The question of sustainability of India’s old pension scheme

Relevance

- GS Paper 2 Important aspects of governance, transparency and accountability, e-governance, applications, models, successes, limitations, and potential; citizens charters, transparency & accountability and institutional and other measures

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Tags: #OPS #NPS # #currentaffairs #upsc

Why in the news?

The Old Pension Scheme (OPS) is in the news because several Indian states have recently restored it for their employees, while the central government has refused to do so. This has led to demands from employees’ unions and opposition parties for the OPS to be reinstated nationwide.

India’s Demographic Advantage

- India boasts a youthful population, with a median age of 27.

- The working-age group is growing 1% faster than the overall population. With 1.4 billion people, this results in a continually expanding workforce.

- India’s growth prospects are rooted in this demographic advantage, fostering a cycle of productivity, consumption, investment, and taxation.

Favorable Dependency Ratio

- India’s dependency ratio, especially in fiscal aspects, is advantageous.

- A lower dependency ratio of working-age individuals to retired persons implies reduced per-capita taxpayer burdens.

- This holds immense significance when assessing the fiscal implications of sustaining retired citizens via social security initiatives.

Contrast with OECD Economies

- In many OECD (Organization for Economic Co-operation and Development) economies, individuals become eligible for old-age benefits at the age of 65 under their respective social contracts. These economies employ a pay-as-you-go system where the working youth supports retirees.

- In India, only 11% of the elderly benefit from government pensions (central or state). Most Indian seniors rely on notably smaller pension schemes. Historically, India’s pension system also operated on a pay-as-you-go basis funded by government revenues.

Old Pension scheme: A Historical perspective

- In the 1990s, it became evident that the guaranteed pension scheme was unsustainable.

- Government employees received 50% of their last salary as a Defined Benefit (DB) pension, adjusted periodically for inflation as dearness allowance.

- Increasing longevity meant retirees received pensions for extended periods, leading to a higher number of pensioners than active employees.

- Continuing the DB scheme from current revenues would strain finances, resulting in mounting fiscal deficits and debt.

- To manage fiscal challenges, the government had to reduce spending in areas like health, education, and capital investments.

- Thus, India shifted from government-funded defined benefits to a joint employee-employer monthly savings approach.

New Pension Scheme (NPS): A Transition from OPS

- Similar to the Mutual Fund industry’s Systematic Investment Plans (SIPs), India’s joint employee-employer monthly savings approach grows the corpus over time and retirees can have a good amount at retirement.

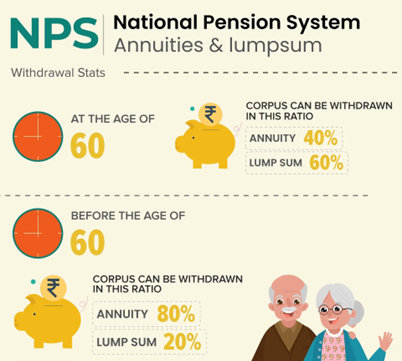

- At retirement, up to 60% of this corpus can be encashed, while the rest 40% is converted into a monthly pension through annuity.

- The Defined Contribution (DC) scheme, adopted in 2004 for government employees, depends partially on stock market returns.

- Importantly, it doesn’t impose a fiscal burden on the government post-retirement, offering a sustainable approach.

Problem with transition

- The governments have to make payments to both DB pensioners and a small fraction of DC retirees, leading to significant differences in pension amounts.

- The absence of incentives for transition during the 2004 pension reform has caused unrest among the DC beneficiaries.

- Some states have returned to DB, igniting a political debate.

- A recent Reserve Bank of India report highlights the fiscal risks of reverting to DB.

- Election season has intensified this debate, with opposition parties promising to return to the old scheme.

Benefits of DC scheme

- It frees up fiscal resources for research, innovation, infrastructure, healthcare and national security.

- It grows along with our capital markets over a long period of time.

Alternative

A hybrid approach, like the one initiated in Andhra Pradesh, could gradually transition new recruits away from DB, ultimately leading to a DC-based system.

Way forward

- The debate should shift from old-versus-new pension to defined benefit versus defined contribution.

- Defined benefit systems entail substantial and uncertain fiscal burdens.

- In contrast, defined contribution systems have no post-retirement costs to the government and offer reasonably predictable steady pension income.

- Thus, transcending to new schemes should purely be by fiscal sustainability and financial predictability aspects.

|

Old Pension Scheme in India The Old Pension Scheme in India, also known as the Defined Benefit Pension Scheme, was a traditional pension system that was prevalent for government employees till 2004. Key provisions ● Defined Benefit: Under this scheme, government employees were entitled to a predetermined pension amount after their retirement. ○ The pension was typically calculated based on the average of the last few years’ salary and the number of years in service. ● Guaranteed Pension: The old pension scheme offered a guaranteed pension amount to retirees, providing them with financial security during their post-retirement years. ● Pension Commutation: Employees had the option to commute a part of their pension to receive a lump sum amount at the time of retirement, while the remaining portion continued as a monthly pension. ● Family Pension: In case of the demise of the government employee, the spouse or eligible dependents were entitled to a family pension, ensuring financial support to the family. New Pension Scheme (NPS) The New Pension Scheme, also known as the National Pension System, was introduced in India in 2004 with the aim of modernizing the pension system and making it more sustainable. Key provisions ● Defined Contribution: Unlike the old pension scheme, where the pension amount was predetermined, the NPS is a defined contribution scheme. ○ Employees and employers contribute a fixed percentage of the employee’s salary to their NPS account, which is invested in market instruments. ● Individual Accounts: Each employee has an individual NPS account, and the retirement corpus depends on the contributions made over the years and the returns earned on investments. ● Portability: The NPS is highly portable, allowing individuals to carry their pension account across jobs and locations, providing flexibility and continuity in pension contributions. ● Choice of Investment: NPS subscribers can choose between various investment options, including equity, corporate bonds, and government securities, providing them with control over their investment strategy. ● Annuity Options: At the time of retirement, NPS subscribers can use their accumulated corpus to purchase an annuity plan, which provides a regular pension income. This annuity offers flexibility in choosing the pension payout structure. |

Difference between OPS and NPS

| Aspect | Old Pension Scheme (OPS) | New Pension Scheme (NPS) |

| Pension Calculation | Defined Benefit | Defined Contribution |

| Pension Amount | Predetermined | Variable, depending on investments |

| Contribution | Fixed, by the government | Employee and employer contribute |

| Investment Component | None | Invested in market-based funds |

| Portability | Limited, transfer to another govt. job | Highly portable across sectors |

| Voluntary Contributions | Not allowed | Allowed, enhancing retirement corpus |

| Annuity Options | Limited choices | Wide range of annuity providers |

| Risk of Returns | Government bears | Employee bears investment risk |

| Flexibility | Limited | More flexibility in investment |

Source: Livemint, Business Standard.

Mains Question

In the context of India’s pension system, critically analyse the transition from the old scheme to the new one. Discuss its implications for fiscal sustainability and retirement security.