Empowering Women: Financial Inclusion

Relevance

- GS Paper 2 Welfare Schemes for Vulnerable Sections of the population by the Centre and States and the Performance of these Schemes.

- Tags: #PradhanMantriJanDhanYojana #womenempowerment #financialinclusion #Minteditorial #UPSCMains2024.

Why in the News?

Despite advancements in account ownership through schemes like Pradhan Mantri Jan Dhan Yojana (PMJDY), many women in low-income segments lack awareness and utilization of financial services, hindering their economic empowerment.

Aadhaar-Powered Financial Inclusion

- India’s Aadhaar-based identification system and the Pradhan Mantri Jan Dhan Yojana (PMJDY) have effectively expanded financial inclusion, especially among low-income women.

- This initiative empowers women by granting them secure access to banking services, facilitating transactions, savings, and credit access, ultimately enhancing their financial independence and well-being.

Empowering Women through Account Ownership

- Receiving payments in bank accounts intensifies women’s engagement with financial services, enhancing their savings, borrowing, and fund management capabilities.

- The Global Findex Report 2021 demonstrates that in developing countries, digital payment recipients tend to make digital payments (83%), use accounts for savings (40%), and access formal credit (40%).

- In India, direct benefit transfers into PMJDY accounts hold vast potential for women’s economic empowerment.

- Additionally, employers depositing wages directly into accounts encourages savings and streamlines access to bank financial services.

- However, the report emphasizes that financial literacy is vital, especially for women, to fully leverage the advantages of account ownership while mitigating risks.

Challenges in Financial Literacy

- A survey by Good Business Lab in Karnataka, India, focused on over 900 women working in a garment factory.

- These women held formal salaried positions and received government-mandated minimum wages monthly, with their salaries directly deposited into their bank accounts by their employers.

- The women had an average age of 31 and had completed at least primary education, with many having gone up to the 8th grade or beyond.

Findings of Good Business Lab Survey

Limited Debit Card Usage

- Despite having bank accounts with debit card capabilities, only half of the surveyed women were familiar with using them for ATM withdrawals.

- Even among those aware, fewer than half conducted these transactions themselves.

- Instead, over half relied on family members or trusted individuals for these operations.

Barriers to Digital Transactions

- Factors like fear of losing money, mobility limitations, and a lack of financial control led to women’s reluctance to use digital banking tools.

- Despite 90% of women have smartphone access ,only 15% had ever made UPI or internet banking payments.

Underutilization of Bank Accounts

- The surveyed women not only used their accounts sparingly for payments but also for saving money.

- Only 20% chose to keep their wages in the bank, while 30% preferred keeping cash at home.

- Fewer than 25% utilized formal bank savings options like fixed or recurring deposits.

- Instead, women predominantly favored informal savings groups and semi-formal institutions, such as chit funds, microfinance, or self-help groups, for their savings, highlighting the preference for trusted community-based alternatives.

Limited Formal Credit Usage

- Disparities were evident in the use of formal credit services, as the majority of women preferred borrowing from friends, family, and colleagues, with fewer than 10% having obtained bank loans.

- Disturbingly, their financial resilience was low, with over 50% finding it challenging to access emergency funds of ₹5,000 within 30 days.

- Nearly 85% believed that accessing these funds within a week would be difficult or extremely challenging.

Challenges beyond Account Access

- The low utilization of financial services by salaried women, despite their access to the banking system, raises concerns about the situation for women in informal and rural employment.

To enhance financial empowerment among low-income women, a collective approach involving governments, financial institutions, private employers, and fintech companies is crucial. Additionally, further research is essential for informed policymaking and tailored solutions, ensuring that women are not only aware of financial services but actively utilize them for their economic well-being and resilience.

|

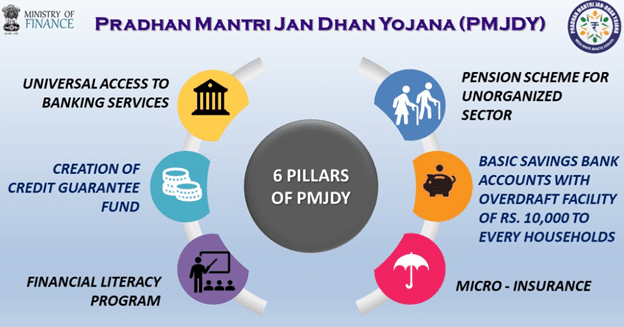

Pradhan Mantri Jan-Dhan Yojana (PMJDY)

Objectives

Key Features

Current Status

|

Source: Livemint

Mains Question

Discuss the impact of India’s Pradhan Mantri Jan Dhan Yojana (PMJDY) in bridging the gender gap in bank account ownership and its significance for women’s financial empowerment.