A Less Taxing Time

Relevance

- GS 3: Indian Economy and issues relating to Planning, Mobilization of Resources

- Tags: #IndianEconomy #GST #TaxBaseExpansion #TaxReforms #IncomeTax

Why in News?

India’s fiscal landscape and tax policies have undergone notable changes, including an expansion in the tax base. However, the impact on the tax to GDP ratio remains a crucial consideration.

Expanding Taxpayer Base: A Surprising Trend

- Before almost every budget, the government typically claims it can’t spend much due to limited tax income.

- However, there has been a surprising increase in both direct and indirect taxpayers, challenging the notion that only a small portion of society pays taxes.

- This growth in taxpayers has occurred during a period of slower and uneven economic growth.

- While this expansion should logically result in a higher tax-to-GDP ratio, which would allow more government spending on public services, tax cuts (including GST) and pandemic related disruptions have curtailed the fiscal benefits of having more taxpayers.

Conscious Shift to Low Taxes

- The relatively stable tax-to-GDP ratio results from a deliberate choice to adopt a low-tax approach.

- Whether driven by ideology or politics is debatable.

- However, this policy shift has transferred more responsibility to the private sector, reducing government resources for development goals

Expanding Taxpayer Base: Notable Growth

- Between 2014-15 and 2022-23, the number of tax-paying companies increased by 43%, reaching 10.7 lakh.

- Individual taxpayers also grew by 65%, rising from 5.38 crore to 8.9 crore, with a significant proportion being small taxpayers with incomes below Rs 5 lakh.

Rising Indirect Taxpayers: A Parallel Trend

- Similar patterns are evident in indirect taxation. As of June 2023, active GST taxpayers increased to 1.4 crore, up from 1.2 crore in 2019.

- Around 80% of these taxpayers are proprietorships, with an additional 10% being partnerships.

- These two categories primarily pushed the expansion of the taxpayer base.

- Smaller businesses have an incentive to register under GST as it allows them to benefit from input tax credit.

- This growth in the indirect tax net potentially contributed to the increase in direct taxpayers as well, reflecting interconnected trends in tax compliance and formalization.

Rising Formalization of Firms and Taxpayers

- The country has approximately 4 crore establishments, and this data suggests that at least 22% of them are operating as formal entities, paying some form of taxes.

- In contrast, even though the number of individual taxpayers surpasses the contributing members of the Employee Provident Fund Organization (EPFO), the share of the formal labor force is probably lower in comparison.

- Nonetheless, it does indicate that income taxpayers are no longer limited to a small segment of the workforce, signifying a broader formalization trend among businesses and taxpayers.

Factors behind Tax Base Growth

- As the economy expands, more businesses open up shop, more people join the labor force, and more formal sector employment are generated, which naturally results in an increase in the tax base.

- In addition, the increased formalization of the economy is believed to have contributed by making tax avoidance or evasion more difficult to execute.

- The fact that the tax rates were lowered during this time may have also contributed, but it also meant that the tax to GDP ratio didn’t increase proportionately to the growth in the tax base.

Corporate Tax Cut Impact

- The government stated in September 2019 that the corporation tax rate for current businesses will decrease from 30% to 22%.

- In general, that equates to a reduction of roughly 25% (although it varies in terms of effectiveness).

- According to the government, this resulted in a revenue loss of Rs. 1.28 trillion in 2019–20 and Rs. 1 trillion in 2020–21 (ignoring the impact of the lack of exemptions under this system).

- In 2018–19, the corporation tax as a percentage of GDP was 3.5%. It had decreased to about 3.1% by 2022–2023.

Personal Income Tax Changes

- In the 2019 interim budget, the government offered full tax rebates for individual taxpayers with taxable income up to Rs 5 lakh.

- This contributed to a rise in the personal income tax-to-GDP ratio from 2.5% in 2018-19 to 3% in 2022-23.

- However, the number of individuals with zero tax liability also increased, from 2.9 crore in 2019-20 to 5.16 crore in 2022-23.

- Recent tax structure changes, including a rebate limit increase to Rs 7 lakh, may further raise the number of individuals with no tax liability, potentially limiting the benefits of an expanded taxpayer base.

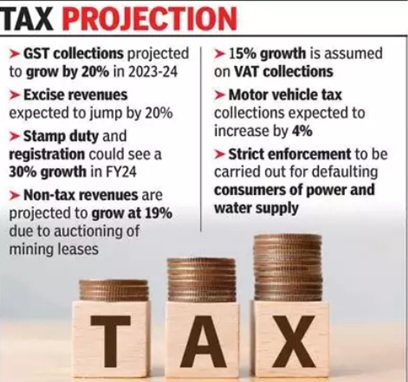

GST Rate Trends

- The Subramanian committee initially suggested a revenue neutral GST rate of 15.5%.

- However, the weighted average GST rate dropped from 14.4% during the transition to 11.6% in 2019 due to tax reductions in November 2017 and December 2018, as per an RBI report.

Stable Tax Collections Despite Rate Cuts

- Despite tax rates being reduced by roughly 25%, tax collections have stayed relatively stable.

- In 2016-17, indirect tax collections were around 6.3% of GDP, and by 2022-23, GST collections had increased to 6.6% of GDP.

- Excluding compensation cess revenue, collections stood at 6.2%.

Estimating the exact impact of these tax cuts on revenue is challenging, but they do seem to improve India’s financial stability. As the economy grows and shifts towards becoming an upper-middle-income nation with a larger organized sector, tax collections should increase further. This will provide the government with more room to increase its spending if it wants to, It’s important not to waste these gains by giving away excessive benefits.

Source: Indian Express.

Mains Question

Discuss the trends in the tax base expansion in India over the past few years and its impact on the tax-to-GDP ratio. Analyze the factors contributing to this expansion and its implications for government revenues?