HOLES IN SOCIAL SECURITY

Syllabus:

GS-II :

- Issues Relating to Development and Management of Social Sector/Services relating to Health, Education, Human Resources

- Welfare Schemes for Vulnerable Sections of the Population by the Centre and States and the Performance of these Schemes; Mechanisms, Laws, Institutions Bodies constituted for the Protection and Betterment of these Vulnerable Sections.

Why in the news?

“India’s Social Security Framework Undergoes Chaotic Expansion Amid Political Dynamics, Lacks Legal Guarantees for Vulnerable Groups.”

source:theeconomictimes

About Addressing the Gaps in India’s Social Security Framework:

- Social security is recognized as a fundamental human right by international organisations like the United Nations and the International Labour Organization (ILO).

- Despite this recognition, India’s social protection architecture faces challenges, with certain groups lacking adequate protection.

| Understanding Social Security:

● Social security, as defined by the International Labour Organization (ILO), ensures access to healthcare and income security, especially during situations like old age, unemployment, sickness, and more. About Legislations for Social Security in India: ❖ Employee Provident Fund Organisation (EPFO): ➢ Established under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952. ➢ Administers schemes like EPF Scheme 1952, Pension Scheme 1995 (EPS), and Insurance Scheme 1976 (EDLI) for social security benefits to workers. ❖ Code on Social Security in 2020: ➢ Aims to provide a statutory framework for social security, including urban and rural poor, construction workers, gig, and informal sector workers. ➢ Proposed benefits include life insurance, disability insurance, accident insurance, maternity and healthcare benefits, and old-age protection. ❖ National Pension System (NPS): ➢ Voluntary retirement savings scheme allowing defined contributions for planned savings and pension benefits. ➢ Open to employees from public, private, and unorganised sectors, excluding armed forces personnel. Understanding the Social Security Schemes in India: ❖ National Social Assistance Programme (NSAP): ➢ Administered by the Ministry of Rural Development for old age, disabled, and widows from below poverty line households. ❖ e-Shram Platform: ➢ National database of unorganised workers, including migrants, construction workers, gig, and platform workers. ❖ Pradhan Mantri Shram Yogi Maandhan (PM-SYM): ➢ Government scheme for old age protection and social security of unorganised workers. ❖ Atal Pension Yojana (APY): ➢ Old age income security scheme for savings account holders aged 18-40 years, targeting the poor, underprivileged, and workers in the unorganised sector. Understanding Digital Public Infrastructure (DPI): · Facilitating essential societal functions such as identification, payments, and data exchange. About Existing DPI in India: · Unified Payments Interface (UPI) o Expanding economic and livelihood opportunities by facilitating commercial transactions for millions. · IndiaStack Components o Aadhaar: Biometric identification system. o AarogyaSetu: Contact tracing application. o CoWIN: Platform for vaccination process. · Open Network for Digital Commerce (ONDC) o Introducing an Amazon-style marketplace for government procurement via Government E-Marketplace (GEM). o Aimed at breaking market concentration in digital markets and fostering fair competition. |

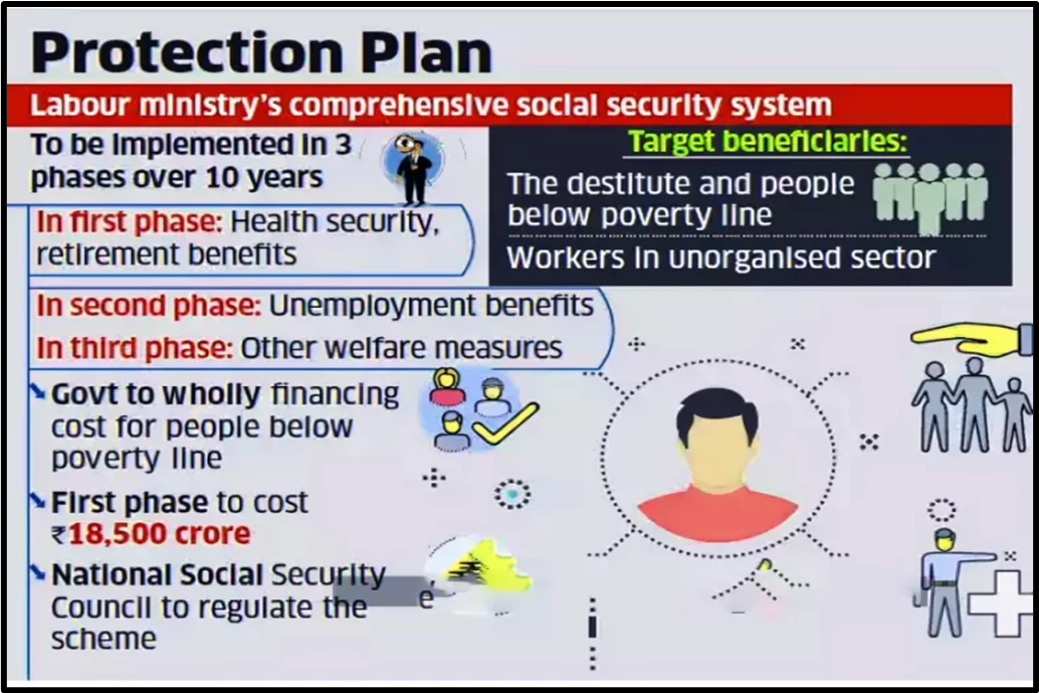

About the Government Initiatives:

- The central government initially opposed expanding social welfare programs but introduced income transfer schemes like MGNREGA and the National Food Security Scheme during the COVID-19 pandemic.

- State governments have also launched various income transfer schemes targeting different demographics, including women, farmers, and youth.

- The Ujwala scheme, initiated by the central government in 2016 to provide subsidised LPG cylinders to poor women, has been extended till February 2025.

- States like Delhi, Himachal Pradesh, and Chhattisgarh have announced new income transfer schemes for women, reflecting a trend towards targeted social security measures.

- Programs like the Ladli Behna scheme in Madhya Pradesh and the Kalaignar Magalir Urimai Scheme in Tamil Nadu have gained popularity for their direct cash transfer initiatives.

Challenges with Social Security in India:

- Lack of Competition:

- Monopoly of EPFO and ESI leads to negative effects on employers, employees, and society, fostering informality over formality due to high prices, corruption pressures, and bad treatment.

- Flawed Design of EPFO:

- EPFO’s design lacks adaptability for contractual employment, with records linked to employers rather than employees, resulting in orphaned accounts with unclaimed balances exceeding ₹25,000 crore.

- Issue of Sustainability:

- EPS diverts 33% of a subscriber’s salary to a defined-benefit plan, but fixes both pension benefits and contributions, leading to unsustainability.

- Recent court decisions have deemed the scheme unsustainable, exacerbating the problem.

- Limited Budget Spending:

- Inadequate budgetary allocation and poor scheme utilisation, exemplified by the National Social Security Fund’s ₹1,000 crore allocation compared to an estimated requirement of ₹22,841 crore.

- CAG audit revealed ₹1,927 crore remained unutilized since the scheme’s inception.

- Challenges with the Code on Social Security (2020):

- Focus on formal enterprises excludes informal workers and contract workers, like construction workers, who frequently change occupations.

- Dependency on enterprise size for coverage overlooks many workers, hindering inclusivity.

- Challenge with Formalization of Workers:

- Registration of over 65 million establishments, primarily in the unorganised sector, poses a challenge.

- e-Shram portal burdens informal workers with registration requirements without incentivizing employers to facilitate registration.

- Lack of employer responsibility fosters informal employee-employer relationships.

Challenges and Future Outlook:

- Groups such as the young and old remain underserved, and work-related precarities persist.

- The implementation of the Social Security Code 2020 remains pending, highlighting the ongoing challenges in establishing a comprehensive social protection framework.

Reforms Needed to Accelerate Formalization for Social Security in India:

- Advocacy for Competition:

- Increase competition by granting employees the choice, rather than employers, to allocate their contributions to either EPFO or the National Pension Scheme (NPS).

- Annual flexibility in this choice, supported by seamless interoperability, would enhance competition.

- Choice for Workers:

- Employees should have the autonomy to allocate their entire contribution to their EPF account rather than diverting a portion to the EPS.

- Alternatively, they could opt out of making employee contributions altogether (up to 12%), providing them with greater control over their savings.

Enhancing Effectiveness through Aadhar Linkages:

- Aadhaar-linked EPFO donations will enable portability, allowing workers to seamlessly transfer their social security benefits between different employers or regions.

Conclusion:

India’s social security framework is evolving, with increasing attention to targeted welfare schemes driven by political dynamics. However, the lack of legal guarantees and the exclusion of certain vulnerable groups highlight the need for a more comprehensive and balanced approach to social protection. The success of India’s digital revolution is a shared aspiration among its citizens, with hopes that it will serve as a global benchmark. However, this vision hinges on the foundation upon which India Stack, a critical component of the digital infrastructure, is built.

Source: Indian Express

Mains Practice Question: “Discuss the challenges and dynamics of India’s social protection architecture, as highlighted in the provided editorial. Evaluate the effectiveness of recent social security schemes introduced by different political regimes. Also, analyse the role of political competition in shaping the stability and evolution of welfare schemes in India.”