Small Saving Scheme

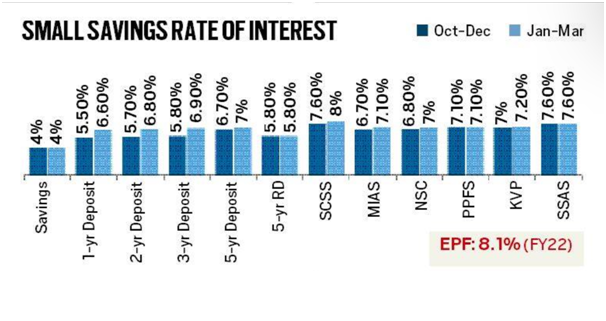

Context: The Finance Ministry in the previous week hiked the interest rates for some small savings schemes by 20-110 basis points for the January-March quarter.

What are small Saving Schemes?

- Small Savings Schemes are a set of savings instruments managed by the Union government with an aim to encourage citizens to save regularly irrespective of their age.

- They provide returns that are commonly higher than bank fixed deposits but also come with sovereign assurance and tax benefits.

- The Finance Ministry reviews the interest rates on small savings schemes on a quarterly basis and sets interest in line with the movement in benchmark government bonds of similar maturity.

- The deposits obtained under various small savings schemes are pooled in the National Small Savings Fund.

- This money is used by the central government to finance its fiscal deficit.

Types of Small Saving Scheme

- The schemes can be grouped into three types-

- Post office deposits (Under this, there are savings deposit, recurring deposit and time deposits with 1, 2, 3 and 5 year maturities and the monthly income account)

- Savings certificates (National Savings Certificate and the Kisan Vikas Patra)

- Social security schemes (Public Provident Fund, Sukanya Samriddhi Account and Senior Citizens Savings Scheme)

Why rise in the Small Saving Scheme ?

- Last year retail Inflation rate breached the mandated government limit(6%) in most of the months, the hike in the small savings rate is seen as critical to safeguarding the interest of savers, especially senior citizens. .

Are the hikes sufficient?

- People who have invested in these schemes are concerned about the real rate of return on their investments in small savings schemes.

- Savers have a low real rate of return if both inflation and interest rates are high,

- Retail inflation rate has remained above 6 percent most of last year, easing only a bit in November to 5.88 per cent.

- Reserve Bank of India on the other hand has hiked the key policy rate by 225 basis points, with the repo rate now at 6.25 per cent.

- Most small savings schemes, till the beginning of the previous quarter, were fetching less than 6 percent interest rate.

- An increase in rates on certain instruments is good news for investors of small saving instruments as except for PPF, Sukanya Samriddhi Yojana and senior citizens’ savings schemes, all others are currently fetching negative real returns.

What Choice do investors have?

- Declining inflation and interest rates will provide a boost to equities. Those individuals who are comfortable with equities should invest in them when it comes to saving for retirement.

| Sukanya Samriddhi Yojana

● The Sukanya Samriddhi Accounts were launched in 2015 under the Beti Bachao Beti Padhao campaign launched exclusively for girl children. ● Such an account can be opened in the name of a girl child below the age of 10 years. ● The scheme guarantees a return of 7.6% per annum and is qualified for tax advantages under Section 80C of the Income Tax Act. ● The term of the deposit is 21 years from the date of opening of the account and a maximum of Rs 1.5 lakh can be invested in a year. |

| Practice Question

What are small Saving Schemes? How inflation impacts their yield? |