The Gig Economy.

Relevance

- GS Paper-2 Govt Policies

- Tags: #upsc #gigeconomy #rajasthanbill #registrationandwelfare.

Why in the news?

The Rajasthan Assembly recently passed a significant Bill aimed at extending social security benefits to gig workers.

- This bill aims to address the lack of protection and benefits for gig workers, who were previously classified as “partners” rather than employees in companies like Ola, Uber, Swiggy, Zomato, and Amazon.

- Earlier, the Code on Social Security, 2020 mandated social security funds for gig workers, including life, disability, health benefits, and more.

What is the Rajasthan Platform-Based Gig Workers (Registration and Welfare) Bill, 2023?

- The Rajasthan Platform-Based Gig Workers (Registration and Welfare) Bill acknowledges the significant contributions of gig workers to the economy and aims to provide them with essential protection and support.

- The primary objective of this bill is to extend social security and welfare benefits to gig workers operating in the state.

Key Features

Registration of Gig Workers:

-

- The bill mandates the registration of all gig workers with the state government to bring them under the ambit of labor regulations.

- The state government will maintain a comprehensive database of all gig workers operating in Rajasthan.

- Each gig worker will be assigned a unique ID, which will facilitate tracking their employment history and entitlements.

Access to Social Security Schemes:

-

- Gig workers will be granted access to a range of social security schemes.

- These schemes may include health insurance, accident coverage, and other welfare measures to provide financial support during emergencies.

Grievance Redressal Mechanism:

-

- The bill ensures that gig workers have the right to be heard and address any grievances they may have.

- This provision seeks to protect the rights of gig workers and provide them with a platform to resolve work-related issues.

Establishment of Platform-Based Gig Workers Welfare Board:

-

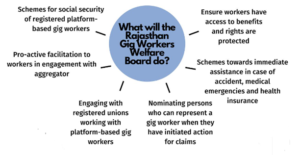

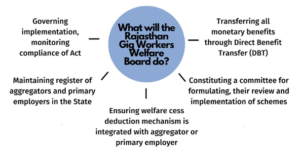

- This board will be responsible for overseeing the welfare and rights of gig workers in the state.

- Welfare Board — comprising State officials, five representatives each from gig workers and aggregators, and two others (“one from Civil Society and another who evince interest in any other field”).

- At least one-third of the nominated members should be women.

- This representation aims to ensure that the interests of both parties are considered when making decisions related to welfare and regulation.

Platform-Based Gig Workers Fund and Welfare Fee:

-

- The bill introduces a “Platform-Based Gig Workers Fund and Welfare Fee” to finance the social security measures for gig workers.

- The fund will be utilized to provide financial support and welfare benefits to gig workers during challenging times.

Fee Levied on Aggregators:

-

- Aggregators will be required to pay a fee for each transaction involving a platform-based gig worker.

- The specific percentage of the fee will be determined by the state government to contribute to the welfare fund.

Penalties for Non-Compliance:

-

- The bill includes provisions for penalties in case of non-compliance by aggregators.

- Aggregators failing to pay the welfare fee on time will be charged an interest rate of 12% per annum from the due date.

- The state government can impose fines of up to Rs 5 lakh for the first contravention and up to Rs 50 lakh for subsequent violations of the Act by aggregators.

Given that the SS Code has conferred the State Government with the duty to formulate social security schemes for gig workers the inter-play between the SS Code and the Bill remains to be seen. It is possible that the rules to be formulated under the Bill address this aspect and any potential overlaps and conflicts with the SS Code are reconciled.

- Rights of registered platform-based gig workers: Platform based gig workers will have the right of access to general and specific social security schemes, opportunity to raise grievances, and participation in all decisions taken for their welfare.

- Central Transaction Information and Management System (CTIMS): The Bill envisages establishing a CTIMS for monitoring and tracking payments made on the platform include details of welfare fee collection. CTIMS will be administered and monitored by the Board. This system will ensure transparency.

- Interest and Penalty: There is a penalty prescribed if any aggregator fails to pay the welfare fee within time which is a simple interest of 12 per cent per annum from the date on which such payment is due. If any other provisions of the Act are violated by the aggregators, the Bill empowers the State Government to impose steep penalties in terms of fine up to INR 5 lakh for the first contravention and up to INR 50 lakh for subsequent contraventions.

Issues faced by gig workers:

- Lack of Social Security: Gig workers often lack access to traditional employee benefits such as health insurance, retirement plans, paid leave, and unemployment benefits. This leaves them financially vulnerable during times of illness, injury, or economic downturns.

- Income Instability: Gig work can be unpredictable, resulting in irregular income streams. Gig workers may face financial uncertainty due to fluctuations in demand for their services, making it challenging to plan for the future.

- Exploitative Practices: Some digital platforms or employers may engage in exploitative practices, such as unfair wages, arbitrary account deactivations, and a lack of transparent policies. Gig workers may have limited recourse to address such issues.

- Lack of Legal Protections: Gig workers are often classified as independent contractors, not employees, leaving them without the same legal protections and rights afforded to traditional employees.

- Work-Life Imbalance: While gig work offers flexibility, it may also lead to difficulties in setting boundaries between work and personal life, resulting in work-life imbalance and potential burnout.

- Limited Skill Development: Gig workers may face barriers to skill development and upskilling opportunities, which could hinder their professional growth and earning potential.

- Access to Finance: Gig workers may face challenges in accessing financial services such as loans and credit, as they often lack a stable income and formal employment records.

Who are Gig Workers?

- A ‘gig worker’ is currently defined as someone who “earns from such activities outside of the traditional employer-employee relationship and who works on a contract” for various platforms or aggregators, such as Swiggy, Zomato, Ola, Uber, Urban Company, etc.

- Gig workers are different from regular employees, as they have flexible work hours and multiple sources of income.

- They are paid on the basis of the tasks or services they complete, rather than on a monthly or hourly basis.

- Gig workers provide various services, such as food delivery, ride-hailing, home services, e-commerce, content creation, graphic design, web development, etc.

- They use their own devices, vehicles, and tools to perform their work.

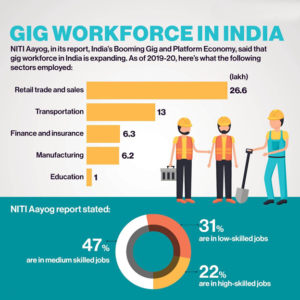

- Gig workers are estimated to be around 15 million in India, according to a report by Boston Consulting Group and Michael & Susan Dell Foundation. They are expected to grow to 90 million by 2028.

- A Gig economy is a free market system in which temporary positions are common and organizations contract with independent workers for short-term engagements.

Who is ‘Aggregator’.

- An ‘Aggregator’ is defined as “a digital intermediary for a buyer of goods or user of a service to connect with the seller or the service provider, and includes any entity that coordinates with one or more aggregators for providing the services”.

- By virtue of this definition, entities which do not directly engage gig workers but merely coordinate with other aggregators also qualify as ‘aggregators’. This is likely to lead to ambiguity on responsibility in terms of compliance where both actual aggregators and coordinating aggregators are involved.

Gig worker

- The term ‘gig workers’ has been defined under the Bill as “a person who performs work or participates in a work arrangement and earns from such activities outside of traditional employer-employee relationship and who works on contract that results in a given rate of payment, based on terms and conditions laid down in such contract and includes all piece-rate work”.

Impacts on the labor market and the overall economy

Economic Growth

- By providing businesses with a flexible and on-demand workforce, the gig economy enhances economic growth. Businesses can adjust their workforce size and composition according to their needs, resulting in cost savings and higher productivity. Additionally, gig workers can work across different sectors and projects, stimulating innovation and entrepreneurship.

Employment Opportunities

- The gig economy creates new sources of income for individuals with different skills and backgrounds. It provides an alternative to traditional employment for people who may face challenges in finding or keeping a job, such as those with low education levels or disabilities. This wider access to the labour market can lower unemployment rates and increase workforce participation.

Workforce Diversity

- The gig economy enables individuals from diverse backgrounds and demographics to join the labour market on their terms. It allows people to balance work with other aspects of their lives, such as family or education, fostering workforce diversity and inclusivity.

Changing Work Dynamics

- The gig economy challenges the conventional norms and structures of work. It has led to the expansion of remote work and the gig-on-demand model, changing the relationship between employers and workers. This change has encouraged businesses to adopt more flexible practices to attract and retain talent.

Code on Social Security, 2020

- The Code on Social Security, 2020 aims to amend and consolidate laws related to social security to extend it to all employees and workers in organized or unorganized sectors.

- The Code can be applied to establishments subject to size-threshold through notification by the central government.

- Separate Social Security Funds will be set up by the Central and State Governments for unorganized workers, gig workers, and platform workers.

- Registration provisions are specified for unorganized workers, gig workers, and platform workers.

- A National Social Security Board will be established to recommend and monitor schemes for these categories of workers.

- Funding for schemes of gig workers and platform workers may come from contributions by central and state governments, as well as aggregators.

- Penalties for certain offenses have been reduced, including obstructing inspectors and unlawfully deducting contributions from wages.

- During an epidemic, the central government may defer or reduce employer and employee contributions (under Employee State Insurance (ESI) and Provident Fund (PF) for up to three months.

Some possible ways forward

- Enhanced Social Security: Governments can explore innovative ways to provide gig workers with social security benefits and protections, such as portable schemes that allow workers to accumulate and transfer benefits across different platforms and jobs, or hybrid models that combine contributions from workers, platforms, and the state.

- Regulatory Framework: Formulating comprehensive regulatory frameworks to protect gig workers’ rights and ensure fair practices by digital platforms is essential to prevent exploitation, discrimination, and abuse. Such frameworks should also clarify the legal status and classification of gig workers, as well as their entitlements and obligations.

- Skill Development and Upskilling: Investing in skill development programs to empower gig workers and improve their income-earning potential is crucial to enhance their competitiveness and employability in the dynamic labour market. Such programs should also include digital literacy and soft skills, as well as opportunities for lifelong learning and career advancement.

- Stakeholder Collaboration: Encouraging collaboration between governments, businesses, and gig worker representatives to address challenges and create a sustainable gig economy is key to fostering trust, dialogue, and cooperation. Such collaboration should also involve sharing best practices, data, and insights, as well as promoting awareness and education among gig workers and the public.