Regulatory Framework for Distribution of Capital Market Products & Services

- Recently, the International Financial Services Centres Authority (IFSCA), in furtherance of its mandate to develop and regulate financial products, financial services and financial institutions in the International Financial Services Centres (IFSC), has notified the regulatory framework for Distribution of Capital Market Products and Services under IFSCA (Capital Market Intermediaries) Regulations, 2021.

- In recognition of the crucial role played by distributors in distribution of capital market products and services, a regulatory framework for distribution activities has been specified.

- Further, as the unified regulator of a global financial centre, IFSCA has enabled the registered distributors to undertake global distribution from IFSC and offer their services to clients in various jurisdictions. In order to protect the interest of clients, the framework provides for various eligibility requirements, a detailed code of conduct including an advertisement code, other obligations, various permissible activities, responsibilities of issuers and service providers in IFSC, etc.

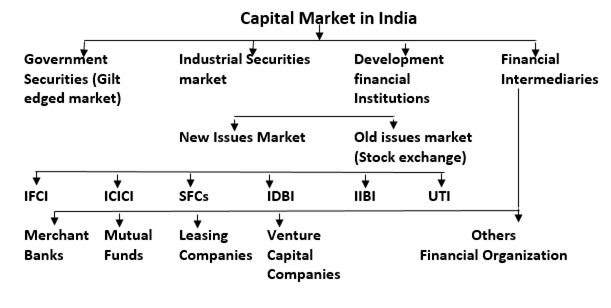

Capital Markets:

- Capital markets are venues where savings and investments are channeled between the suppliers who have capital and those who are in need of capital. The entities that have capital include retail and institutional investors while those who seek capital are businesses, governments, and people.

- Capital markets seek to improve transactional efficiencies. These markets bring those who hold capital and those seeking capital together and provide a place where entities can exchange securities.

The salient features of this framework are as under:

- Distributors may undertake distribution of:

- Capital Market Products – which include a wide bouquet of securities as covered under Securities Contracts (Regulation) Act, 1956.

- Capital Market Services – which include portfolio management services and investment advisory services.

- While distributors may offer their services to “sophisticated investors” and distribute a wide bouquet of products and services to them, the distribution to other investors may be undertaken with higher level of diligence and from a restricted set of products and services.

- Distributors are permitted to enter into arrangements with other distributors (called, Associated Distributors) from India, IFSC and foreign jurisdictions to widen the scope of their operations, get access to a larger pool of issuers and service providers, and cater to a broader clientele.

- IFSCA registered / licensed entities, such as Banking Units, Finance Companies, Broker-Dealers, Investment Bankers, Investment Advisers and Corporate Agents – may avail of the simplified registration process and undertake distribution services from IFSC.

- For investing in such jurisdictions which permit omnibus structures, certain distributors, such as Banking Units, Finance Companies, Broker-Dealers and those with a net worth more than USD 1,50,000, are permitted to invest through such structure, subject to adequate measures, such as prior consent of clients, maintenance of records, compliance with KYC and AML/CFT norms, etc.

- A comprehensive code of conduct has been prescribed to ensure distributors maintain high standards of integrity, disclosure, diligence, promptitude and fairness in their dealings with clients. The code of conduct shall be complied by all registered distributors, associated distributors and other distributors that are empaneled by IFSC based entities for distribution of their products / services.