Cabinet Approves Royalty Rates for Strategic Minerals

Relevance

- GS Paper 1 Distribution of Key Natural Resources across the world.

- Tags: #Rareearthelements #lithium #Royalty #UPSC #UPSCMains2023.

Why in the News?

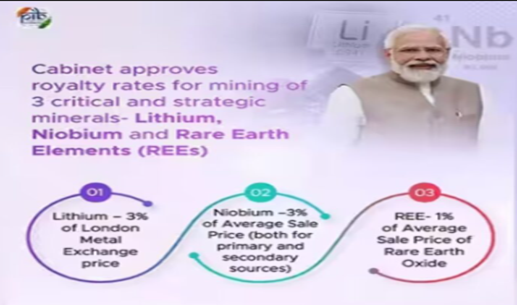

The government has approved royalty rates for the mining of 3 critical and strategic minerals – Lithium, Niobium, and Rare Earth Elements (REEs). These minerals play a vital role in India’s commitment to energy transition and achieving net-zero emissions by 2070.

What are Rare Earths?

- Rare Earth Elements (REEs) encompass a group of 17 chemical elements situated within the periodic table.

- These elements consist of the 15 lanthanides, along with scandium and yttrium.

- Notably, they often occur together in the same ore deposits due to their similar chemical properties.

The approved royalty rates are as follows

- Lithium: The royalty rate for Lithium mining will be 3% of the London Metal Exchange price. This mineral is of particular importance due to its role in energy storage and clean energy technologies.

- Niobium: For Niobium mining, the rate will be 3% of the Average Sale Price. Niobium is a critical element used in various industries, including aerospace and electronics.

- Rare Earth Elements (REEs): The royalty rate for REEs will be 1% of the Average Sale Price of Rare Earth Oxide. REEs are crucial components in advanced technologies, including electronics and renewable energy solutions.

Previous Royalty Rates

- Prior to the amendment, the Second Schedule of the MMDR Act mandated a high royalty rate of 12% of ASP for all minerals

- It not specifically provided a royalty rate, making them non-competitive in the global market.

Mines and Minerals (Development and Regulation) Amendment Act 2023.

- In July of the current year, the Indian Parliament passed the Mines and Minerals (Development and Regulation) Amendment Act 2023.

- A key reform introduced by this Act is the provision for an exploration license, which will include critical minerals.

- The introduction of this exploration license is intended to encourage and incentivize private sector participation in mineral exploration, especially for critical and deep-seated minerals.

- Moreover, the Act delisted six minerals, including Lithium and Niobium, from the list of atomic minerals.

- This change allows private sector companies to obtain concessions for these minerals through the auctioning process.

- The amendment stipulated that mining lease and composite licenses for 24 critical and strategic minerals should be auctioned by the central government.

Alignment with Global Benchmarks

- By amending the Second Schedule of the Mines and Minerals (Development and Regulation) Act, 1957, India’s royalty rates for these minerals have been effectively aligned with global benchmarks.

- This move aims to attract bidders to participate in future auctions, which can be conducted by the central government or states.

Calculation of Average Sale Price (ASP)

- The Ministry of Mines has provided guidelines for calculating the ASP of these minerals, serving as the basis for determining bid parameters.

- The focus is on encouraging domestic mining to reduce imports and establish end-use industries like electric vehicles (EVs) and energy storage solutions.

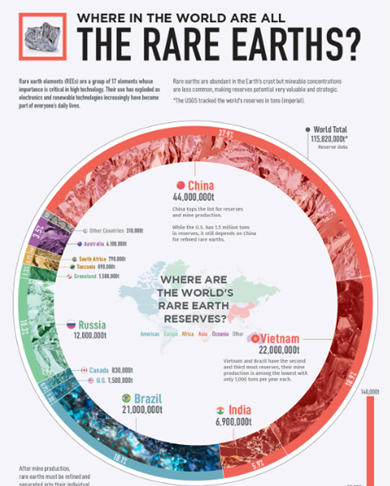

How and Why Does China Dominate the Sector?

- China’s dominance in the Rare Earth sector can be attributed to its early entry into Rare Earth mining in the 1950s.

- However, it remained relatively small-scale until the 1970s when chemist Xu Guangxian devised an effective method for separating Rare Earth elements.

- After the Cultural Revolution ended, China intensified its focus on exploiting its natural resources.

- China’s paramount leader, Deng Xiaoping, recognized the strategic significance of Rare Earth resources in 1992.

- He compared their value to oil reserves in the Middle East, emphasizing the importance of handling Rare Earth resources correctly.

- Since 2010, when China restricted Rare Earth exports to Japan, the US, and Europe, several production units have emerged globally, including in Australia and the US.

- Despite these efforts, China maintains the dominant share in the production of processed Rare Earths.

Challenges in Implementing New Royalty Rates on Critical Minerals

- Global Benchmark Alignment: The new royalty rates aim to align India with global standards.

- Mining Infrastructure: Developing the necessary infrastructure and capabilities for mining lithium, niobium, and REEs may pose challenges, as India currently imports these critical minerals.

- Environmental Concerns: Mining of these minerals, particularly REEs, can have environmental impacts that require careful regulation and mitigation.

- Mining Practices: Ensuring responsible and sustainable mining practices, especially in ecologically sensitive regions, is a challenge.

- Geopolitical Dynamics: The growing strategic importance of these minerals in the context of evolving geopolitical dynamics poses challenges in securing supply chains.

- Resource Exploration: India must invest in resource exploration efforts, including geological surveys and feasibility studies, to identify potential mining sites.

- Market Demand and Prices: The demand and prices for these critical minerals may fluctuate, affecting the financial viability of mining projects.

- Mineral Processing and Value Addition: Developing mineral processing and value addition capabilities is essential to maximize the economic benefits of these resources.

- Skill Development: Preparing the workforce with the necessary skills and expertise for mining these minerals is a long-term challenge.

Impact on Key Sectors

- Strategic Resource Security: The approval ensures a reliable domestic supply of critical minerals, enhancing national resource security.

- Energy Transition Catalyst: This move supports India’s transition to cleaner energy and achieving its net-zero emissions target by 2070, with lithium playing a pivotal role in electric vehicle batteries.

- Economic Growth: Encouraging indigenous mining stimulates economic growth, reducing imports and fostering related industries and infrastructure development.

- Global Competitiveness: By aligning royalty rates with global benchmarks, India becomes more competitive in international markets for these minerals.

- Technological Advancements: These minerals are essential for emerging technologies, including energy storage, healthcare, and advanced transportation, promoting technological advancements.

- Environmental Responsibility: A focus on responsible mining is critical as rare earth elements’ extraction can be environmentally challenging, emphasizing sustainable practices.

- Geopolitical Leverage: Reducing dependence on external sources for these critical minerals enhances India’s geopolitical autonomy and strategic influence.

- Resource Diversification: Diversifying mineral resources contributes to India’s self-reliance and minimizes vulnerabilities in key industries, making it self-sufficient in vital sectors.

Future auctions of these essential minerals will be made possible by the stipulated royalty rates, fostering independence and the development of related companies and infrastructure. This strategic move will promote India’s national security and economic growth while advancing its environmental and energy goals.

|

Types of Rare Earth Minerals The 17 Rare Earths comprise

What are Rare Earths Used For?

|

Source: Indian Express, Livemint, Business Standard, AIR News

Mains Question

Discuss the significance of the Indian Union Cabinet’s recent approval of royalty rates for critical minerals like lithium, niobium, and Rare Earth Elements (REEs). How does this decision impact the country’s mineral resource management and economic development?