Foreign Direct Investment (FDI) to Gross Domestic Product (GDP) ratio

· The Net Foreign Direct Investment (FDI) to Gross Domestic Product (GDP) ratio is a financial metric that measures the amount of foreign direct investment a country receives in relation to its overall economic output. · It is calculated by taking the net inflow of foreign direct investment (after deducting outflows) and dividing it by the country’s GDP. · This ratio provides insight into the significance of foreign direct investment relative to the size of the economy, indicating the extent to which foreign capital contributes to the country’s economic activities and growth. FDI as % of GDP Source:globaleconomy.com |

Public Investment and Social Development

Challenges in Public Investment

- The credibility of the optimistic picture painted by official sources regarding public investment growth since FY22 is questioned.

- Public investment, combining the central government, state governments, and the central PSUs, appears to be around 6% of GDP, similar to pre-COVID-19 levels, challenging the perceived boost.

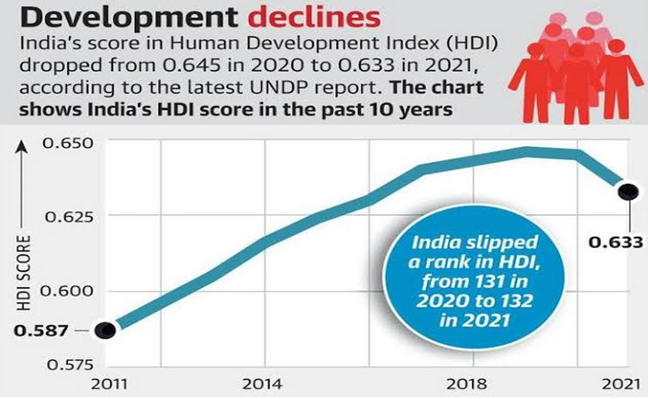

Credibility of Human Development Index (HDI)

- In assessing social development, the Human Development Index (HDI) is considered a more credible measure than other indicators.

- India’s HDI index decreases from 0.645 in 2018 to 0.633 in 2021, with a global rank slip, indicating that other countries have outperformed India in terms of human development.

| Human Development Index (HDI)

· The Human Development Index (HDI) is a composite statistical measure developed by the United Nations to assess and rank countries based on their level of human development. · Introduced by the United Nations Development Programme (UNDP) in 1990, the HDI provides a broader evaluation of a nation’s well-being than purely economic indicators. · Published by United Nations Development Programme (UNDP). · Dimensions: It assesses three key aspects: 1. Health (life expectancy at birth), 2. Education (mean and expected years of schooling), and 3. Standard of living (GNI per capita adjusted for PPP). (Note: GNI per capita is adjusted for PPP to consider the relative cost of living and inflation rates. GNI per capita reflects the average income of a country’s citizens.) · Scoring: HDI values range from 0 to 1, with higher scores indicating better human development. · Categories: Countries are categorized as low, medium, high, or very high development based on their HDI scores. · India holds the 132nd position among 191 countries and territories in the 2021/2022 Human Development Report based on its Human Development Index (HDI). |

Official commentators must engage with critics and acknowledge the gravity of economic setbacks in recent years.

Rather than focusing solely on short-term growth projections, a broader and more realistic assessment is needed to address the strategic threats posed by rising trade deficits, declining industrial growth, and a decade-long decline in fixed investment rates

——————————————————————————————————————————————

——————————————————————————————————————————————

Mains Practice Question:

Despite various government interventions, the Trade deficit with Countries like China is expanding. Examine the persistent vulnerabilities in the Indian Economy exposed by geopolitical shifts and the escalating trade deficit with China.