Time to put a price on carbon emissions

Context: In the absence of a price for the use of natural resources such as air and forests, environmental destruction has been part of every country’s recipe for boosting GDP growth. It has led to relentless emission of carbon, causing runaway climate change.

Ways of pricing

- Three ways of pricing carbon are:

- The establishment of a carbon tax domestically, as in Korea and Singapore

- The use of an emissions trading system (ETS), as in the European Union (EU) and China

- The application of an import tariff on the carbon content, as the EU is proposing.

- Some 46 countries price carbon, although covering only 30% of global greenhouse gas (GHG) emissions, and at an average price of only $6 a ton of carbon, a fraction of the estimated harm from the pollution.

- The International Monetary Fund has proposed price floors of $75, $50, and $25 a ton of carbon for the United States, China, and India, It believes this could help achieve a 23% reduction in global emissions by 2030.

- The economy-wide benefits of carbon pricing in terms of damages avoided plus revenue generation generally outweighed the cost it imposed on individual industries in the EU, British Columbia, Canada, and Sweden.

- A key dynamic is that carbon pricing, by signalling a price for cleaner air, makes investment in renewable energy such as solar and wind, which has huge prospects in India, more attractive.

Impact on India

- Among the three ways of pricing, India could find a carbon tax appealing as it can directly discourage fossil fuels, while raising revenues which can be invested in cleaner sources of energy or used to protect vulnerable consumers.

- It could replace the more inefficient scheme of petroleum taxes which are not directly aimed at emissions.

- India could start with the IMF figure of $25 a ton. The main obstacle is the argument by industrial firms about losing their competitive advantage to exporters from countries with a lower carbon price. It would stand to reason, therefore, for all high, middle and low-income countries to set the same rate within each bracket.

- It might also make sense to allow companies to use high-quality international carbon credits to offset up to a certain percentage of their taxable emissions.

- The EU excludes transport, where higher costs would have been passed on to consumers directly, Singapore provides vouchers for consumers hit by utility price rise, and California uses proceeds from the sales of carbon permits partly to subsidise purchases of electric cars.

- Some make a case for exempting “emission intensive trade exposed” enterprises from the carbon tax, but output-based rebates would be superior ways of doing the same.

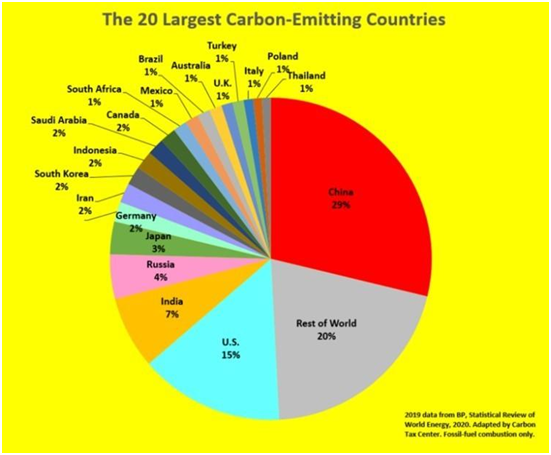

A high enough carbon tax across China, the U.S., India, Russia, and Japan alone (more than 60% of global effluents), with complementary actions, could have a notable effect on global effluents and warming. it could also pave the way to seeing decarbonisation as a winning development formula. as carbon pricing gains acceptance, the first movers will be the most competitive. India, as president at the G-20 summit this September, can play a lead role by tabling global carbon pricing in the existential fight against climate change.

| Practice Question

1. What are the ways of carbon taxing? Do you think it is a viable way to solve the climate issue? |