The art of letting it be

Monetary Policy Committee is unlikely to cut rates any time soon as global and domestic risks loom large

Relevance

- GS Paper 3 Indian Economy and issues relating to planning, mobilization, of resources, growth, development, and employment.

- Inclusive growth and issues arising from it.

- Tags: #monetorypolicy #MPC #RBI #currentaffairs #upsc.

Why in the News?

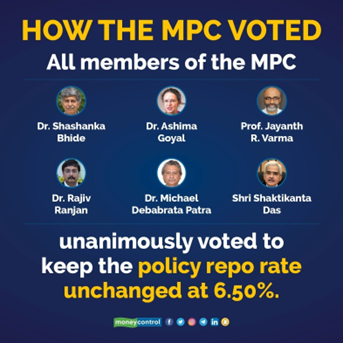

In the realm of monetary policy, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has recently opted to maintain its current interest rate stance.

This decision was reached during the October review meeting, where the committee chose to withdraw accommodation, following a repo rate hike earlier in the year. Amidst both domestic and global uncertainties, this choice underscores the importance of domestic factors and the cautious approach needed to navigate the current economic landscape.

Domestic Factors Trump External Triggers

- While external factors do influence the RBI’s decisions, domestic considerations take precedence. Unforeseen inflation risks, particularly in food prices like tomatoes, emerged early in the fiscal year.

- Although the vegetable price surge has eased, volatile and rising crude oil prices have surfaced as a new concern. Furthermore, the incomplete transmission of previous rate hikes to bank lending and deposit rates has influenced the MPC’s choice to maintain its stance of withdrawal of accommodation.

Global and Crude Oil Price Impact

- External factors, including the hawkish monetary policies of major central banks like the US Federal Reserve and the escalation in crude oil prices, have played a pivotal role in the RBI’s decision-making process.

- Global central banks initially eased monetary policies to combat economic collapse during the COVID-19 pandemic and subsequently had to implement multiple rate hikes to control inflation, a situation more pronounced in advanced economies.

- India, in contrast, has seen a more moderate rate increase. The delicate balance for developed economies lies in avoiding over-tightening that might trigger a recession or insufficient tightening that would allow inflation to persist.

Monetary Policy’s Lagging Effects

- Monetary policy operates with a lag, affecting growth before inflation.

- The US, due to its loose fiscal policy, has experienced slower transmission of rate changes to growth and inflation.

- Consequently, despite the recent softening of inflation, there remains concern about the possibility of a slowdown in the US, rather than its complete avoidance.

Crude Oil Vulnerability and Inflation Concerns

- India’s vulnerability to crude oil price fluctuations is significant, with approximately 85% of its requirements being imported.

- The volatile nature of crude prices presents a risk, as sustained high levels could lead to increased production and transportation costs, thereby driving up headline inflation.

- Furthermore, elevated crude prices can pose challenges to the current account and fiscal deficit while potentially hampering economic growth.

Inflation Outlook and Cautious Optimism

- While headline inflation experienced a spike, policymakers can find some relief in relatively stable fuel and core inflation, with the headline primarily driven by food prices.

- However, concerns persist due to volatile crude oil prices. It’s essential to monitor global demand conditions and potential geopolitical factors, as they can offset any expected weakening in global demand for crude oil.

Growth Projections and Supply Shocks

- India’s economic growth has remained robust despite challenges such as costly crude oil, a weakening rupee, and fluctuating food inflation caused by erratic monsoons.

- Supply shocks continue to be a concern, particularly in categories like cereals, pulses, and spices.

- Agricultural performance in irrigated areas, which heavily rely on the southwest monsoon, can also be affected by suboptimal reservoir levels.

The RBI’s Stance

- Despite the surge in headline inflation, the RBI’s decision-making remains influenced by the relatively stable fuel and core inflation.

- Nevertheless, the vulnerability to crude oil price fluctuations calls for vigilance. The RBI has retained its GDP growth outlook for this fiscal year, but various factors, including global slowdown, domestic rate hikes’ impact, and unpredictable weather patterns, have led to a more cautious economic forecast.

In conclusion, the RBI’s MPC has made a strategic decision to keep interest rates steady, considering both internal and external factors. With uncertainties surrounding inflation, volatile crude oil prices, and global economic conditions, the central bank’s vigilance remains paramount. As supply shocks and challenges persist, the RBI’s stance of withdrawing accommodation is likely to endure, emphasizing the need for a steady and cautious approach in monetary policy.

|

About Monetary Policy Committee (MPC) · Statutory Framework: The Finance Act, 2016, amended the Reserve Bank of India Act, 1934, establishing a statutory and institutionalized framework for the Monetary Policy Committee (MPC). · Constitution: The central government has the authority, under Section 45ZB of the amended RBI Act, to constitute a six-member MPC. · Primary Function: The MPC’s primary role is to determine the benchmark policy rate, known as the repo rate, aimed at maintaining inflation within a predefined target range. · Composition: The MPC consists of six members, including the RBI Governor (as Chairperson), the RBI Deputy Governor responsible for monetary policy, one official nominated by the RBI Board, and three members representing the Government of India. · Tenure: External members of the MPC serve for a four-year term. · Meeting Quorum: A meeting of the MPC requires a quorum of four members, with at least one being the Governor or, in the Governor’s absence, the Deputy Governor, who is also an MPC member. · Decision Process: MPC decisions are made through a majority vote. In the event of a tie, the RBI Governor holds the casting vote. · Binding Decisions: The decisions taken by the Monetary Policy Committee are binding on the Reserve Bank of India, shaping the nation’s monetary policy. |

Sources: Indian Express

Mains Question

“In the context of global economic challenges and emerging market dynamics, critically analyze the role and impact of India’s monetary policy framework in maintaining economic stability. Discuss the key factors influencing the Reserve Bank of India’s monetary policy decisions and their implications for India’s economic growth and inflation management.”