How to curb irresponsibility.

Our plea is to stop trying to envision better ways of Parliament writing a fiscal responsibility law. New ideas are needed

Relevance

- GS Paper 3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

- Tags: #fiscaldeficit #FRBM #moneybill #currentaffairs #upsc.

Why in the News?

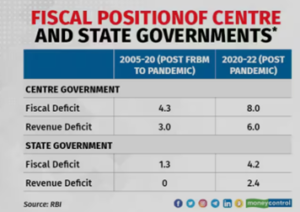

CAG report suggests that targets set by Fiscal Responsibility Act to not met for 5 years. In the realm of fiscal policy, the adage “today’s deficit is tomorrow’s taxation” holds true. The inherent incentives of ruling parties to overspend in the short term with hopes of electoral victory often lead to excessive deficits and their detrimental economic consequences in democracies.

Fiscal Responsibility Laws (FRL) Worldwide

- Countries like Germany have embedded fiscal responsibility into their constitutions with mechanisms like the “debt brake.” In the United States, a statutory debt ceiling limits government borrowing. These examples demonstrate international efforts to address fiscal irresponsibility.

Fiscal Responsibility in India

- In India, the need for fiscal responsibility laws became evident in the 1990s. Article 292 of the Indian Constitution allowed the government to borrow, leading to the creation of the

- Fiscal Responsibility and Budget Management Act, 2003 (FRBM). However, the effectiveness of this law has been questionable, with frequent deviations from its fiscal targets.

The Challenge of Implementing FRBM in India

- The Indian experience with the FRBM Act highlights several challenges. Over the years, budgeted and actual fiscal values have consistently deviated from the original law.

- The frequent amendments to the FRBM Act, often passed as money bills, have delayed the achievement of fiscal targets.

- For instance, deadlines for revenue deficit elimination were repeatedly extended. The money bill route allowed successive governments to dilute the fiscal targets originally set by the FRBM Act.

The Influence of Money Bills

- The mechanism of money bills in the Indian Constitution has significantly interfered with the ability of parliamentary law to restrain fiscal discretion effectively.

- Money bills, passed by the Lok Sabha, contain provisions that can amend any aspect of fiscal responsibility law.

- This approach has been consistently used by governments to amend and dilute fiscal targets, making it difficult for parliamentarians to exercise checks and balances.

The Dominance of Finance Bills

- Finance bills, often introduced as money bills, carry immense weight and influence. The ruling party prioritizes winning approval in the Lok Sabha, where it holds a significant majority, while the Rajya Sabha’s approval is not necessary.

- This dominance allows the Finance Bill to be used as a tool for amending fiscal responsibility laws, even if many parliamentarians disagree with the amendments.

The Anti-Defection Law Dilemma

- Another hurdle arises from the anti-defection law, which prevents Members of Parliament from voting against the party leadership’s wishes.

- In coalition governments, where small parties may have issue-based voting options, the fear of toppling the government through a Finance Bill vote can deter dissenting parties.

- This makes voting down a Finance Bill a risky nuclear option, further diminishing the effectiveness of parliamentary oversight.

Reassessing the Concept of Money Bills

- The core issue lies in the definition of money bills in the Indian Constitution. Regardless of how well-crafted an FRL like the FRBM Act is, the concept of money bills, as defined, remains a formidable obstacle. This constitutional framework limits the ability to modify the basic structure of fiscal responsibility law.

A Call for a New Approach

- In light of these challenges, our plea is to abandon the idea of framing FRLs as parliamentary laws. India requires a paradigm shift towards fiscal institution building that promotes genuine fiscal responsibility.

- While FRLs have their merits, attempting to embed them within parliamentary law appears counterproductive. Fiscal thinkers must revisit the drawing board, recalling the discussions of 2001, and embark on a fresh journey of innovative ideas.

In conclusion, India’s fiscal responsibility laws need a new approach. The dominance of money bills, the anti-defection law, and the ease with which fiscal targets can be amended have hindered the effectiveness of existing FRLs. It’s time to explore alternative avenues that can truly promote fiscal responsibility in the country.

| Key Points about the FRBM Act

1. Enactment Date: The Fiscal Responsibility and Budget Management (FRBM) Act was enacted in August 2003. 2. Objective: The primary aim of the FRBM Act is to make the Central government accountable for ensuring inter-generational equity in fiscal management and maintaining long-term macro-economic stability. 3. Debt and Deficit Limits: The Act sets limits on the Central government’s debt and deficits to promote fiscal discipline. 4. Fiscal Deficit Cap: It restricts the fiscal deficit to 3% of the Gross Domestic Product (GDP). 5. State Fiscal Responsibility: The 12th Finance Commission recommended that states enact similar laws to ensure financial prudence. States have since adopted their own Financial Responsibility Legislation, with a 3% cap on annual budget deficits relative to Gross State Domestic Product (GSDP). 6. Transparency: The Act mandates greater transparency in the Central government’s fiscal operations and requires fiscal policy to be conducted within a medium-term framework. 7. Medium-Term Fiscal Policy Statement: The Union government’s Budget includes a Medium Term Fiscal Policy Statement that outlines revenue and fiscal deficit goals over a three-year period. 8. Rules and Amendments: Rules for implementing the Act were notified in July 2004 and were later amended, with the most recent target set at 3.1% for March 2023. 9. NK Singh Committee Recommendations: The NK Singh committee, established in 2016, recommended fiscal deficit targets of 3% of GDP by March 2020, 2.8% in 2020-21, and 2.5% by 2023. Relaxation under the FRBM Act Escape Clause Under Section 4(2) of the Act, the Central government can exceed the annual fiscal deficit target under specific circumstances, including: – National Security and War: In the event of national security threats or war. – National Calamity: During national calamities, such as natural disasters. – Agricultural Crisis: In the case of a collapse in agriculture. – Structural Reforms: To facilitate structural reforms in the economy. – Economic Downturn: If there is a decline in real output growth of a quarter by at least three percentage points below the average of the previous four quarters. – COVID-19 Pandemic: The lockdown and economic impact of the COVID-19 pandemic can be considered as a national calamity, providing a basis for relaxation under the Act.

|

| Sources: The Indian Express

Mains Question “In light of the challenges posed by repeated legislative amendments to fiscal responsibility laws in India, analyze the effectiveness of fiscal institution building as an alternative approach to ensure fiscal responsibility. Provide insights into the advantages and disadvantages of this approach while considering the broader implications for fiscal governance in the country.” 250words. |