RBI’s Vigilance against Illegal Loan Apps

Relevance

- GS Paper 3 Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

- Tags: #NBFC #RBI #Digitallending #banking #Liveminteditorial #UPSCMains2024

Why in the News?

The rise of illegal loan apps in India has prompted discussions between the Ministry of Electronics and Information Technology (MeitY), the Ministry of Finance, and the Reserve Bank of India (RBI).

Collaborative Efforts to Tackle Predatory Loan Apps

- Officials from the Ministry of Electronics and Information Technology (MeitY) recently met with their counterparts from the Ministry of Finance and Reserve Bank of India (RBI) to address the growing menace of illegal loan apps.

- They considered implementing additional KYC-like measures for regulated entities (REs) like banks and non-bank finance companies (NBFCs) to oversee their digital lending partners.

- The urgency arises from a BBC documentary that exposed the harmful practices and tragic consequences of these apps, including at least 60 related suicides.

Holistic Approach to Digital Finance Oversight

- While efforts like KYC are important, a comprehensive approach may be more effective in supervising digital finance, with the RBI playing a central role.

- The RBI Working Group on Digital Lending proposed the establishment of the Digital India Trust Agency, an independent body responsible for verifying digital lending apps, maintaining a register of authorized apps, and ensuring compliance.

- However, this proposal was not implemented.

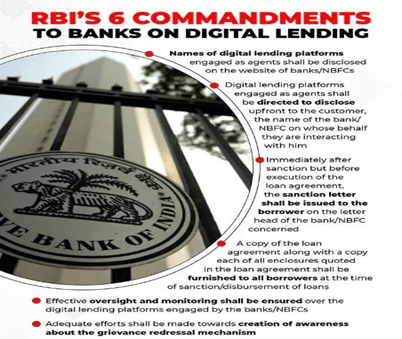

- The RBI issued digital lending guidelines and collaborated with app stores, but these actions shifted oversight responsibility to other parties, distancing the RBI from direct supervision.

RBI’s Direct Role in Digital Supervision

- Banks, NBFCs, and mainstream app stores are essential allies for the RBI in regulating digital lending.

- RBI should take a more direct role in enabling these actors to ensure that unauthorized lending entities do not appear on app stores.

- Collaboration with these stakeholders can enhance digital supervision and protect consumers from illegal loan apps.

First – RBI’s Need for Standardized Proof-of-Partnership

- RBI should establish a standardized and comprehensive proof-of-partnership requirement between digital lenders and regulated entities (REs).

- The current approach, where Regulated Entities (RE) list partner apps on their websites, lacks clarity, putting undue responsibility on app stores.

- Given the vast number of apps, achieving flawless screening is a daunting task.

- For instance, Google Play scans 125 billion apps daily for security risks.

- Standardized proof-of-partnership is an essential necessity since there is also a chance that app stores would mistakenly disable legal apps during their testing process.

Second – Securing Proof-of-Partnership: Preventing Tampering

- To strengthen the oversight, the RBI should establish measures to ensure that proof-of-partnership cannot be tampered with.

- Traditional KYC procedures alone are insufficient to deter fraudulent actors from mimicking legitimate lenders.

- The diverse landscape of banks and NBFCs provides ample room for misrepresentation, making it essential to develop tamper-proof systems for verifying lender-app partnerships.

Third – Blockchain for Transparent Partnership Validation

- Blockchain technology, with its decentralized and immutable transaction ledger, offers an ideal solution for validating partnership certificates in digital lending.

- Regulated entities (REs) can issue standardized certificates to partner apps, each assigned a unique identity traceable within the blockchain.

- RBI could manage this private blockchain, with REs as active participants, allowing restricted access to entities like app stores designated by MeitY.

- Such a system ensures the security and integrity of proof-of-partnership, enhancing regulatory oversight in digital lending.

Fourth – Inclusive Participation in Oversight

- RBI should expand participation in partnership validation.

- Public bodies operating under statutory instruments separate from the RBI Act and state-level institutions involved in lending through digital apps should join the blockchain network, enhancing regulatory collaboration and oversight.

Fifth – Fostering a Responsible Borrowing Culture

- In addition to regulatory measures, promoting a responsible borrowing culture through consumer awareness campaigns is essential.

- It’s vital to educate the public about the mechanics of financial fraud and the risks of unauthorized loan apps, similar to the ‘Jago Grahak Jago’ initiative.

- This collective societal effort complements institutional mechanisms in ensuring digital safety in lending practices.

RBI’s Role in Digital Lending Regulation

- It is important to acknowledge the progress India has made in the digital financial sector under the supervision of the RBI as we consider the difficulties associated with digital lending.

- With 46% of all real-time payments done globally in 2022 originating in India, the nation has seen extraordinary development in retail payments.

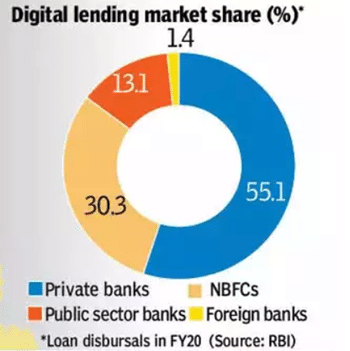

- Nearly 73 million loans were disbursed in the digital lending industry in 2022–2023, demonstrating its impressive expansion.

RBI cannot afford to avoid regulating new digital services, even while these accomplishments highlight the extraordinary progress that has been made in financial inclusion. To safeguard the citizens of India, it has to overcome its lethargy and take the lead as the central regulator.

|

Digital Lending in India

Factors contributed to the growth of digital lending in India

Challenges

Regulatory Framework

|

Source: Livemint

Mains Question

Discuss the rising challenges posed by illegal loan apps in India and the threats they pose to consumers. What role can the Reserve Bank of India (RBI) play in mitigating these challenges?