Pharma Sector: Shift Focus From Volume To Value

Relevance

- GS 2: Issues Relating to the Development and Management of Social Sector/Services relating to Health, Education, and Human Resources.

- Tags: #PharmaIndustry #IndianPharmaceuticals #MedicineQuality #MakeInIndia #UPSC #MintEditorial #CurrentAffairs.

Why in the News?

The Indian pharmaceutical industry is a global powerhouse, contributing significantly to healthcare worldwide. To unlock its full potential, a simplified and strengthened regulatory framework is essential.

Indian Pharma’s Global Influence

The Indian pharmaceutical industry is a global powerhouse, significantly impacting worldwide healthcare.

- Pandemic Resilience: During the COVID-19 pandemic, the sector displayed robust manufacturing capabilities, ensuring a continuous supply of high-quality medicines to over 150 countries.

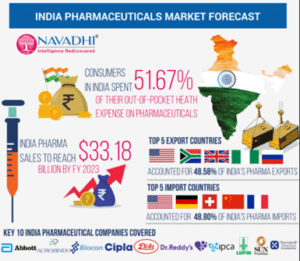

- Global Rankings: India ranks 3rd in global pharmaceutical production by volume and 14th in overall value.

- Innovation Potential: Despite its manufacturing prowess, the industry has significant untapped innovation potential, which accounts for the majority of sector value globally.

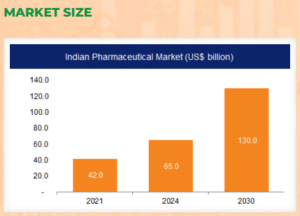

- Growth Projections: Leveraging manufacturing, digital expertise, and a youthful population, India aims to achieve a $120-130 billion market by 2030 and $400-450 billion by 2047.

Research and development (R&D) investment Disparity

- Indian Pharma companies allocate around 8% of their revenues to research and development (R&D), whereas global counterparts typically invest 20-25%.

- Indian government has unveiled a ₹5,000 crore fund through the Promotion of Research & Innovation Scheme.

- These funds aim to establish Centers of Excellence and stimulate private sector research.

- This initiative is crucial for the Indian Pharma industry to move up the value chain and compete effectively on the global stage.

Simplify regulations to drive innovation

- The Indian Pharma industry faces a highly complicated regulatory landscape for research and development (R&D).

- Multiple Regulatory Agencies: The current framework involves numerous regulatory bodies, causing significant delays in approvals for pharmaceutical companies.

- Importance of Simplification: Streamlining these processes is imperative to accelerate the transition from lab to market, ensuring sustainable industry growth.

- Fostering Innovation: Simplification is not only about efficiency but also nurturing innovation within the sector.

Amendment to New Drugs and Clinical Trial Rules

Recent changes reflect India’s commitment to ethical research and innovation.

- Promotion of Alternative Methods: Encouraging computer simulations and test tube studies reduces reliance on animal testing.

- Alignment with Global Trends: These changes align Indian practices with global trends in research.

- Emphasis on Patient Safety: The rules prioritize patient safety and aim to improve clinical research.

- Supporting Industry Growth: These revisions support the pharmaceutical industry’s growth and promote innovation.

Quality Alignment with Global Standards

India should align its regulatory standards with global benchmarks like “International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use” (ICH) “Pharmaceutical Inspection Co-operation Scheme”(PIC), to ensure high-quality pharmaceutical products.

- The New Drugs, Medical Devices, and Cosmetics Bill, 2022: This bill reflects India’s commitment to quality by emphasizing safety, effectiveness, and international compliance.

- Global Best Practices: The bill highlights the need to adhere to global best practices, fostering trust in Indian products worldwide.

- Harmonization for Trust: Alignment with international regulatory bodies will boost trust in Indian producers globally, encouraging vital international collaborations for sector growth.

Maintain an Equitable Pricing Policy

Given the level of competition, India has some of the lowest drug prices in the world.

- Competitive Pricing Landscape: India boasts one of the world’s lowest medicine prices due to intense competition, with over 1,800 subgroups and 55,000 brands, averaging 30 brands per subgroup.

- Moderate Price Increases: In the past three years, medicine prices have seen an annual increase of around 5%, lower than the Wholesale Price Index and Consumer Price Index hikes.

- Competition’s Impact: Despite allowing a 10% price increase for non-scheduled pharmaceuticals, high competition has maintained the average increase at 5%.

- Regulatory Focus: Regulations should prioritize affordable and accessible medicines while ensuring the cost viability of market-needed products.

- Influence on Investments and Innovation: A balanced pricing ecosystem is essential to attract investments and stimulate innovation and quality in the pharmaceutical sector.

“Make in India” to “Discover and Make in India for the world”

- The Indian pharmaceutical sector is knowledge-driven and crucial to the country’s strategic goals.

- India is now widely considered as the “Pharmacy of the world,” with a concentration on high-quality yet reasonably priced medicines.

Policy Stability and Predictability

To unlock the Pharma industry’s potential, stable and predictable policies are crucial.

- Shift to Value Leadership: The sector’s transition from volume to value leadership requires a strong regulatory framework that prioritizes patient-centricity.

- Balancing Access, Affordability, and Innovation: Striking the right balance between access, affordability, and innovation is essential for sustainable growth.

A stable policy environment encourages long-term investments in research and innovation. Collaboration among government, regulators, industry, and academia is vital for realizing the industry’s vision and addressing global patient needs, benefiting the nation’s economy.

Source: Mint

Mains Question

Examine India’s pharmaceutical pricing policy, its impact on innovation and quality, and suggest regulatory strategies for balancing affordability and innovation in the sector?